![]()

We have mentioned for a while now that the G10 FX market is starting to get interested in relative yield differentials. On the back of this theme, we think that the NZD could rally against the USD in the short term, as disappointing US inflation data may support the Fed maintaining its dovish rhetoric, at least in the near-term.

On Wednesday night at 2200 BST/ 1700 ET, the RBNZ is expected to hike interest rates, which may add to the NZD’s attractiveness from a yield perspective. The statement released after the rate decision will be crucial to determine if the RBNZ will continue to hike rates or if they will stay on hold. We don’t expect them to express any dovish sentiments, which could limit NZD downside in the medium-term.

From a technical perspective, a few things suggest that we could be about to embark on another leg higher in NZDUSD:

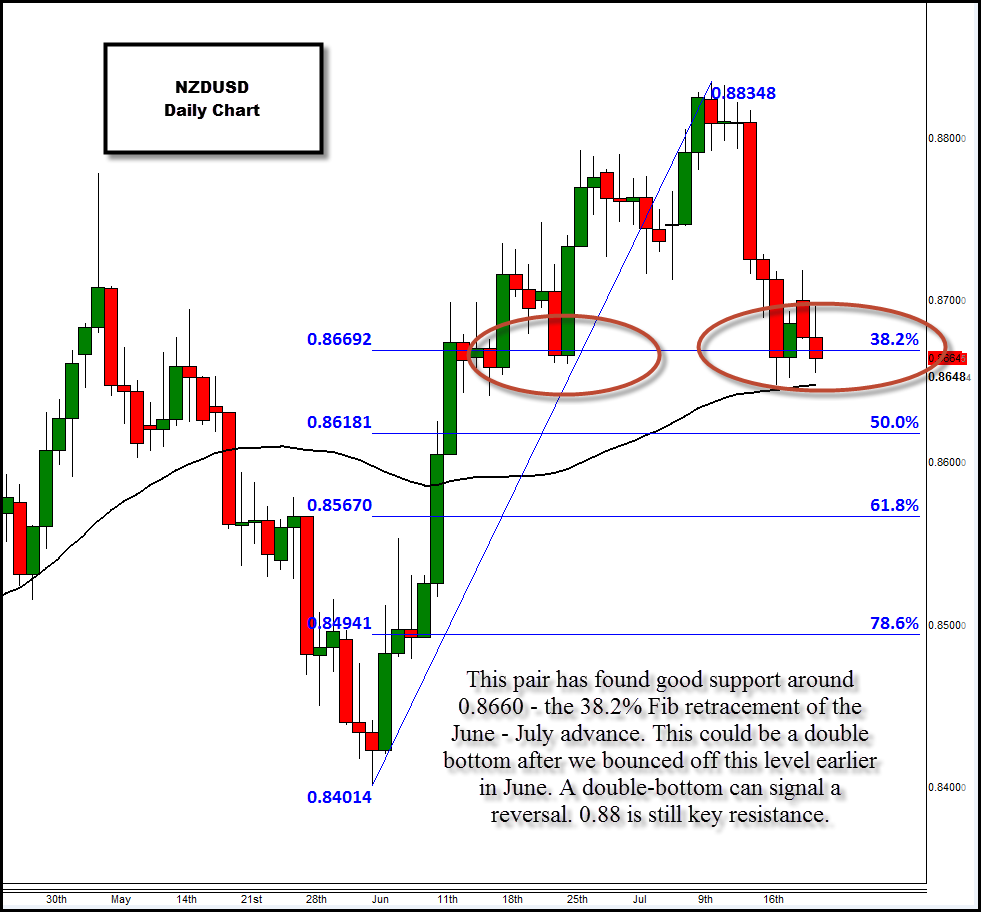

- NZDUSD found support at the 38.2% retracement of the June low – July high.

- 0.8650 – 0.8665 is a key support zone that also includes the 50-day sma, the market seems to respect this level.

- The low so far on Tuesday at 0.8656 corresponds with the low from 17th June, this is looking like a double bottom. Double bottom patterns can signal a reversal in trend.

As we lead up to the RBNZ meeting the tide could be changing for the NZD. The technical picture is starting to look more encouraging, and after NZDUSD dropped more than 2.5% since peaking earlier this month, the RBNZ may not sound too concerned about the strength of the kiwi, which could also excite NZD bulls. If this happens then NZDUSD may make another stab at 0.8800.

As a caveat to the above, unfortunately we don’t have a fly on the wall at the RBNZ, and they could say, or do, anything. If they are more dovish than we or the market expects (either they don’t hike rates, or the statement is particularly dovish) then the NZD could sell off sharply. Below 0.8666 opens the way to the 50% retracement of the June low to the July high at 0.8623, then the 61.8% retracement of the same move at 0.8571.

Takeaway:

- NZDUSD could be in focus as we lead up to Wednesday’s RBNZ meeting.

- Disappointing US Inflation data combined with an expected RBNZ rate hike could lead to some long interest in NZD in the next 24-48 hours.

- If the RBNZ hikes rates, sticks to its moderately hawkish tone and does not sound worried about Kiwi strength then NZDUSD may make another run at 0.8800.

- The technical picture is also supportive, as the recent sell off in NZDUSD found support around the 38.2% Fib retracement of the June – July advance.

- However, if the RBNZ sounds more dovish than expected we would expect NZDUSD to reverse course, key support levels include 0.8570.

Figure 1:

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.