![]()

Just because the market’s mind is concerned with things of a turkey nature does not mean that themes are failing to develop. Today’s data has been illuminating and could drive equities and FX in the next few days.

1, Worrying trends in UK growth

First up came news about the UK economy. Overall Q3 GDP was unrevised at 0.7%; however the detail of the report painted a different picture. Not only is growth slowing, but it’s the wrong kind of growth. The recovery is dependent on private consumption and government spending (bad), while exports and investment (good) are slowing sharply. Exports fell 0.4% in Q3, while imports rose 1.4%, so the UK is, once more, spending more than it earns. Exports have fallen by more than 10% in the last 12 months, mostly on the back of the slowdown in the Eurozone. That may sound like an excuse, but the UK government’s plans to turn around our export sector could not have come at a worse time with both Eurozone and Chinese growth taking a stumble. Private consumption is a bright spot, and it will be interesting to see if UK retailers can benefit from post-Thanksgiving “Black Friday” sales that are being advertised this side of the Atlantic. Government spending also boosted growth, and it was revised up to 1.1%, while the market had expected a reduction to 0.2%. The fact that the government decided to ramp up spending is hardly surprising given that we were less than a year from the next UK election, however it is slightly embarrassing for a government who has staked its reputation on debt reduction. This goes some way to explain why government borrowing continues to rise. This data also helps us to understand the BOE’s note of caution in its recent Inflation Report, and supports a weaker pound in the medium-term.

2, More trouble for the ECB

German import price inflation for October may have fallen by less than expected, however, on an annualised basis inflation was still down by 1.2%. Thus, Germany is still importing deflation, which does not bode well for the Eurozone’s flash estimate of November CPI due on Friday. On an otherwise quiet day, this inflation data could keep things interesting for the EUR into the weekend, and a reading lower than 0.3% could trigger a collapse to 1.20.

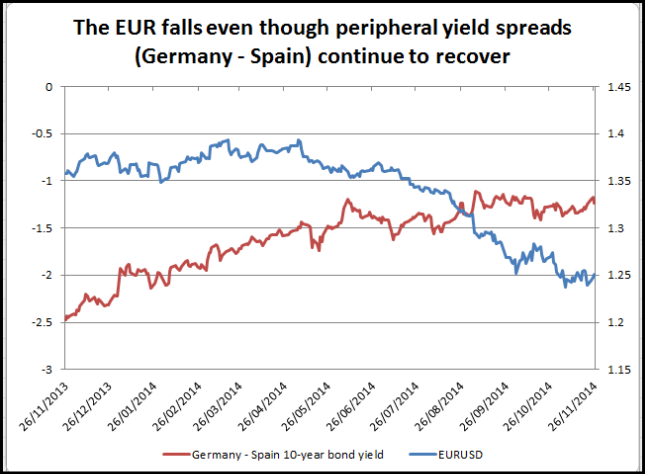

Narrowing yield spreads in Europe’s periphery have tended to equate to a stronger euro, but as you can see below, this is not the case at the end of 2014, with tightening spreads contrasting with the sour tone to the EUR. However, this trend has been bucked today – bond yields in Europe’s periphery are rising at the same time as the single currency, EURUSD is at its highest level since 21st November. We think today’s price movements are an anomaly and looking forward, we would not be surprised to see European peripheral bond yields continue to fall alongside the EUR, as the latest trends in German import prices add to pressure on the ECB to embark on some form of QE in the New Year. See figure 1 below for more.

3, Has the US joined the global economic slowdown?

The US squeezed the last of this week’s data into Wednesday, however rather than pass by unnoticed on this quiet week, the weaker tone to the US data has unnerved some in the market as they assess whether this is the start of a trend, or just a blip. Initial jobless claims jumped above 300,000 for the first time since mid-September last week. However, the 4-week moving average remains below the 300k mark. We will watch this data to see if it was just a blip or the sign of something more serious. Durable goods orders excluding defence and aircraft fell 1.3% in October. Durable goods are a proxy for business investment, which could be retracting as global growth starts to slow.

Consumer confidence may have fallen back in November, but the real test for the US consumer will be Black Friday sales. We should know if the US consumer lived up to its reputation by the weekend, if sales break records then fears about global growth could fade into the background and we could see the dollar index decisively break above 88.00, its highest level since 2010.

4, OPEC

This is the main event for an otherwise quiet Thursday. Read our preview HERE Comments worth noting today include the Saudi oil minister who said that production did not need to be cut. It appears that Iran is sticking with the Saudi’s on this one. The only hint of discord came from the UAE who blamed the US for causing a global oil supply glut. Tomorrow is the main event with the post-meeting press conference scheduled for approx. 1500 GMT. At this stage it appears very unlikely that the cartel will cut production, although it may announce a meeting in 3 months’ time to assess the situation. Oil is lower again today, and WTI has fallen some $3 since OPEC arrived in Vienna on Tuesday. Thus, the “bad” news on production could already be priced in, even though we continue to think WTI oil could fall to $70 in the coming days.

Overall, the markets are quiet, the dollar is losing some steam, equities are directionless as volume seeps out of the market, the EUR is making a short-term comeback and oil is under pressure as we wait for the outcome of the Opec meeting.

Figure 1:

Source: FOREX.com and Bloomberg

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.