![]()

US stock index futures are pointing to a slightly higher open on Wall Street today. On Wednesday, we reported that stocks could bounce back as the Fed prepared to deliver its last policy statement of the year (see the email below). Not only were we expecting a slightly less hawkish tone from the Fed than was expected, but we were also wary of a technical bounce. Sure enough, the Fed did sound a little dovish as it maintained the “considerable time†pledge and said it would be “patient in beginning to normalize the stance of monetary policy.†This helped to soothe investor nerves, leading to a sharp bounce in the stock markets.

Although a rally into the year-end now looks odds on for equities, the lack of any major economic data releases over the festive period could dampen the appetite for risk. What’s more the on-going currency crisis in Russia, worries about Greece, and uncertainty over sovereign QE from the ECB could also hold investors back a little. Indeed, according to a Reuters report published today, the ECB is considering ways to make the weaker Eurozone members – such as Greece and Portugal – bear more of the risk and cost of quantitative easing. The central banks of these nations could be required to set aside extra funds to cover potential losses from any bond-buying. Although this may be exactly what the Germans want, such conditions, Reuters says, could curtail the scope and impact of QE. Therefore, this may not be such good news for the markets. However, the report is not confirmed yet and is lacking a lot of details. What’s more, the introduction of sovereign QE in any way shape or form, and whenever that may be, should spark an immediate response in the global stock markets in the form of a rally.

Technical outlook

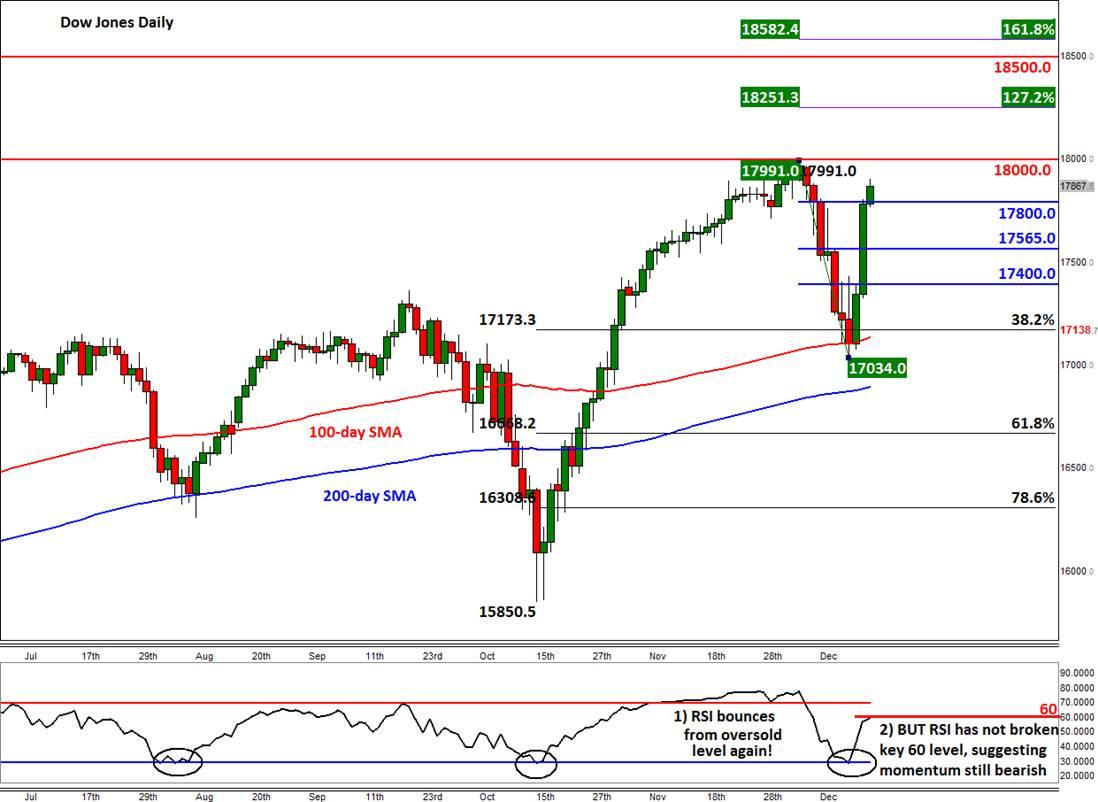

On Wednesday, we highlighted the fact that a closely-watched momentum indicator, the Relative Strength Index (RSI), had drifted below the oversold threshold of 30. The RSI had created a similar pattern on an intra-day chart, too. Both were therefore suggesting that a rally could be on the cards for the Dow Jones, and indeed the stock markets in general. As it turned out, this is exactly what has happened. But as the index future is now climbing back towards the prior record high of just below 18000, the RSI is still holding below the key 60 level. The indicator needs to break above this level in order to signal that the momentum has shifted back into the buyers’ favour.

But the fact that the recent sell-off has been halted around the shallow 38.2% Fibonacci level of the last upswing bodes well for the bulls. It suggests that the bulk of the market participants may still be positioned long, hence the sharp rebound following the recent countertrend move. So, as things stand, the longer-term technical outlook for the Dow is bullish. If the index manages to break through the 18000 barrier soon, then it could embark on a rally towards the next Fibonacci extension levels of the recent downswing around 18250 (127.2%) and 18580 (161.8%). There is also a psychological level at 18500 which needs some attention, should we get there.

On the downside, the potential support levels to watch are 17800, 17565 and 17400. These were all formerly resistance. Meanwhile a potential break below the recent low of 17035 could expose the 200-day SMA for a test, at 16895. Below this are the 61.8 and 78.6 per cent Fibonacci levels of the last upswing at 16670 and 16310 which may also offer some support.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.