![]()

It was a big weekend for Japan with a general election and the Q4 Tankan index. Incumbent PM Abe won a very comfortable majority, which means that Abenomics will remain in play for the next few years until his term expires. The Tankan index was weaker than expected, it came in at 12, rather than the 13 expected. However, capex spending was higher, up 8.9%, vs. expectations of an 8.1% increase.

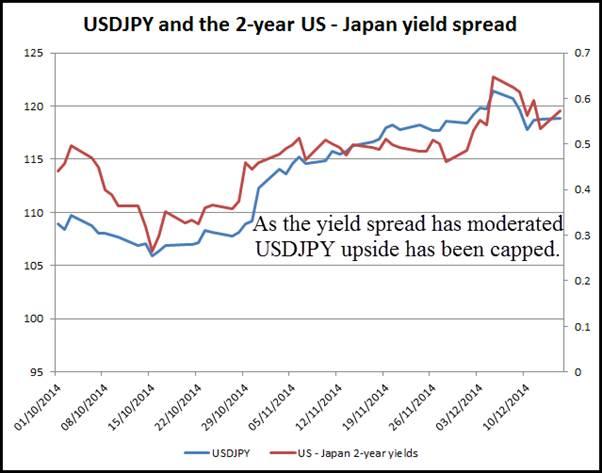

The yen was the top performer in the G10 FX space last week ahead of the election, however, now that these Japanese risks are no longer in play, should we expect a resumption of the USDJPY uptrend? USDJPY has failed to trend in a clear direction since the election results, and right now it looks like this pair could be in consolidation mode, at least until Wednesday’s FOMC meeting, because:

Liquidity is thin and there are rumours in the market that people are cutting their dollar longs into year end.

Although the FX market has been predicting a hawkish Fed at this week’s meeting, the Treasury market has not seen the memo. US 10 year yields are hovering close to their lows of the year so far and even two year yields are well off their recent highs. Since USDJPY and Treasury yields have a close positive relationship, when US yields are falling this can limit USDJPY upside.

The Nikkei also has a close relationship with USDJPY, when the Nikkei moves higher it can correspond with USDJPY weakness. Overnight the Nikkei came under pressure, dropping more than 1.5%. This may have been due to some nervousness on the back of the hostage situation in Sydney, but it limited USDJPY upside earlier on Monday.

USDJPY and the FOMC:

Expectations are high that the FOMC will… change one phrase in their statement. Dropping the comment “considerable time” when it comes to raising interest rates, may not sound like much, but it could have a huge impact on USDJPY on Wednesday. If the phrase “considerable time” is dropped then we could expect to see a sharp rebound in US Treasury yields and also in the dollar. If the Fed decides not to change its statement then we could see the dollar fall sharply.

Due to the importance of this week’s FOMC meeting, we prefer a short term view on USDJPY. We think this pair could remain range bound until we hear from Janet Yellen and co. on Wednesday. The top of the most recent range is 119.55, which could act as strong resistance. Support lies at 117.44 – the low from 11th Dec.

Conclusions:

The yen has been range-bound even after a big win for PM Abe at this weekend’s elections.

USDJPY could remain range bound until the FOMC meeting on Wednesday.

USDJPY tends to move closely with the Nikkei, there could be some headwinds for the Nikkei this week, which could limit USDJPY upside.

Ultimately if the FOMC is perceived as being hawkish, then we would expect a large rebound in US Treasury yields, which could trigger a move back to 121.85 in USDJPY, which is the high from 8th Dec.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.