![]()

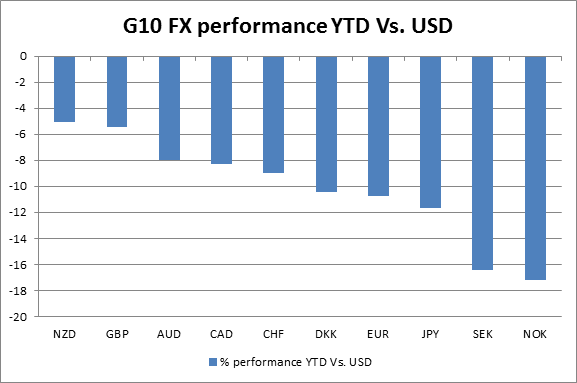

With only a couple of weeks left until the end of the year it is worth evaluating FX performance this year. As you can see in the chart below, the USD has been a stand-out performer in both the G10 and EM FX spaces. The gains in the buck have also been impressive, highlighting the momentum gained by the buck in recent months.

Looking at the G10 space first, the sharpest sell off has been vs. the NOK and the SEK. This is partly down to the decline in the oil price, as Norway is a major oil producer in Europe, but it is also down to a re-adjustment in relative interest rate differentials. Although Norway has a substantially higher nominal interest rate than the US, the market punished the NOK because of the central bank’s shift to a dovish stance, culminating in a rate cut earlier this month. The dollar trend is built upon Fed tightening expectations, and central banks that are cutting, or erring on the dovish side, are seeing a weaker currency vs. the USD, which is a theme that could last into 2015.

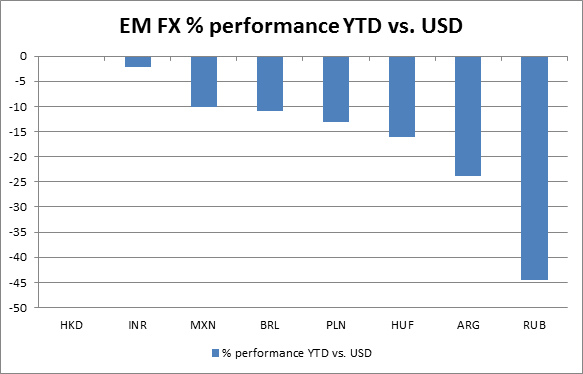

The dollar has also risen against the emerging market FX space. Interestingly the rupee, which was severely punished in 2013, was one of the more resilient currencies vs. the USD in 2014. This was due to a change in government and a falling oil price that helped to improve India’s trade deficit, as the government subsidises oil costs for some of its citizens. India’s current account has improved to -1.3% of GDP from -5.38% last year, and the market has rewarded this improvement with a fairly stable INR performance during the dollar rally.

In contrast, the Russia RUB has fallen 40% and has experienced bouts of extreme volatility. Weak economic growth, a sharp decline in oil prices and the severing of diplomatic ties with the West contributed to the sell-off and currency panic last week. As we move towards a new year, Russia still has to contend with these problems and the recent increase in interest rates to 17% could deepen the recession next year. Thus, we could see the dollar further outperform the RUB next year.

Other notable under performers include the HUF, TRY, BRL and MXN. Any country with large dollar denominated debts, or large external deficits were punished, as a rising dollar and tighter monetary policy from the Fed could weaken their ability to pay back these debts, ultimately leading to deterioration in their credit outlook.

What next for the buck?

Even though the USD has performed well across the board in 2014, we think that there could be further to go in 2015, after all the dollar has just emerged from 15 years of under-performance, so this could be a structural shift for the USD. Rate divergence with the rest of the G10 along with fundamental issues in the EM FX space could fuel another leg higher in the dollar rally in the first half of 2015. Our outlook for 2H 2015 is slightly more nuanced and could rest on the Fed’s willingness to have a stronger currency when the ECB, BOJ, SNB et al are all actively pursuing policies that could weaken their currencies?

This question will, no doubt, get answered at some stage in 2015, until then we think the dollar up-trend may be here to stay.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.