![]()

Fundamentals: ZEW = EW!

Earlier today, traders got their first glance at the German ZEW survey for the month of August, and it wasn’t pretty. The index came out at just 8.6 vs. a consensus forecast of 18.2, marking the eighth consecutive weaker-than-expected reading from this leading economic indicator. The figure has shed over 50 points from its high of 62 at the beginning of the year, and is now at risk of turning negative for the first time since 2012. The ZEW survey adds to the string of poor economic reports out Germany, which is typically seen as the engine of Eurozone economic growth. If the German economy continues to stutter, the ECB may have no choice but to institute outright QE sooner rather than later.

Technicals: Price Action is King

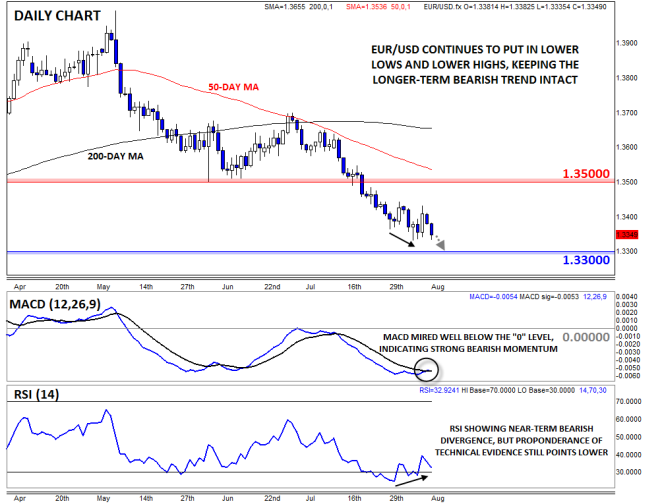

As you might expect after a string of weak economic reports, the EURUSD’s chart is also painting a bearish picture. The unit continues to put in lower lows and lower highs on the daily chart, the textbook definition of a downtrend, while both the 50- and 200-day MAs are trending lower. At the same time, the MACD indicator is mired well below the “0” level, showing strong selling momentum. The only potential concern from a technical standpoint is the potential divergence developing in the RSI indicator, which failed to confirm last week’s low in price. That said, the preponderance of technical evidence suggests that EURUSD should remain under pressure in the days to come and that bears may look to target the 1-year low around 1.3300 next.

Sentiment: Positioning Data Reaching an Extreme

While fundamental and technical traders duke it out on a daily basis, sentiment traders typically only throw their hats into the ring when markets are reaching an extreme. Based on the most recent Commitment of Trader report from the CFTC, traders extremely pessimistic on the Euro’s prospects:

“Commercial traders,” shown in red above, are typically large companies trying to hedge their currency risk, and as a result, they are not interested in making money trading. For this reason, the large (green) and small (blue) speculators give the most reliable indication of how active, profit-driven traders are positioned. Both of these subsets are positioned at multi-year bearish extremes: Large speculators are net short to the tune of nearly 125k contracts, whereas small speculators are short nearly 50k contracts. Both of these readings are the most extreme since mid-2012 and the overall ratio of sellers to buyers is approximately 4:1.

This extreme bearish positioning shows that many traders are already short EURUSD; from a contrarian perspective, this phenomenon could actually indicate that there soon may be “no one left to sell,” even if the fundamental and technical outlooks continue to deteriorate.

While we still generally favor sell opportunities in EURUSD, bearish traders should still keep a close eye on the market’s reaction to news announcements over the next few weeks. If EURUSD stops selling off and begins to hold steady (or even rally) on poor economic data, it would indicate that a near-term extreme has been reached and the pair may be due for a recovery rally toward at least 1.3500.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.