![]()

The EUR/USD has dropped sharply in the past hour or so and is in danger of resuming its long-term downward trend. Not only has it come under pressure from technical selling, but there’s also some fundamental news behind this latest move. According to a Reuters report, which cites “several sources familiar with the situation”, the European Central Bank is considering buying corporate bonds on the secondary market. The report suggests the ECB may decide on the matter as soon as December and begin purchasing early next year. Of course, the ECB has already started buying covered bonds as of yesterday, but expanding its asset purchases programme to include corporate bonds, which are much riskier, would mark a significant expansion in its already ultra-loose monetary policy stance. If the report is confirmed, the euro could come under increased pressure.

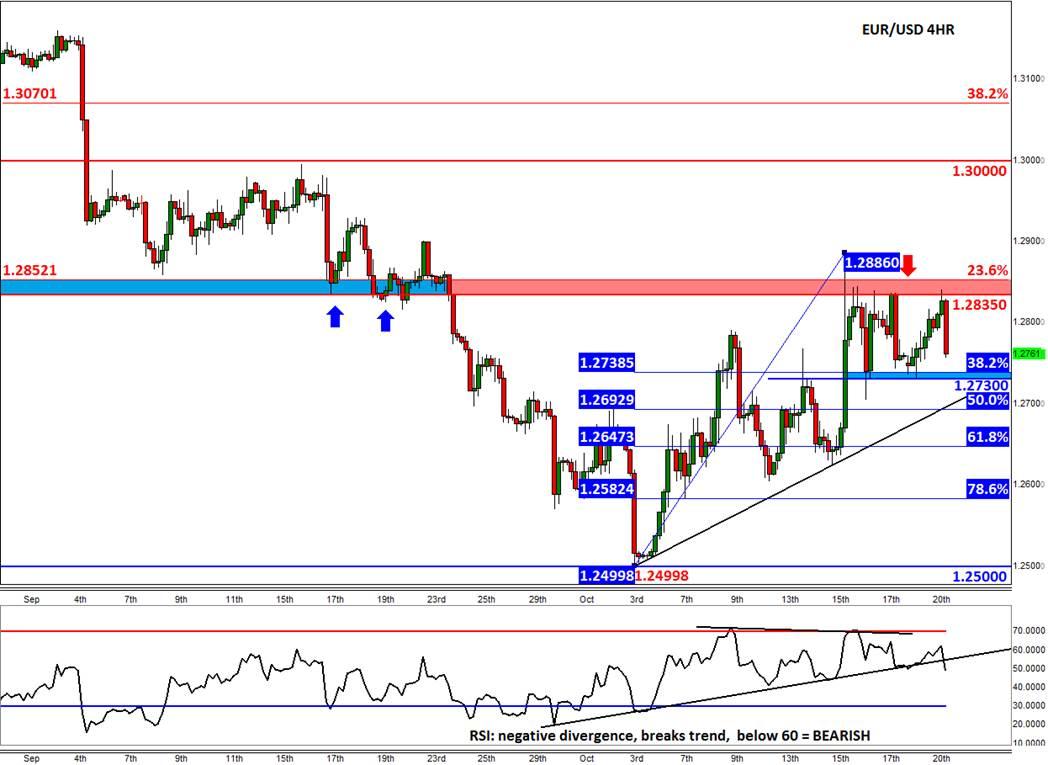

Now that the euro had had a decent bounce back, it may be a good time for its downward trend to resume – especially against the dollar, with the US central bank on course to end its own QE programme at the end of this month and raise interest rates next year. If the EUR/USD’s kick back rally that started from the psychological 1.2500 support does end here, it would be a significantly bearish outcome. That’s because it would have not even had a 38.2% retracement from its May peak (~1.4000). So far, it has only retraced to the 23.6% Fibonacci level at 1.2850 where it has come under additional pressure from the past price reference point, namely at 1.2835.

The downward move could accelerate if and when the EUR/USD breaks below a short-term upward trend around 1.2700. There are obviously a few important intra-day support areas to watch now, with the first one coming in around 1.2730/40, which, as can be seen on the chart, is also a Fibonacci-based level. So, there is still a good chance the EUR/USD may bounce back and push through the 1.2835 resistance level and head sharply higher. However the odds are stacked against the bulls, with the ECB’s on-going interventions, weaker Eurozone data and better fundamental developments in the US all likely to weigh on this pair. Meanwhile the Relative Strength Index (RSI) is bolstering the bearish argument. Not only has it recently created a negative divergence with the underlying EUR/USD prices (i.e. the EUR/USD created a higher high while the RSI made a lower low), it has also broken its own uptrend and is now below the key 60 level.

But in the absence of any major European data today or tomorrow, the potential downward move could be limited. That said, we do have some key data out of the US to look forward to. Existing home sales for September will be published at 14:00 GMT today, which are expected to have climbed to 5.11 million annualised units from 5.05m the month before. The more important inflation data will come out tomorrow at 12:30 GMT, with the CPI seen flat and core CPI up 0.2% month-over-month.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.