![]()

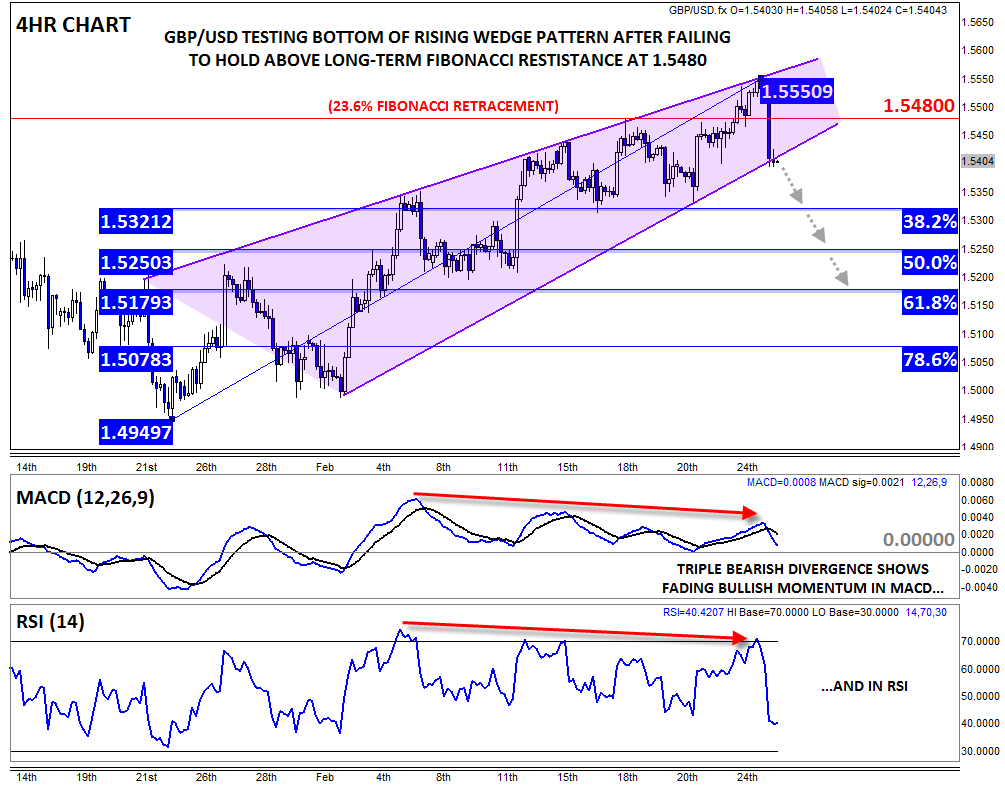

One of today’s biggest moves has been in GBPUSD, which has dropped 150 pips after setting a a new 2-month high at 1.5550 earlier today. Beyond the broad-based dollar strength, the pound has also been hit by weaker-than-expected Q4 Business Investment data, which fell -1.4% vs. an expected gain of 2.0% (last quarter’s reading was also revised down 0.7% to -1.4%). Earlier this week, my colleague Fawad Razaqzada noted that the pair had peeked out above the 23.6% Fibonacci retracement of last year’s second half drop, but with today’s reversal, it looks like that move may have been a false breakout. Astute traders will note that the pair is also forming a large Bearish Engulfing Candle* on the daily chart (not shown), signaling an abrupt shift from buying to selling pressure.

Adding to the short-term bearish technical evidence, the pair has been forming a rising wedge pattern over the last month. Though this pattern is created by a series of higher highs and higher lows, the shallower slope of the highs suggests that the bulls may be losing momentum. If the unit breaks below its current support level at 1.5400, we could see a more substantial drop emerge. Further bolstering the bearish case, the rising wedge pattern is confirmed by triple bearish divergences in both the MACD and RSI indicators, showing clearly receding bullish momentum.

At this point, the outlook for GBPUSD seems relatively straightforward: bulls will be on edge unless the pair can get back above long-term Fibonacci resistance at 1.5480 (and ideally the yearly high at 1.5600 as well), and a break through trend line support at 1.5400 could pave the way for a continuation down to the Fibonacci retracements of the February rally at 1.5320 (38.2%), 1.5250 (50%), or 1.5180 (61.8%).

*A Bearish Engulfing candle is formed when the candle breaks above the high of the previous time period before sellers step in and push rates down to close below the low of the previous time period. It indicates that the sellers have wrested control of the market from the buyers.

Source: FOREX.com

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.