![]()

It’s been another day of records for the EUR, with EURUSD falling below 1.10 to a fresh 11-year low of 1.0930 so far. The chances of it breaking to another multi-year low before the end of the day are also high as we wait for payrolls data later on Friday.

Only NFP can save EUR now…

STOP PRESS: to make NFP Friday even more complicated than usual, there could be a delay to today’s data due to snow. Up to 2 hours, we are hearing, although nothing has been confirmed on the BLS website.

Assuming that NFP does get released on Friday, here at FOREX.com we produce two predictions for NFP each month. This month one of our prop models is looking for 220k, slightly below consensus, while the other is looking for more than 300k, which is well above expectations. We are wary over the Feb payrolls number because of the recent bout of bad weather across the US, which could cause disruption to the numbers. We think that a weather-related data miss of 180k or less for NFP could trigger a reversal in the USD and ease some of the downward pressure on EURUSD. However, if the data is roughly in line with expectations then we could see another sharp move lower for EURUSD and we would target 1.0765 – a key support level from 02/09/2003.

Although we are still some way from EURUSD reaching parity, there are some things to consider:

Another strong NFP number could make the Fed less patient when it comes to raising rates, at the same time as the ECB is starting its QE programme.

This is one of the reasons why German 30-year bond yields fell to a record low on Friday.

ECB QE has boosted European stocks and bonds (yields have fallen), which is weighing on the EUR.

However, the European data has been picking up of late, for how long will the market ignore it?

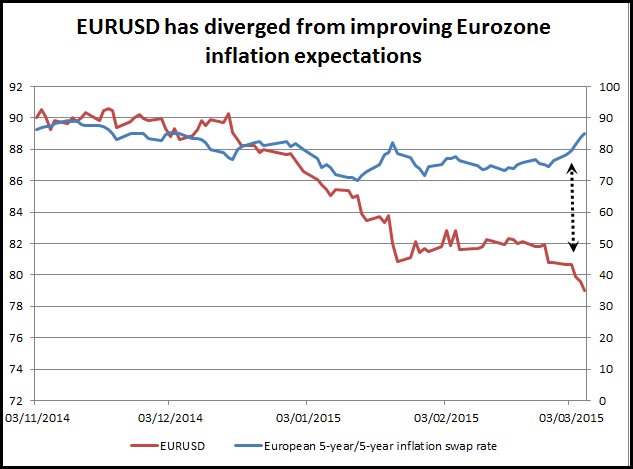

Also, there are signs that deflation in the currency bloc could be coming to an end. The 5-year/5-year EUR inflation swap rate is an indication of the market’s future expectations for prices in the currency bloc. This has risen sharply in recent days and surged to its highest level since early December 2014 on Friday.

We think that it is worth watching European inflation expectations closely. As you can see in figure 1 below, which shows EURUSD and 5-yr/5-yr EUR inflation swap rate normalised to show how they move together, the EUR and future inflation expectations tend to move closely together, but have diverged sharply this month. If inflation expectations continue to pick up, then maybe the ECB’s QE programme, which has fuelled the EUR weakness, could be cut short?

Where does that leave the EUR?

For now, the downtrend in EUR is strong and broad-based. It would be a braver trader than I to stand in its way ahead of today’s NFP data. Of course, the market could over-shoot to the downside. If we see a decent NFP number and EURUSD tumbles to 1.0765 or lower, then we could get a short squeeze, as the market may start to book some profit.

But a short squeeze doesn’t mean the end of the trend is nigh, it usually only means a brief respite, perhaps back to 1.10 or slightly higher. It will take a big effort to change sentiment towards the EUR at this stage. If this is to happen in the short-term then the following may need to happen:

A big miss for NFP on Friday.

Eurozone data continues to pick up.

We see a sustained improvement in Eurozone inflation swap rates, which starts to get some ECB members worried about the recent QE pledge.

Overall, the market is happy to sell EUR, but after such a strong, sustained downtrend, the road to parity may not be a straight line. It relies on strong US data, and the market continuing to ignore the better tone to European data and inflation expectations. Thus, even though the EUR may look vulnerable today, it could encounter a sharp short squeeze, especially if we get a weak payrolls number at some stage on Friday.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.