![]()

Can the BOE boost the pound’s fortunes?

Until a few weeks ago the pound was one of the most overbought currencies in the G10. This has been rectified by the recent bout of selling, and the CFTC’s measure of long GBP positions held by the speculative community has fallen to its lowest level since February. Since the fundamentals of the UK economy are basically unchanged, could the pound start to look attractive once more?

This could depend on this week’s 2 major event risks. The employment report due before the Inflation Report on Wednesday is expected to show solid employment growth. The economy is expected to have created 270k jobs in the three months to June, while the jobless rate is expected to fall by 30k and the unemployment rate is expected to drop to 6.4% from 6.5%. Although wage growth is expected to remain weak, if the upcoming Inflation Report boosts expectations of a rate hike for later this year then traders may be happy to get back into the pound after its recent decline.

The spare capacity conundrum

At the last Inflation Report in May the focus was on the amount of spare capacity in the UK economy. Unless this spare capacity is eroded then there won’t be a rate hike, said Carney. If Carney and co. can confirm that the capacity gap is closing then the prospect of a rate hike by the end of the year could grow.

The technical view:

But while the fundamentals could be GBP supportive, dependent on the outcome of the Inflation Report, the technical picture is slightly more worrisome. GBPUSD has extended its recent bout of weakness and momentum indicators are now looking decidedly bearish. The break below 1.6800 brings 1.6740 into view, the 61.8% Fib retracement of the March to July advance, below here opens the way to 1.6693 – the May low.

If we get a close below 1.6693, it would be extremely bearish and would suggest that there could be further downside to come. However, if Carney and co. sound optimistic about the economic outlook then we could see a return to 1.6889 – the August 5th high, which is key resistance over the next couple of days.

The yield perspective:

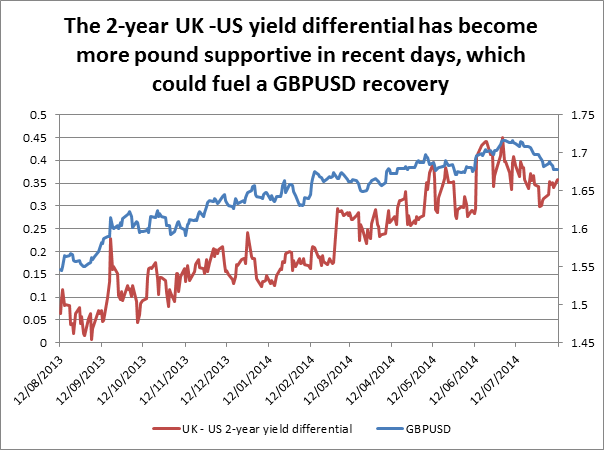

The 2-year yield differential between the UK and the US has bounced back in recent days, which could also be pound supportive. If the BOE points to a rate hike later this year then the 2-year yield spread, which is sensitive to changes in monetary policy, could continue to move in the pound’s favour. (See figure 1 for more).

Takeaway:

The pound has been under pressure in recent weeks, but positioning is now looking healthy and a lot less stretched to the upside.

The Inflation Report on 13th August could determine if the pound rallies once more, or if it extends its recent decline.

If the BOE sounds optimistic that spare capacity in the UK economy is starting to shrink then expectations of a rate hike could be brought forward.

The technical picture is still looking weak. A break below 1.6693 in the medium-term would be a very bearish development that would open the way to further losses.

If the Inflation Report triggers a reversal in GBPUSD then short-term resistance includes 1.6889 – the August 5th high.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.