![]()

Following in the wake of a (very) slight miss in Friday’s NFP report, the US Dollar is continuing to pull back today. After a strong run over the last few weeks, the greenback is deeply overbought; therefore, the recent dip may simply represent profit-taking on the part of long-term dollar bulls, but the key question for FX traders is “How much further will the dollar drop?†As always, the answer is a nuanced.

Of course, the primary factor driving the dollar’s uptrend has been (and still is) expectations of diverging monetary policy between the Federal Reserve and the rest of the developed world. Despite the minimal rise in wages in Friday’s NFP report, the biggest takeaway is that the US labor market continues to strengthen. The unemployment rate has dropped to just 5.8%, which is rapidly approaching both the Federal Reserve’s and the Congressional Budget Office’s expectations of full employment, suggesting that price pressures, and corresponding rate hikes by the Fed, may be just around the corner.

On the other hand, there are some dynamics that favor an extended pullback in the world’s reserve currency. For one, bullish positioning in the dollar is still near multi-year extremes, suggesting that speculators may be getting ahead of themselves and that a near-term dip could clear some of the excess froth. In addition, US rates have actually been pulling back since Friday’s NFP report. The benchmark 10-year bond yield fell from a peak of 2.40% before the jobs report down to 2.27% earlier today. Clearly the bond market, which is widely seen as the “smartest†market, is not pricing in any imminent rate hikes.

Technical View: USDJPY

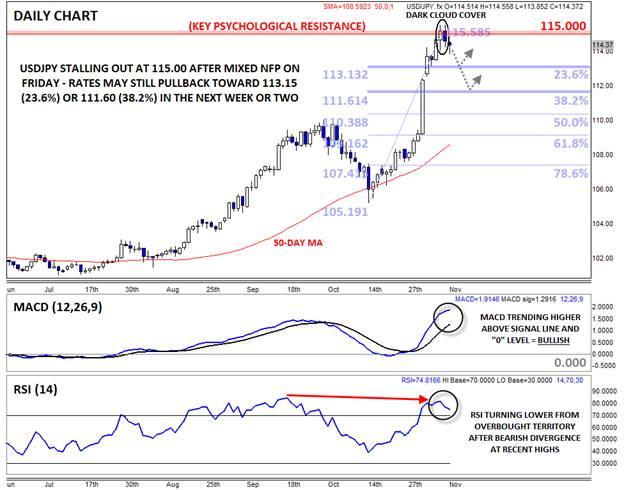

The daily USDJPY chart puts a fine point on the general dollar discussion above. After exploding over 1,000 pips higher over the last month, USDJPY bulls are no doubt anxious to take profits. As we go to press, the pair is testing a key psychological area of resistance at 115.00 and just put in a daily Dark Cloud Cover* candlestick formation, signalling a shift from buying to selling pressure and a possible near-term top in the market.

Meanwhile, the secondary indicators are painting a mixed picture. The lagging MACD indicator continues to show strongly bullish momentum, but the RSI is overbought and exhibiting a bearish divergence at the current highs. While the USDJPY chart is certainly not outright bearish, a short-term dip and consolidation would go a long way toward resolving the near-term divergence and building a platform for a more sustainable move higher.

For this week, bears may look to take the pair down to support at the initial Fib retracements at 113.15 (23.6%) or 111.60 (38.2%), but at this point, a deeper retracement seems unlikely, given the long-term bullish tailwinds for the greenback. Of course, a bullish break above Friday’s high at 115.60 would clear the way for further gains toward the 116.00 round handle or previous resistance above 117.00 in time.

A Dark Cloud Cover is formed when one candle opens near the top of the previous candle’s range, but sellers step in and push rates down to close in the lower half of the previous candle’s range. It suggests a potential trend reversal.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.