![]()

The highly-anticipated Federal Reserve Monetary Policy Statement just hit the wires, and there’s plenty for both bulls and bears to digest. Tackling the proverbial “Elephant in the Room” first, the committee chose to keep the “considerable time”[until the first interest rate hike] pledge in its statement. Many market participants thought that the central bank would remove this key phrase to start preparing traders for the inevitable hike, but the inclusion of that statement suggests the initial rate hike may not come as soon as some optimists had hoped.

Beyond that one detail though, many of the other new developments favored USD bulls. For one, there were two dissenters to the statement: Philadelphia Fed President Charles Plosser and Dallas Fed President Richard Fisher. From the statement:

“President Fisher believed that the continued strengthening of the real economy, improved outlook for labor utilization and for general price stability, and continued signs of financial market excess, will likely warrant an earlier reduction in monetary accommodation than is suggested by the Committee’s stated forward guidance. President Plosser objected to the guidance indicating that it likely will be appropriate to maintain the current target range for the federal funds rate for “a considerable time after the asset purchase program ends,” because such language is time dependent and does not reflect the considerable economic progress that has been made toward the Committee’s goals.”

While dissents from two dyed-in-the-wool hawks are hardly surprising, this development shows the committee is becoming increasingly fractured between the hawks and doves. From a functional standpoint, Plosser and Fisher are almost certainly not going to see any interest rate hikes before they cycle out of the FOMC at the end of the year, but they may set a precedent for incoming hawks and moderates in 2015.

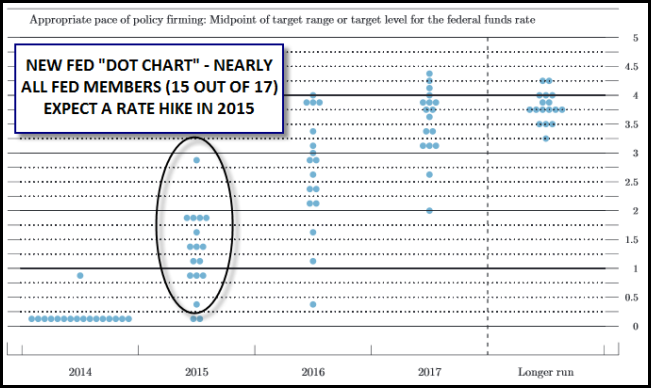

This month’s FOMC meeting also featured the release of the Summary of Economic Projections, including the so-called “dot plot” of Fed members future forecasts for growth, inflation, unemployment and interest rates. Overall, Fed officials were marginally more pessimistic about growth over the next few years, though they were more optimistic about the unemployment rate continuing to fall. At the margin, the critical interest rate forecasts inched higher, with 14 of 17 members now expecting an interest rate next year (only 12 had expected a 2015 hike back in June).

As final notes, the Fed also “tapered” its QE program by another $10B as expected, leaving monthly purchases at just $15B until next month, when they’re expected to be wound down completely. Meanwhile, in one last hawkish hint, the Fed’s statement also outlined new instruments to be used as part of the central bank’s “exit strategy,” suggesting that the members are looking seriously at how to normalize policy in the wake of the dramatic easing measures of the past few years.

Market Reaction

The US dollar initially rallied on the news: EURUSD, AUDUSD, and NZDUSD were all driven to or through their recent lows, while USDJPY surged to above 108.00. As we go to press though, the greenback is pulling back off its highs as traders tune in to Fed Chair Yellen’s press conference. Traders will be looking for more clarity on the Fed’s anticipated timeline from the chairwoman, though we’re skeptical that she’ll provide much insight.

Source: Federal Reserve, FOREX.com

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.