![]()

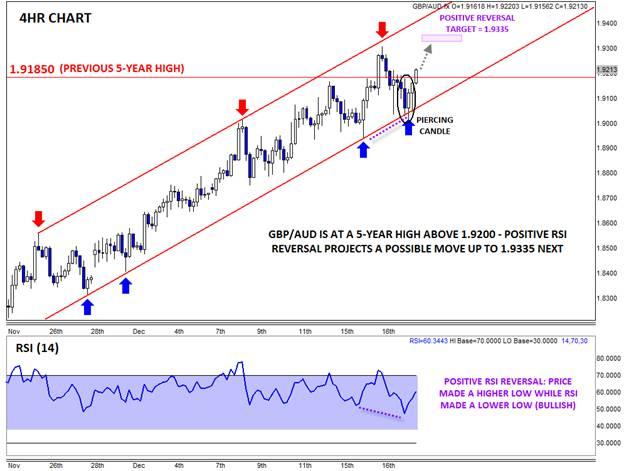

GBPAUD has clearly reflected this economic divergence, with GBPAUD trending smoothly higher within a bullish channel since late November. In fact, the pair hit its highest level in over five years earlier this week before pulling back yesterday. Then, ahead of today’s North American session, rates carved out a clear Bullish Piercing Candle* on the 4hr chart; this candlestick pattern indicates a shift from buying to selling pressure and has led to a resumption of the established uptrend.

Even more significantly, the pair has formed a positive reversal with its 14-period RSI. That is, the exchange rate made a higher low while the indicator made a lower low. This bullish development shows that GBPAUD is actually outperforming the underlying indicator and projects a possible target area all the way up at 1.9335.

Of course, there’s no guarantee that GBPAUD necessarily will rally to that level, but with the multi-year breakout and established bullish channel to support the positive reversal pattern, we wouldn’t be surprised to see GBPAUD reach that level in the coming days. At this point, only a break back below the bullish channel at 1.9050 would erase the near-term bullish bias.

*A Piercing Candle is formed when a candle trades below the previous candle's low, but buyers step in and push rates up to close in the upper half of the previous candle's range. It suggests a potential bullish trend reversal.

Source: FOREX.com

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.