![]()

Markets across Europe are tanking today, with all of the major European bourses registering losses. The biggest declines are in the Italian and Spanish indices, which are down more than 4%. This is worrying, as Italian and Spanish indices seem to be following Greek stock market, which has fallen nearly 10% in the last 2 days. There isn’t one thing that is weighing on the markets, instead it appears to be an accumulation of fears, and one of those is the prospect of a second sovereign debt crisis in the Eurozone.

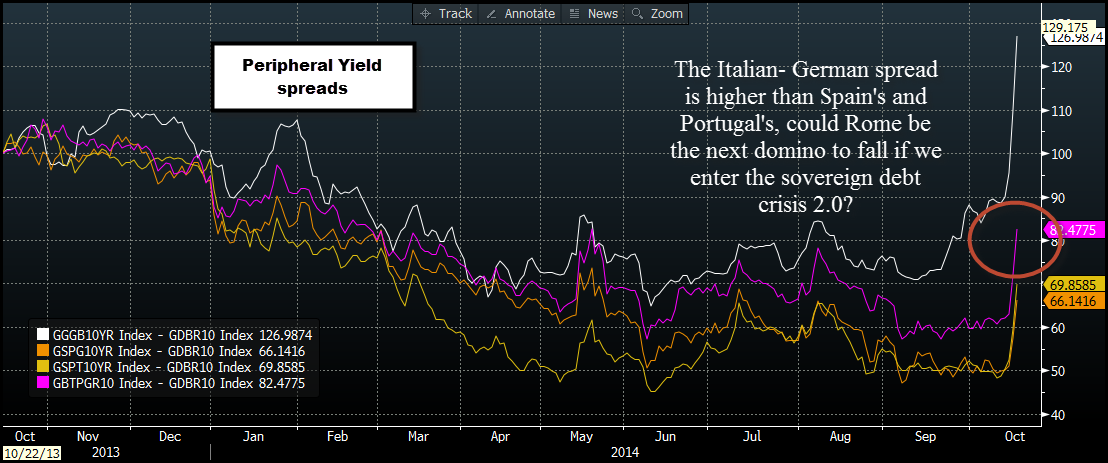

As we mentioned yesterday, although Greek yield spreads with Germany had started to move higher, contagion to other, larger European nations had been fairly limited. However, today we have seen the first signs of contagion starting to emerge. As you can see in the chart below, Spanish and Portuguese yield spreads with Germany have also surged this morning and are at their highest levels since May. While yield spreads remain low compared to the peaks that they reached back in 2011/ 2012, it is the speed of the move that has taken the market by surprise and is weighing on risk sentiment.

Is Italy the next in the firing line?

But the next domino to fall could prove to be too big to bail… Italy. Its economic growth is lagging behind Spain, and its debt to GDP ratio has surged since the first crisis broke out in 2010, it now stands at 132.6%. Since Italy is the third largest economy in the currency bloc, it will be much more difficult to bailout compared with Greece or Ireland. Italian yields have jumped 40 basis points so far this morning. Although yields are still at 2.72%, the pace of this increase is a major concern. If it continues to rise, then we could be at 7%, which is considered a line in the sand that can push a member state to require a bailout. During the peak of the sovereign debt crisis, bond yields would rise extremely quickly, so just because Italy’s 10-year yields are below 3% now, doesn’t mean they will stay in stable territory during this bout of market volatility. As you can see in the chart below, Italy’s yield spread with Germany is already above Portugal’s and Spain’s, which suggests that Rome could be the next domino to fall, especially now that the Five Star political movement is trying to get Italy out of the Eurozone.

Greece is back in the market’s bad books

Greece’s bond yields are close to 9% at the time of writing, after surging 110 basis points this morning. This pace is reminiscent of the peak of the sovereign debt crisis, before Greece had a bailout. Any sign that the ECB is stepping in to buy sovereign debt could actually spook the markets even more as it would be a throwback to the days when weekend summits were called to arrange bailouts and the ECB had to step in at the last moment. While yields in Greece remain at these elevated levels, we think that sovereign risks could continue to build in Italy, Spain and potentially even France, where yields have also risen today, although at a slower rate than elsewhere.

Can Janet Yellen save the day?

Elsewhere, the buck’s status as a safe haven was called into question yesterday; however, it is getting its groove back on Thursday and is one of the strongest performers in the G10 along with the yen. With sovereign fears rising in the currency bloc, it is only natural that the USD would act as a harbour in the storm. EURUSD has backed away from its 1.2845 intra-day highs as sovereign debt fears start to bite. We think that this pair could test early October lows at 1.25 in the coming days.

US stock market futures are also pointing to a lower open this morning, we shall have to see if a plethora of earnings data can calm markets. Watch out for Goldman Sachs who report earnings before the market opens, and Google, who report earnings after the market close.

The power to calm markets could lie with one woman, Janet Yellen, the head of the US Federal reserve. She is making a speech at an inequality conference tomorrow at 1330 BST/ 0830 ET. If she uses that platform to say that the Fed won’t leave markets to drown in this latest wave of risk aversion then we could see a brighter end to the week for markets. For now, get your hard hats at the ready.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.