![]()

The focus may be firmly on the ECB today, but 15 minutes before ECB President Draghi’s monthly press conference we will get the first releases of critical US jobs data. At 1315 BST/ 0815 ET we get US ADP private sector payrolls data, then at 1310 BST/ 0830 ET we get jobless claims data for last week.

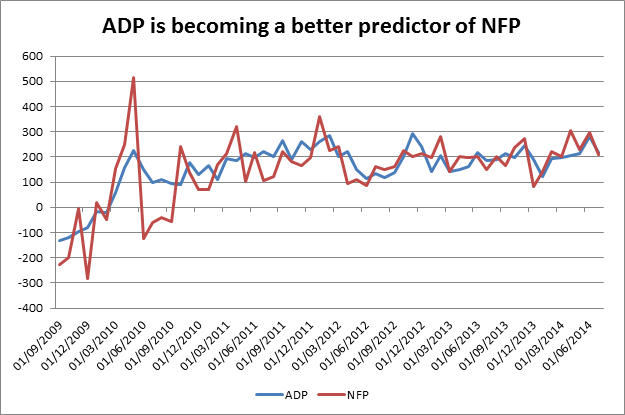

The market is looking for a robust reading of ADP for August, and is expecting 220k, up a touch from 218k in July. Initial jobless claims are also expected to remain steady at 300k, up a touch from last week’s 298k. Today’s data is merely the aperitif ahead of tomorrow’s key Non –Farm payrolls data; however, we still think that today’s data could be important from a market perspective, as ADP has become a better predictor of NFP in recent months, as you can see below.

So what could this mean for the dollar? Below we lay out a couple of scenarios:

1, Strong ADP, a fall in jobless claims: this could shake the dollar bulls back to life after a couple of days of sideways action for the buck. This could help USDJPY make another stab at 105.44 resistance, and help the dollar index to target prior highs above 83.00.

2, Data is in-line with expectations: The market reaction could be limited as the dollar fades to the background as we wait for the EUR’s reaction to the ECB press conference.

3, Weaker data: If the data disappoints this could weigh heavily on the USD, especially if the ECB does not embark on a QE programme, as we expect.

4, Non-manufacturing ISM: this data for August will be released after Draghi’s press conference, the market expects moderation to 57.7 from 58.7, however, if the index is stronger than expected, it could spark a dollar rally.

Overall, since the market is expecting some big numbers on the jobs front, the larger risk is for a disappointment, as it will be hard for the data to beat very optimistic market forecasts. Due to this, the bias could be to the downside for USDJPY in the lead-up to Friday’s NFP report. Although a stronger than expected Non-manufacturing ISM could limit any short term downside.

The technical view:

In the short term, with strong resistance at 105.44, the January high, the pair is coming under some selling pressure. Any data misses later today could exacerbate this trend. However, we continue to think that this weakness will be temporary as USDJPY was clearly overextended and due a pullback from recent highs.

Key support levels to watch include:

104.64, the 38.2% retracement of the latest advance.

104.32 – the 61.8% retracement of the same move.

103.56 – August 28 low.

If the jobs data manages to beat these expectations then we could see back to 105.44 – the January 2nd high, above here leads to 107.23 - the 138.2% Fib extension of the January – February sell off, then 110.66 – the August 2008 high.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD pressured as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.