![]()

The price of WTI crude oil this morning fell below the key $80.00 for the first time since June 2012. However it has bounced back sharply from there and not even a bearish-looking oil report could halt the comeback. The Energy Information Administration (EIA) data showed crude stockpiles in the US climbed by a much larger than expected 8.9 million barrels last week, while gasoline inventories decreased by a good 4 million barrels and distillate stocks also fell slightly. Overall, I don’t think the decreases in gasoline stocks were large enough to outweigh the impact of the overall crude stockpile build. The rally therefore is mainly because of technical reasons (see below) and also due to a slightly weaker dollar after St. Louis Federal Reserve Bank President James Bullard said the Fed should consider delaying the end of its QE stimulus programme in a bid to halt the drop in inflation expectations. That was enough to cause stocks to swing widely into the positive territory and the dollar to give back its entire gains from earlier in the day. Oil found additional buoyancy from the release of some stronger than expected US economic data, which helped to boost demand expectations a little. Nevertheless, demand growth for oil is still likely to be weaker than had been expected which is why the International Energy Agency (IEA) revised down its estimates for both 2014 and 2015. In addition, the plentiful global supply of oil should help to keep a lid on prices.

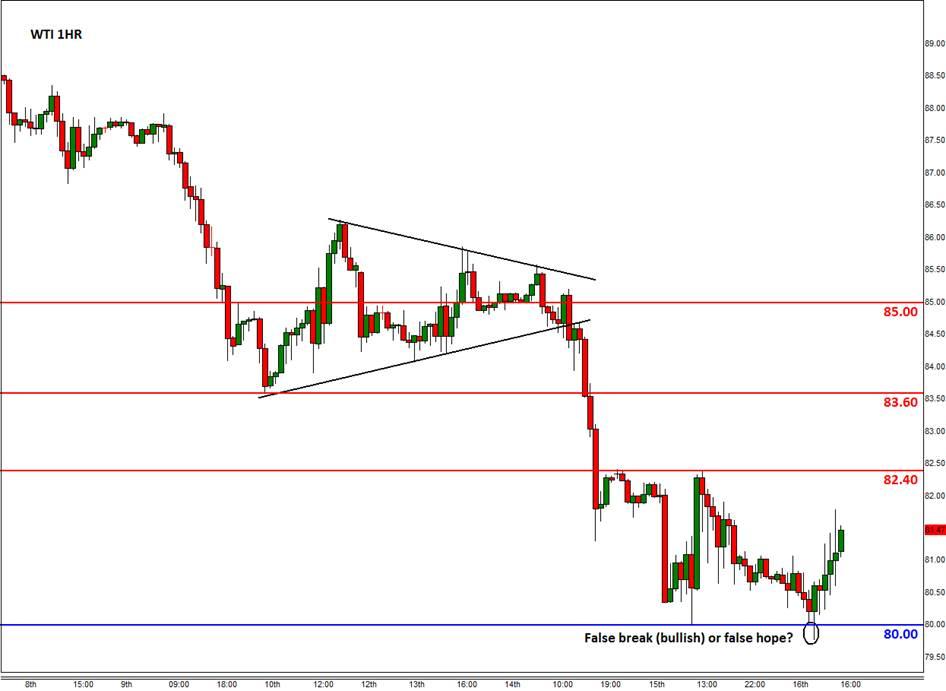

Nevertheless, WTI looks like it may stage a recovery of some sort from these oversold levels. As mentioned, it momentarily dipped below the psychological $80 mark this morning. But the lack of further supply below this key level caused prices to bounce back as the shorts started to cover some of their positions. There’s probably more stop loss orders above the previous high at $82.40 and if these get triggered then we may see a more profound rally towards $83.60 and possibly even $85.00. On the other hand, a closing break below $80 could pave the way for a move down to $77.50 and possibly lower over the coming weeks.

Figure 1:

Source: FOREX.com. Please note this product is not available to US clients.

Figure 2:

Source: FOREX.com. Please note this product is not available to US clients.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.