![]()

As we approached the European close last week, the EUR had fallen more than 3% versus the USD. The driver was the ECB’s decision to embark on a QE programme to combat deflationary forces at work in the Eurozone. In the past the EUR has rallied when the ECB had taken steps to help the struggling currency bloc, think back to the LTRO in early 2012 or the bailout announcements at the peak of the sovereign debt crisis, not so this time.

The EUR is weak because of two main factors: firstly, the ECB’s bailout programme may be open-ended if inflation does not stabilise by September 2016 and could be worth significantly more than EUR 1 trillion; secondly, the dollar is on a rampage, rising significantly against all G10 currencies apart from the CHF and JPY.

The dollar seems to be rallying due to interest rate differential. Essentially the ECB threw everything apart from the kitchen sink at its deflation problem, so we all know the data points to watch out for to determine the success (or otherwise) of this programme: CPI.

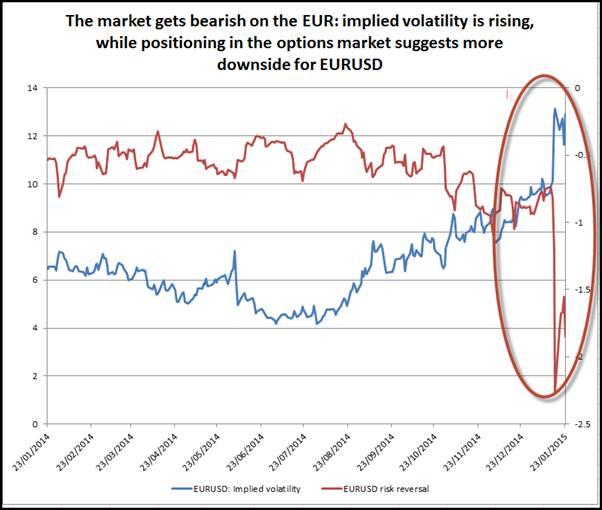

But how low can the EUR go? Just because we have already fallen nearly 7% versus the dollar does not mean that we have had all the EUR weakness for 2015 in the first month of the year. We had expected a break in EUR selling pressure on the back of the QE announcement on Thursday, however, when this didn’t happen, we decided to do some digging into the options market to see what sentiment towards the single currency is like.

The result makes for some uncomfortable viewing for EUR bulls. The chart below shows implied volatility and risk reversals, another measure of volatility, for 1 month EURUSD options. The chart shows that implied volatility (blue line) is moving higher, while the risk reversal has turned bearish. In layman’s terms this means that the market is taking a directional view that the EUR will fall further. The options market suggests that the euro is expected to remain volatile, with a bias to further weakening. Overall, this analysis suggests that there could be further EUR weakness, and there could be further wild moves, even after the EUR weakness we witnessed last week.

Figure 2:

Source: FOREX.com

The technical picture is also looking decidedly bearish, as you can see in the chart below; however, EURUSD is approaching a major level of support – 1.12 – the 61.8% retracement of the EUR’s entire life. This could stem some of the selling pressure, and acted as good support earlier on Friday. However, if this level is breached, then we could see back to 1.10, a key psychological level, or even 1.0765- a low from 2001. Below here, parity, or even lower, is a possibility.

Figure 3:

Recommended Content

Editors’ Picks

AUD/USD recovers to near 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to near 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.