![]()

On Sunday 30th November the Swiss people will go to the polls to decide on a referendum on the Swiss Central Bank’s (the SNB) gold reserves. The proposal put forward by the right wing Swiss People’s Party would require the SNB to hold gold reserves equivalent to 20% of their total assets, all Swiss gold held with foreign central banks would need to be repatriated, and the SNB would need to commit to never selling gold in the future.

The results:

It looks like the earliest result will be out at 1300 local time on Sunday; however it depends on the region, with each Canton releasing their results at different times. Geneva’s result will be critical, it tends to give continual results as they come in, likewise, Zurich is expected to release the participation number during the day, before sending the results in the evening.*

What the polls say

The latest polls suggest that after initially polling well, in the last month support for the Yes campaign has faded. The latest opinion poll suggests that the Yes vote will only win 38%, with 47% voting no, the Yes campaign need to win over 50% of the vote to implement the proposal. According to this poll 15% of voters were undecided, so for the Yes camp to secure victory they would need to convince all of the 15% to vote Yes, which seems unlikely, in our view.

Potential reactions:

Even though the Yes camp is unlikely to win, it’s worth sketching out the various outcomes and what this could mean for FX and precious metals markets:

If the Yes vote wins:

Gold: this would mean that the SNB would need to accumulate 1,500 tonnes of gold over 5 years, which is about half of annual production. We would expect an initial jump in the gold price; however, we think any upside could fade in the days after the result as it is not clear how the SNB would increase its gold holdings. It could spread gold purchases over a long time frame, or use swaps and other derivatives to purchase gold, thus making it hard to see their footprint in the market.

FX: We think that the SNB will maintain the EURCHF peg no matter what the outcome of this weekend’s referendum as it is central to the Bank’s monetary policy strategy. However, a win for the Yes camp could put upward pressure on the CHF as its status as a safe haven kicks in, and as investors test the SNB’s resolve to maintain the EURCHF peg. We would expect the SNB to take immediate reaction after the vote to limit EURCHF downside, which could include cutting interest rates deeper into negative territory to weaken the CHF. Rates could be cut late Sunday evening/ early Sunday morning, triggering excess volatility in EURCHF and EUR crosses.

Essentially a win for the Yes camp would push Switzerland back onto the gold standard, so every time the SNB intervene to protect the 1.20 peg in EURCHF they would need to buy gold at the same time to ensure its 20% share of the balance sheet. This could trigger excess volatility for the gold market, with investors pushing up the price of gold every time EURCHF looked like it may hit 1.20. In the lead up to the vote we could see the market challenge 1.20 in EURCHF as tail risk starts to rise, thus we could see some volatility in EURCHF in the next few days, especially with the US out on holiday on Thursday and the markets are likely to remain quiet on Friday. If 1.20 is breached in the short term we expect the SNB to intervene.

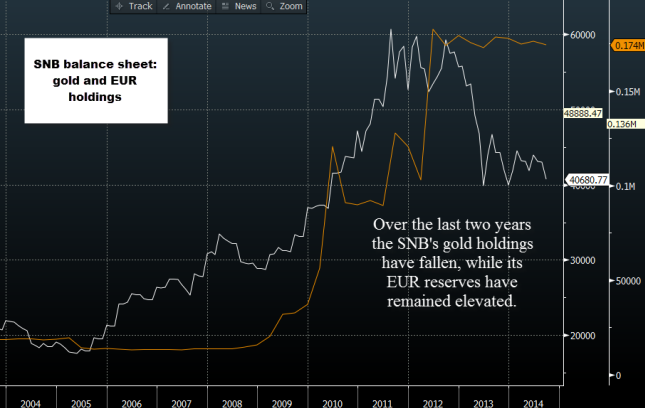

The other impact could be on the EUR. The SNB holds the majority of its assets in EUR as a result of maintaining the 1.20 peg. Thus, it would need to sell EUR to boost the share of gold on its balance sheet, which could trigger another leg lower in EURUSD and leave the EUR vulnerable to further downside in the medium-term.

If the No vote wins:

This is the most likely outcome in our view; however, maintaining the status quo could still impact the markets.

Gold: This could trigger a sharp move lower on Sunday night/ Monday morning in gold as the market prices out the possibility of SNB purchases. We think that the impact will be short-lived and the mild trend higher in the price of gold will continue.

FX: We may see a relief rally in EURCHF on the back of a win for the No camp, however, we expect it to be short-lived, as the pressures on the EURCHF peg continue to build.

EURCHF and the SNB

Regardless of the outcome of Sunday’s referendum we expect the SNB to maintain the 1.20 peg as it is a central part of its monetary policy strategy. The most recent SNB statement reiterated that the Bank would buy EUR in “unlimited quantities” to protect the peg. If the Yes vote wins protecting the peg becomes trickier, as we mention above, however, the peg could still be threatened even if the Swiss people vote No.

EURCHF has been under pressure not only because of the Swiss referendum but also because of the weak Eurozone economic outlook and the prospect of QE from the central bank. By implementing the peg the SNB essentially imports the ECB’s monetary policy, so if the ECB decides to embark on QE in the coming months then the SNB will need to respond. They could cut interest rates further into negative territory, or they may choose to intervene to show the market they are committed to keeping EURCHF above 1.20. We think that it is unlikely the SNB will move the EURCHF peg in the medium term as this would dramatically increase their already elevated share of EUR’s on their balance sheet (see figure 1).

Interestingly, there are rumours that Hungary was selling francs last week. Hungarians hold a lot of CHF-denominated mortgage debt, and may have been reducing exposure to the CHF ahead of the referendum. There is evidence that the SNB intervened to boost EURCHF on 19th November when this cross fell to 1.2009. The SNB may have intervened in small quantities of approx. CHF 2-4 billion, which seems to have worked. The release of the latest poll data on the referendum may have also added to this mini recovery.

My thanks to Sebastian Galy at Societe Generale for his insight on the results process for this referendum. There is a good chance that we won’t know the final result until Sunday evening.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.