![]()

The dollar is in demand today as the euro and the pound give back their recent gains, this was triggered by ECB President Mari Draghi who was speaking at the European Banking Conference in Frankfurt. He focused on inflation and said that some inflation expectations are excessively low. This is significant since the ECB’s mandate is to promote price stability in the medium-term. If inflation expectations are also falling then the ECB should feel motivated to take more accommodative policy action. Draghi is chomping at the bit to take steps towards QE, and for the second time this week he has said that the ECB would broaden its purchases (of bonds) if its current policy to boost inflation does not work.

QE in December anyone?

While the ECB never pre-commits to policy (or, so they say), the fact that Draghi openly touted the prospect of QE in Frankfurt is worth noting, since the Bundesbank has been resistant to the idea of sovereign bond purchases. If Draghi is able to persuade the Germans that QE is the only answer to the ECB’s problems then QE could be on the cards for early 2015. This is what the market is currently pricing in, and why the euro is under pressure and the USD is clawing back some lost ground.

The technical picture: could 90.00 be on the cards?

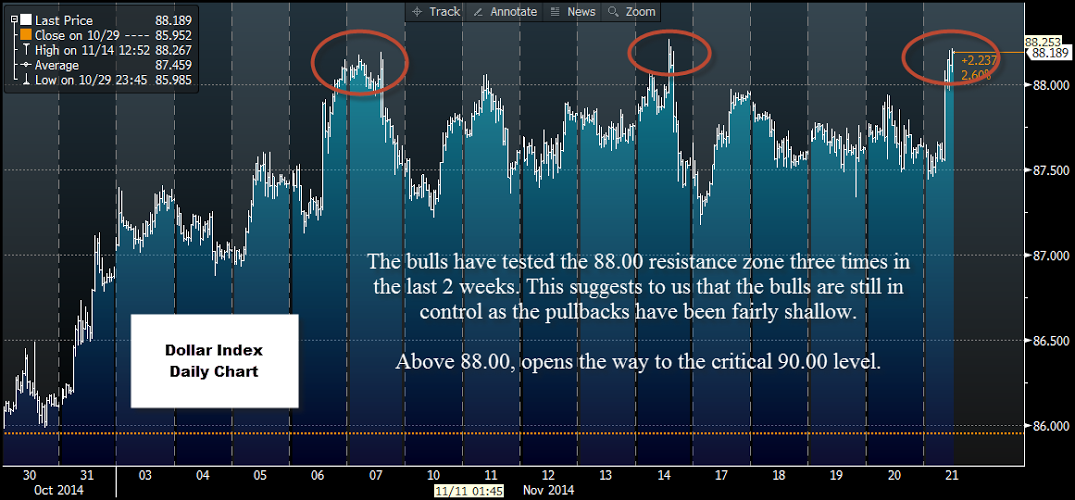

The fundamental picture is supportive for the buck right now, and the technical picture also suggests that the dollar index could make a decisive break of 88.00. The dollar index has tested resistance at 88.00 three times since the 7th November, as you can see in the chart below. The pullbacks have been shallow, suggesting that the bulls still have control; they are just taking a breather. Since this level has been tested repeatedly in the last two weeks, we believe it could eventually be broken, which would open the way to 90.00 – a key psychological level and the highest level since 2006.

If we get a weekly close above 88.00 later today then it could herald another leg higher for the dollar against the EUR and the GBP, with 1.55 a possibility in GBPUSD, and 1.20 a potential for EURUSD.

Conclusion:

ECB President Mario Draghi has been touting the prospect of QE once again, which is weighing on EURUSD.

The dollar index is testing a critical level of resistance.

The market is making its third attempt to take 88.00 in DXY. This suggests to us that the bulls have control and we could clear this level in the coming days, which may open the way to 90.00.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.