![]()

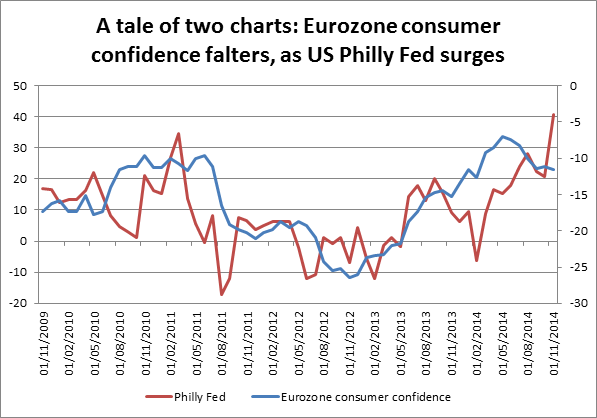

Figure 1 below shows the extent of the contrast between the US and Europe’s economic fortunes. The red line shows the Philly Fed, which almost doubled in November to 40.8 from 20.7, the highest level since 1993. The blue line shows Eurozone consumer confidence, which has headed south since May. The contrast between the two – with US manufacturing confidence surging while the Eurozone consumer woes continue to build – highlights how the US and the Eurozone are at very different stages of the economic cycle, which should limit the upside in EURUSD.

The outlook for EURUSD

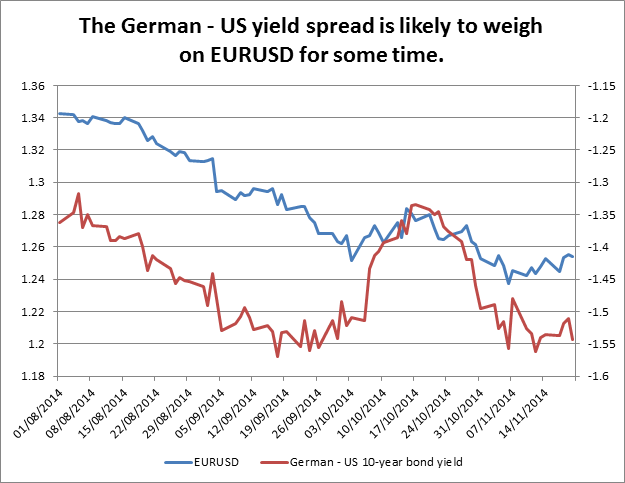

Figure 2 shows EURUSD and the spread between German and US bond yields. This spread is mired in negative territory; it’s actually at its lowest level since 1989, as the market prices in the prospect of Fed-style QE for the ECB at the same time as the Fed thinks seriously about tightening interest rates.

On Thursday, the yield spread has fallen further on the back of the weak European data, while EURUSD has managed to hold onto recent gains. This divergence is not sustainable in our view, which is why the market has been hesitant to push EURUSD above 1.2570-00, a noted area of resistance. Even if we do get above this level in the near-term, we still think upside will be capped, and the next level of resistance lies at 1.2663 – the 50-day sma.

Conclusion:

- It has been a good data day for the US, with the Philly Fed and existing home sales smashing expectations.

- Inflation has also ticked higher in the US, bucking the global disinflationary trend, suggesting that the US is firing on all cylinders.

- In contrast the Eurozone remains mired in economic trouble and consumer confidence continues to plunge.

- The contrasting economic fortunes are weighing on the German – US yield spread, which fell deeper into negative territory today.

- This should limit EURUSD upside, and we expect this pair to resume its downtrend in the coming days, potentially targeting 1.20 sometime in Q1.

Figure 1:

Source: FOREX.com and Bloomberg

Figure 2:

Source: FOREX.com and Bloomberg

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.