![]()

The North American trading session has been underwhelming for stocks and the USD so far as Canadian data has earned a majority of the attention in early trade. The lack of US data points has given way to Canadian GDP which improved 0.3% in the month of December when only a 0.2% rise was anticipated. In addition, the Annualized release that measured Q4 rose 2.4%, beating the 2.0% expected with the previous revised from 2.8% to 3.2%. It turns out the Canadian economy isn’t in as dire straits as many had assumed heading in to 2015 which may cause the Bank of Canada to raise an eyebrow toward the strong performance. Considering the BoC will be making a monetary policy decision tomorrow, this good news couldn’t have come at a more convenient time.

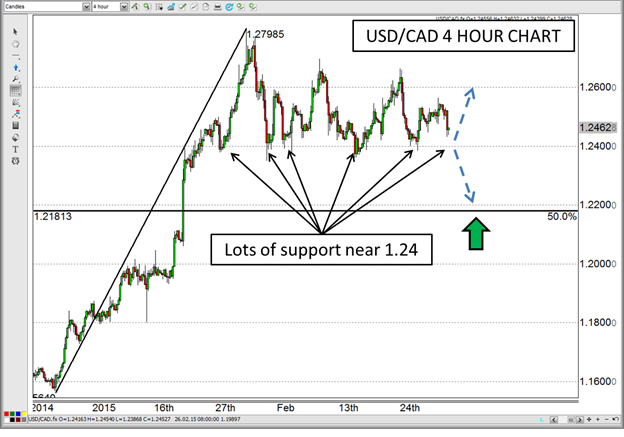

In response to the strong Canadian data, the CAD has improved against virtually all other major currencies, and threatens to challenge a well-supported level in the USD/CAD. However, simply looking at GDP to help determine the path of BoC policy would be a fool’s errand. Besides, that data was from 2014, and we’re already two-thirds of the way though Q1 of 2015, so it’s admittedly a bit crusty. On the other hand, BoC Governor Steven Poloz mentioned in a speech last week that “the downside risk insurance from the interest rate cut buys us some time to see how the economy actually responds.” If we were to read that as a direct statement insinuating what they will do this time around, it appears Poloz is telling us that they want to wait and see what happens; meaning no rate cut this time around.

The problem with expecting no rate cut from the BoC is that the majority of economists expected them to cut rates by another 25 basis points; at least at the end of last week. As we get closer to the decision, the majority has flipped to expect no cut from the institution. This indecision from those who should know best also creates a lot of indecision by investors who rely upon those opinions, which could lead to a lot of action in the CAD over the next 24 hours. The major level of support I mentioned earlier is around the 1.24 handle in the USD/CAD, and could be the major level that indicates what to expect from there. If broken, it could open the floodgates to a further decline as we approach Non-Farm Payroll at the end of the week, but if it holds, the market may just wait until after NFP before picking a side.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.