![]()

Gold continues to remain in favour during this period of great uncertainty and stock market turmoil. It is however a concern that the metal has not yet found greater safe haven demand, which goes to show what investors really think about the outlook for the yellow metal even at times like this. Indeed, ETF investors have yet to show their support and some are exiting the market at these higher levels: despite yesterday’s sharp rally, the world’s largest gold-backed ETF, the SPDR Gold Trust, saw an outflow of 2.1 tons from its holdings. But the physical demand from India appears to be growing ahead of the Hindu festivals of Dhantera and Diwali, as pointed out by the All India Gems & Jewellery Trade Federation. This may be why India’s trade deficit grew significantly in September, which in turn argues against the import restrictions being lifted any time soon. Nevertheless, this can only be a good sign. But whether this, the on-going global macro concerns or the stock market turmoil will encourage investment demand to rise remains to be seen.

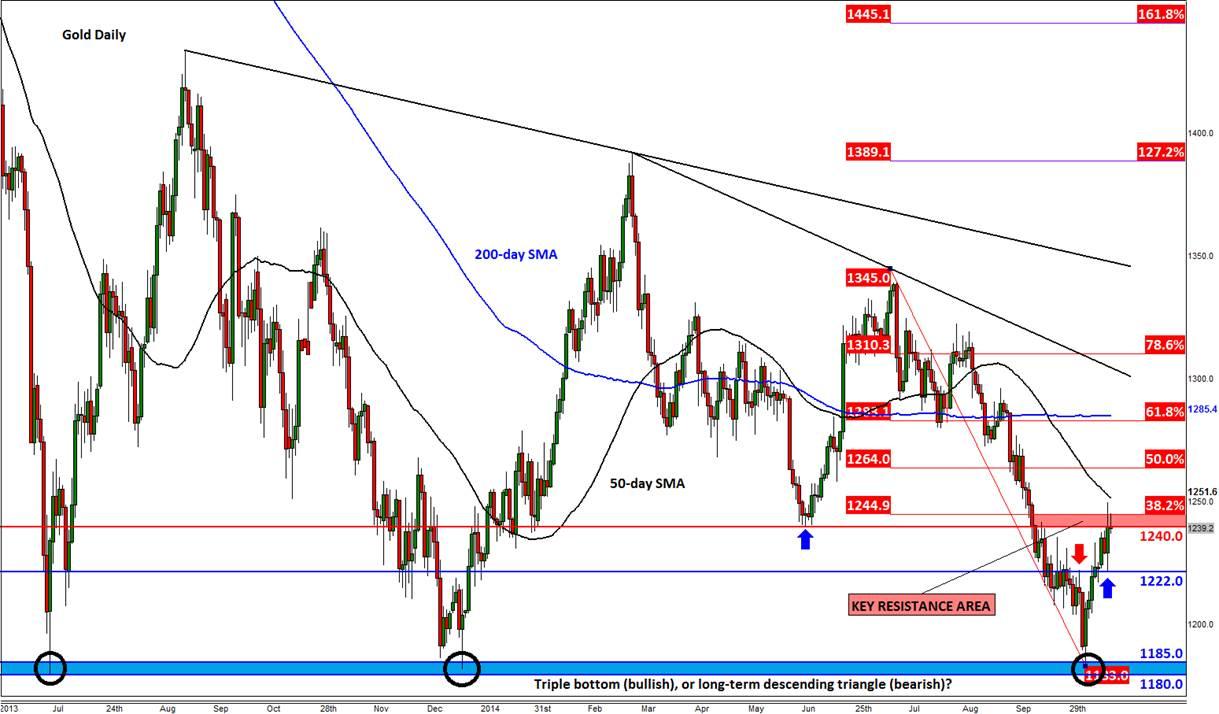

What about the technical outlook? Well that too is vague, although it depends on what time frame one is referring to. The key question is whether the recent bounce back from the $1180/85 area is the start of a triple bottom pattern or another false hope for the long-term bulls. We may get some more clues depending on what gold will do around the key area of $1240/45 which is currently being tested as resistance. Even if price were to climb above here, the longer-term bearish trend lines would still remain in place, so it wouldn’t necessarily be the end of the downward trend – it would merely weaken. But it will undoubtedly encourage some shorter term bullish speculators, who may have been on the side-lines until now. The $1240/5 is important because not only was this a key support and resistance area in the past, it also ties in with the 38.2% Fibonacci retracement of the downswing from July. Traders may also wish to keep an eye on $1251/2 which is the 50-day SMA. The next key area is around $1283/6 – this is where the 200-day SMA meets the key 61.8% Fibonacci retracement level. Meanwhile support comes in around $1220/2. If gold breaks below here then a revisit of the $1180/5 area could be on the cards.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.