![]()

Given today’s Japanese bank holiday (Labor Thanksgiving Day), it’s not surprising that the FX markets have gotten off to a bit of a slow start. The performance of the US Dollar has been mixed in Asian and early European trade as traders weigh the sustained uptrend against the lack of new bullish catalysts for the world’s reserve currency. Further complicating matters, many US traders may restrain from meanginful trades ahead of Thursday’s Thanksgiving holiday. While US economic data tomorrow and on Wednesday may inject some volatility to the markets, the overall environment favors potential countertrend pullbacks this week.

One pair that may be particularly vulnerable to a countertrend pullback is EURUSD, which collapsed on the back of some dovish comments from ECB President Mario Draghi on Friday. Draghi’s focus on the Eurozone’s subdued inflation expectations has caused some traders to speculate that the ECB may enact a sovereign QE program as soon as next month (see my colleague Kathleen Brooks’ note “The Dollar Index Takes a Stab at 88.00 Resistance” for more).

That said, EURUSD has stabilized off key technical support at 1.2360 so far today, helped along by a better-than-expected German IFO report in today’s early European session. The monthly survey of German manufacturers, builders, wholesalers, and retailers improved from 103.2 last month to 104.7, beating the expectations of a drop to 103.0. Notably, this marks the first time that the widely-watched index has improved since April, suggesting that the Eurozone economic activity may finally be stabilizing after the precipitous decline in Q2 and Q3.

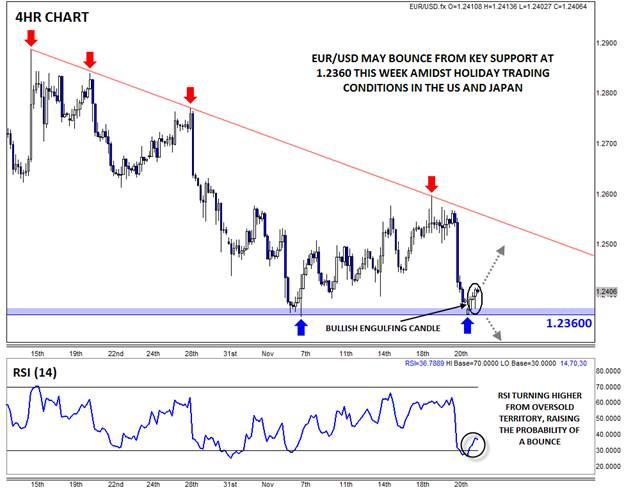

On a technical basis, the pair remains within its longer-term downtrend, though Friday’s big drop has opened the door for a modest recovery within the context of the overall downtrend early this week. Looking at the 4hr chart, the rates carved out a Bullish Engulfing Candle* on the back of the IFO report, showing a shift to strong buying momentum in the near term. In addition, the 4hr RSI has turned higher from oversold territory, marking a potential trough on the chart.

As long as rates stay above horizontal support at 1.2360, EURUSD could bounce back toward its bearish trend line near 1.25 in a potentially slower holiday week. Of course, a break below key support at 1.2360 would suggest that the bears have reasserted control of the market and would open the door for a drop toward 1.2300 or 1.2200 next.

A Bullish Engulfing candle is formed when the candle breaks below the low of the previous time period before buyers step in and push rates up to close above the high of the previous time period. It indicates that the buyers have wrested control of the market from the sellers.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.