![]()

For over two weeks now, EURUSD has frustrated both bears and bulls. After shedding 300 pips in July, the pair has now been contained to just a 110-pip range for over half of August. The recent price action has been particularly exasperating, but a developing technical pattern suggests that we may see a breakout and the return of volatility this week.

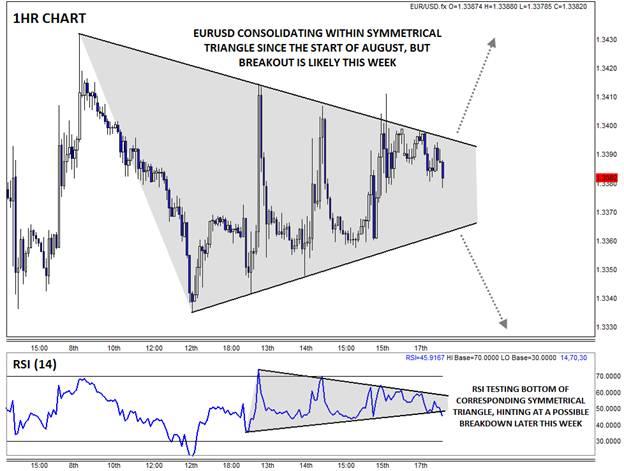

Since the minor high formed on August 1st, EURUSD has been putting in consistently lower highs, but the rates have also been forming higher and higher lows as well, creating a textbook symmetrical triangle pattern on the 1hr chart. This pattern is analogous to a person compressing a coiled spring: as the range continues to contract, energy builds up within the spring. When one of the pressure points is eventually removed, the spring will explode in that direction.

Unfortunately, it’s notoriously difficult to predict the direction of a symmetrical triangle breakout in advance, but there are tools that can help tilt the odds in a trader’s favor. For one, these patterns tend to break in the same direction as the previous trend, which in this case was to the downside. At the same time, the RSI is forming a corresponding symmetrical triangle pattern; a breakout from an indicator pattern can often lead a breakout in the price pattern itself. As it currently stands, the RSI is testing the bottom of its channel, potentially bolstering the case for a downside breakout later this week.

For now, more conservative traders may want to wait for a confirmed breakout before committing in either direction. If we do see a breakdown, EURUSD bears may look to target the 1-year low at 1.3300 next, followed by the 38.2% Fibonacci retracement of the 2012-14 rally near 1.3250. Meanwhile, a bullish breakout would point to a more substantial bounce toward 1.3450 or psychological resistance at 1.3500 next.

Key Economic Data that May Impact EURUSD This Week (all times GMT):

Ø Monday: US NAHB Housing Market Index (14:00 GMT)

Ø Tuesday: US Building Permits, Housing Starts and CPI (12:30 GMT)

Ø Wednesday: FOMC Meeting Minutes (18:00)

Ø Thursday: Eurozone Flash PMIs (8:00), US Initial Unemployment Claims (12:30 GMT), US Existing Home Sales and Philly Fed Manufacturing Index (14:00)

Ø Friday: Fed Chair Yellen Speech (14:00), ECB President Draghi Speech (18:30)

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.