![]()

Much like the USDJPY, which we discussed at length earlier today, the AUDNZD has been rangebound for most of 2014. In its case, the antipodean pairing has been finding consistent support in the 1.05-1.06 area and resistance between 1.09 and 1.10. While sideways trade is hardly ideal for longer-term buyers or sellers, bulls will certainly agree that 2014 has been an improvement over 2012 and 2013, when the typically-staid pair fell over 2400 pips in 24 months. Indeed, there are growing technical signs that rates may be carving out a significant long-term base within the current range.

Because both Australia and New Zealand are affected by many of the same global economic trends, differences in relative monetary policy and interest rates are the primary driver of the AUDNZD exchange rate. To that end, the upcoming Reserve Bank of New Zealand monetary policy decision coming could set the near-term tone for the pair. As my colleague Chris Tedder discussed yesterday, the central bank is likely to raise interest rates by 25bps one last time before pausing its rate hike cycle for a few months. Relative to the market’s expectations though, there is a small risk that the bank could be more hawkish than expected, which could lead to a pullback in the AUDNZD.

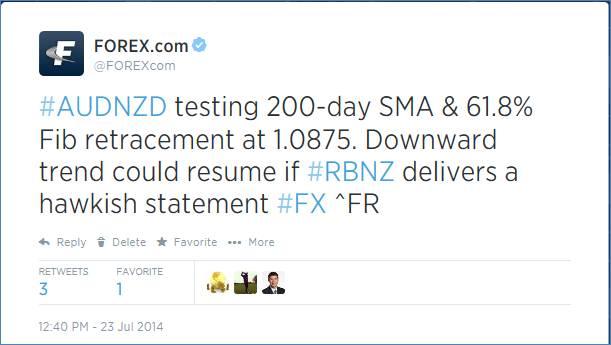

From a technical basis, we noted a key area of resistance on twitter earlier today:

As the chart below shows, 1.0875 is the critical resistance level to watch. Technical traders will be hyper focused on this area, as the AUDNZD has not traded meaningfully above its 200-day MA since August of 2012, and then only briefly. The secondary indicators are generally supportive, with the RSI rising within its own bullish and the MACD trending higher above the signal line and the “0” level, but given the importance of the 1.0875 level, we’re treating the rally with skepticism until/unless rates can rise through that barrier.

If we do see a bullish breakout this week, a move up to the 78.6% Fibonacci retracement at 1.0945 or the previous highs near 1.1000 becomes more likely. On the flip side of the coin, a more-hawkish-than-expected RBNZ could reverse the recent rally for a move back down toward 1.0800 or 1.0700 in the near-term.

Source: FOREX.com

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.