![]()

One theme we’ve been consistently highlighting over the last few weeks is policymakers’ (and thus traders’) increasing focus on inflation reports. With price pressures in many developed markets rapidly falling toward outright deflation, many central banks are pondering additional monetary stimulus to help support their moribund economies.

Tomorrow, Statistics Canada will release its measure of CPI inflation (Oct), with traders and economists expecting a -0.3% m/m contraction on the headline figure, but a 0.2% m/m rise in the Core reading (2.0% and 2.1% y/y, respectively). Following in the wake of today’s decent US CPI report, there is a chance core inflation could come in hotter than expected in Great White North, though the persistent fall in oil prices will keep a lid on headline inflation.

Technical View: CADJPY

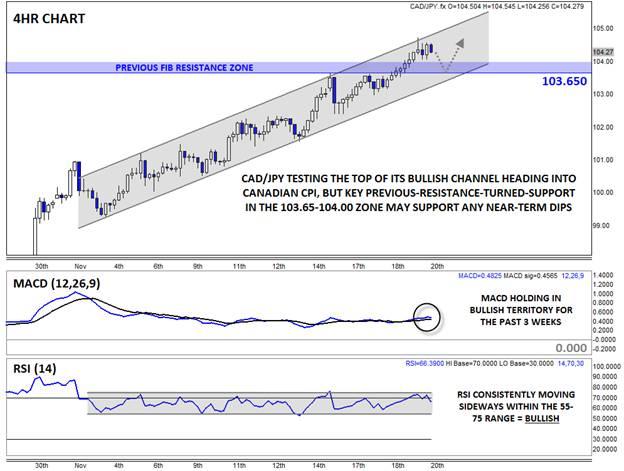

It will hardly come as a surprise to any readers that CADJPY has been surging of late, primarily on the back of continued easing and poor economic data out of Japan. The 4hr chart (below) shows that rates have been consistently following a bullish channel higher since the start of November, though a near-term pullback is possible after rates hit the top of the channel earlier today. More importantly, the pair just broke above a key area of converging previous / Fibonacci extension resistance in the 103.65-104.00 zone; now that this resistance zone has been broken, it should provide support on any near-term dips moving forward.

Turning our attention to the secondary indicators, the uptrend remains healthy. The MACD has been moving sideways above the zero level for the last three weeks, while the RSI has also been rangebound in a bullish range (55-75) since the beginning of the month. As long as these indicators maintain their consistently bullish positions, the path of least resistance for CADJPY will remain to the topside. Only a move back below key previous-resistance-turned-support in the 113.65-114.00 area would leave the pair vulnerable to a deeper pullback.

Source: FOREX.com

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.