![]()

Highlights

- NFP Prep: Another Round of 200k+ New Jobs on Tap?

- Another View: The Sixth Sense

- View How Our NFP Forecasts Compare

NFP Prep: Another Round of 200k+ New Jobs on Tap?

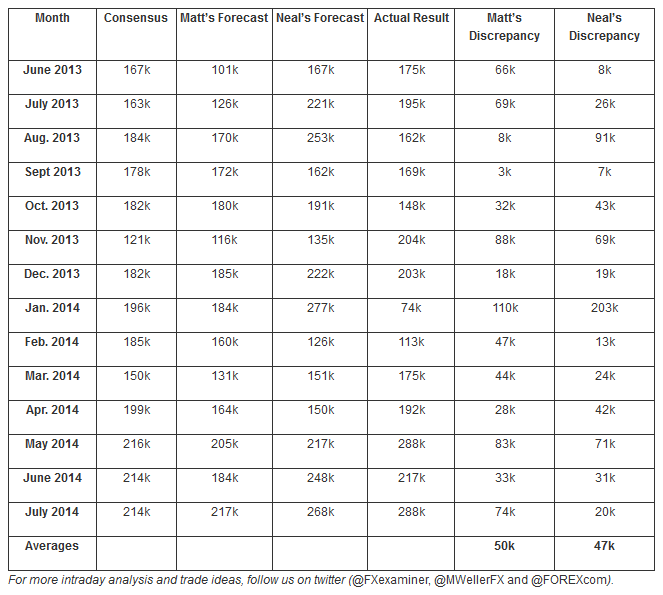

By: Matt Weller, Senior Technical AnalystThe July Non-Farm Payroll report will be released tomorrow at 8:30 ET (13:30 GMT), with expectations centered on a headline print of around 230k new jobs. My NFP forecasting model suggests that the NFP report will come in slightly below expectations, with leading indicators suggesting a July headline NFP reading of 206k.

The model has been historically reliable, showing a correlation coefficient of .90 with the unrevised NFP headline figure dating back to 2001 (1.0 would show a perfect 100% correlation). As always, readers should note that past results are not necessarily indicative of future results.

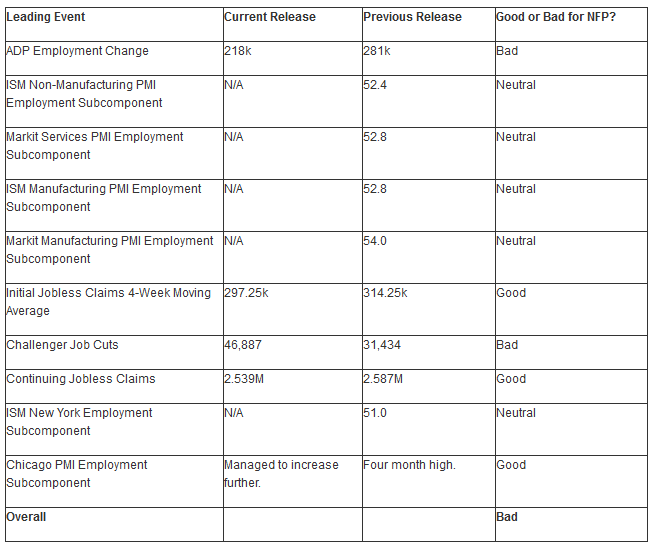

Source: Bureau of Labor Statistics, FOREX.com

This month’s report is highly unusual in that two of the four leading indicators, the ISM Manufacturing and ISM Non-Manufacturing reports, will not be released until after NFP. As a result, this notoriously hard-to-foresee report will be even more difficult to handicap. That said, the two reliable employment indicators we did receive were solid: the ADP employment report moderated from last month, but printed a solid 218k reading, while Initial Jobless Claims dropped further to just 302k in the survey week and have since dropped below 300k.

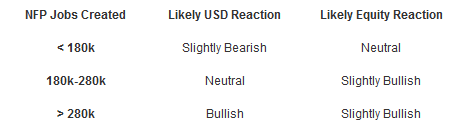

Trading Implications

The uncertainty in heading into this month’s NFP report is partially balanced by the likelihood that it will not dramatically affect the Fed’s monetary policy. The headline NFP report has now shown in excess of 200k new jobs were created in each of the past five months, and traders are finally starting to believe that the US economic recovery is accelerating. With Wednesday’s Federal Reserve statement reiterating that the Fed will keep interest rates low in the near term, the market reaction is likely to be somewhat subdued.

Therefore, only a large surprise relative to expectations is likely to wake volatility from its slumber. See three possible scenarios for this month’s NFP report, along with the likely market reaction below:

Historically, USD/JPY has one of the most reliable reactions to payrolls data, so traders with a strong bias on the outcome of the report may want to consider trading that pair.

Though this type of model can provide an objective, data-driven forecast for the NFP report, readers should note that the U.S. labor market is notoriously difficult to foretell and that all forecasts should be taken with a grain of salt. As always, tomorrow’s report may come in far above or below my model’s projection, so it’s absolutely essential to use stop losses and proper risk management in case we see an unexpected move. Also, please be aware that placing stop loss orders will not necessarily limit your losses.

Another View: The Sixth Sense

By: Neal Gilbert, Senior Market Analyst

This month my Non-Farm Payroll model is forecasting a robust 262k increase in jobs in July 2014, which would continue the incredible run of impressive results emanating from the US employment sector. Once again though, much like last month, there is a dearth of leading employment information available to us prior to the all-important release making it increasingly difficult to fortell. Nonetheless, despite the lack of information, last month’s forecast correctly presumed an above consensus result; something that this month’s forecast is repeating.

While some reliable indicators, like ADP Employment Change, provided a convincing argument for the direction of jobs gained, others like a majority of the influential PMI subcomponents won’t be released in time to utilize them. That means that an incredible 5 out of 10 potential indicators (HALF!) aren’t giving my model any hint on a positive or negative outcome; a situation that could throw off the forecast wildly.

For instance, if all of the missing data were negative, it would subtract 28 points from my final model result, effectively subtracting 56k jobs from my forecast. On the other hand, if they were all positive, it would ADD 56k jobs to it. So I’ve got a margin for error between 206k (262k – 56k) and 318k (262k + 56k); daunting to say the least, but still encouraging considering the consensus is around 230k. Others who make forecast models around the world may have the same challenges, therefore, making this a very difficult NFP to foretell.

Using my forecast model had previously required me to take last month’s result and either add to or subtract from it based on ten employment reports released before NFP; however, all of the weather related craziness in the first quarter of 2014 created a challenge to that doctrine in that previous results were anticipated to be revised substantially higher. While that anticipation turned out to be inherently incorrect, my forecast was actually fairly accurate utilizing the average calculation. Therefore, I will continue to repeat the method of using a three month average which takes into consideration the possibility of a revision. So instead of using 288k as my base (last month’s result), it will now be 272k (an average of 304k April, 224k May, and 288k June).

Here is the breakdown of the leading employment reports:

As you can see from the table above, the majority of the employment indicators that were available gave a positive score, but they were outweighed by the strength of ADP, ultimately leading to a negative score. Taking all these results together, I came up with my NFP estimation of 262k new jobs created in July 2014. This is better than the consensus estimate of around 230k, and could prompt the USD to continue its impressive strength following the strong GDP report earlier this week.

Any figure above 200k would be encouraging for the growth of the US economy, but it also means that the Federal Reserve would likely continue moving closer to the end of Quantitative Easing and an eventual interest rate hike; maybe as soon as six months after QE’s demise. It would also mark the sixth straight month of 200k or more jobs gained; a feat that hasn’t been achieved since 1997 (the same year that M. Night Shyamalan wrote the classic thriller, The Sixth Sense…eerie)! Therefore, if my forecasting model presumes correctly, I would expect to see an initial surge in a currency pair like the USD/JPY, which typically has the most logical reaction to NFP releases.

View How Our NFP Forecasts Compare

Recommended Content

Editors’ Picks

AUD/USD defends 0.6400 after Chinese data dump

AUD/USD has found fresh buyers near 0.6400, hanging near YTD lows after strong China's Q1 GDP data. However, the further upside appears elusive amid weak Chinese activity data and sustained US Dollar demand. Focus shifts to US data, Fedspeak.

USD/JPY stands tall near multi-decade high near 154.50

USD/JPY keeps its range near multi-decade highs of 154.45 in the Asian session on Tuesday. The hawkish Fed expectations overshadow the BoJ's uncertain rate outlook and underpin the US Dollar at the Japanese Yen's expense. The pair stands resilient to the Japanese verbal intervention.

Gold: Buyers take a breather below $2,400 amid easing geopolitical tensions

Gold price is catching a breath below $2,400 in Asian trading on Tuesday, having risen over 1% in the US last session even on a solid US Retail Sales report, which powered the US Dollar through the roof. Easing Middle East geopolitical tensions and strong Chinese data could cap Gold's upside.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Israel-Iran military conflict views and takeaways

Iran's retaliatory strike on Israel is an escalation of Middle East tensions, but not necessarily a pre-cursor to broader regional conflict. Events over the past few weeks in the Middle East, more specifically this past weekend, reinforce that the global geopolitical landscape remains tense.