![]()

The early portion of the North American trading day has been wrought with markets essentially doing their own thing as developments from around the globe have had regional effects. The Aussie dollar has been getting hammered ahead of the Reserve Bank of Australia interest rate decision this evening; equities are all over the place as Asia was up, Europe is down, and the Americas were weak at first, then rallying; the US dollar is simply reacting secondarily to other regions; and the euro is finding some early love as it has rallied on the back of better than expected data out of Europe. One currency that isn’t getting too much favor though is the Pound Sterling that has been losing ground against everything except the euro.

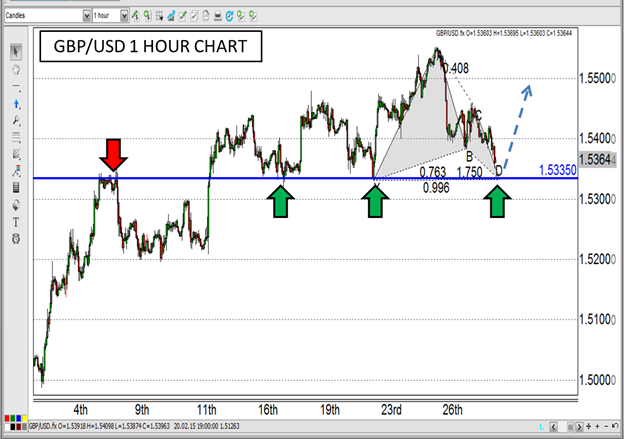

The weakness in the GBP isn’t really based on anything fundamental as UK data wasn’t depressing by any stretch of the imagination this morning. While the House Price Index was dismal (0.4% expected, -0.1% actual), Manufacturing PMI beat estimates and Mortgage Approvals fell in line giving a mixed bag of results. US data was also heterogeneous with Markit Manufacturing PMI beating consensus and ISM Manufacturing PMI missing. Personal Spending and Personal Income were also disappointing, but the USD has gained favor anyway. The GBP weakness in this environment sets up some intriguing opportunities as it approaches support levels in the GBP/USD as a result of the mixed readings, and could find favor like the euro did in early trade.

When searching for support or resistance levels in currencies, it helps to find levels that have been bounced off in the past, and the GBP/USD has a prime example in its sights. The 1.5335 level has been both a support and resistance level over the last month, and to help the cause, there is a bullish Gartley pattern that completes around the same level. If that support can hold once again and the fundamental moves begin to make a little more sense, the GBP/USD may be in for a rebound as the day progresses.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.