![]()

Like many other FX pairs the EUR/USD has been trading in a very tight range so far today. This is mainly due to the lack of any major European macroeconomic pointers and as investors await direction from the US where we have pending home sales due at 15:00 BST (10:00 EDT). The euro has at least managed to put the brakes on as it is currently a touch firmer on the session. It has been boosted by some surprisingly good news out of the state-controlled lender Bankia, which has helped to push the 10-year Spanish bond yield to below 2.5% for the first time since the euro was introduced. Shares in Bankia rose more than 1.5% in Madrid after the troubled lender posted first half earnings that easily topped the estimates: €432 million. Also helping the sentiment was Moody’s decision late on Friday to upgrade the Portuguese credit worthiness as the ratings agency pointed out that the troubles in Banco Espirito Santo was unlikely to impact the government's finances.

But volatility in the EUR/USD and the FX market as a whole should begin to rise as we progress through the week, for there’s so much global economic data set to be released over the next several days. As well as pending home sales today, there will be other high-impact US data later this week that includes among other things, the second quarter GDP estimate, ADP private sector payrolls and of course the official jobs report on Friday. In Europe, we will have the German Preliminary CPI estimate for July on Wednesday, followed by the eurozone equivalent a day later on Thursday and some manufacturing PMIs on Friday. Thus there’s so much data to look forward to this week which should hopefully lead to some volatility and exciting trading opportunities.

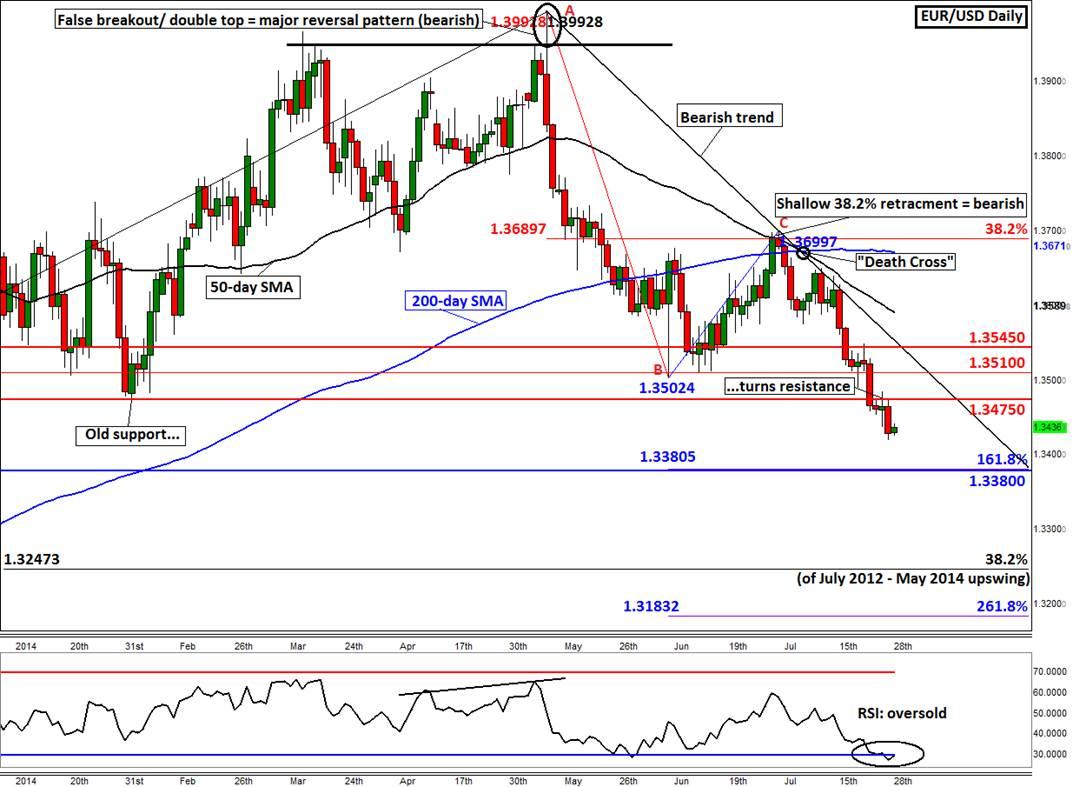

The fact that the euro is slightly firmer today suggests that the sellers may be reducing some of their positions ahead of those economic data releases as they are probably looking to re-enter at better levels, for the EUR/USD’s charts still look anything but bullish. Take the daily chart as example. As can be seen, the euro topped in May at just below the 1.40 level where it created a false breakout reversal pattern when Mario Draghi, who had already voiced "serious concern" about a strong foreign exchange rate, said the ECB was comfortable with acting in June if needed. Sure enough, at its June meeting the ECB intervened as it introduced several stimulatory measures which among other things included negative deposit rates. Following a brief respite, the EUR/USD continued to break further lower as the ECB maintained its bearish bias and as the eurozone economic data were mostly uninspiring. That “brief respite” ended around the 38.2% Fibonacci retracement point of the down move from the May peak, at just below the 1.37 handle. In other words, it was a very shallow retracement, suggesting that the next leg of the move, which has already begun, could be quite significant.

Indeed, having broken another support level at 1.3475 last week (which then turned into resistance), the path of least resistance continues to be on the downside for the EUR/USD. It will remain that way until at least it manages to take out the bearish trend line – and even then we are unlikely to see a sharp rally. In fact, the bulls will do well to push rates back above 1.3475, 1.3510 or 1.3545 in the very near term. These were all previously support and resistance levels.

On the downside, the next likely target is around 1.3380 which ties in with the 161.8% Fibonacci extension level of that “brief respite” corrective move that occurred between points B and C last month. The 261.8% extension of the same price swing comes in around the 1.3180/5 area. Ahead of that lies the long-term 38.2% Fibonacci retracement level (of the upswing from the July 2012 low to this year’s peak) at 1.3245/50. But with the RSI currently below 30, in other words in the “oversold” territory, there is a chance for a short-term pullback. This makes sense especially as we have all the above-mentioned data and more coming up this week.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.