![]()

On Friday morning the S&P 500 future had managed to bounce back a little, pointing to a firmer open on Wall Street, but the index still looked set to close lower for a second straight week. The release of mostly better than expected corporate earnings results so far have been overshadowed by mixed-bag US data and geopolitical risks stemming from the Middle East and North Africa (MENA) and Ukraine. The focus of the attention has shifted from the troubles in Iraq to the Israel-Palestine conflicts. Following several days of deadly air strikes, the Israeli military has begun a ground offensive against the militants in Gaza. Although the conflicts there are unlikely to cause any disruptions to oil supply from MENA, the markets are nonetheless growing worried about the region’s instability. There have also been renewed worries over the possibility of retaliatory action from Russia after it was slapped with fresh sanctions by the US over its involvement in the crisis in Ukraine. Sentiment turned really sour after the unfortunate news of the Malaysian airline crash in Ukraine on Thursday. Gold prices and the Volatility Index (VIX) both jumped as complacent investors decided it was better to play it safe.

On Friday, rescuers had reportedly found the second flight recorder from the Malaysia Airlines Flight MH17. Thus, soon it will hopefully become clear who was responsible for the plane’s crash, which could either add to or take away some of the uncertainty hanging over the markets. If it was indeed brought down by a ground-to-air missile, as many expect that was the case, then it would solidify the claims it was the pro-Russian rebels, who some suggest may have done it by mistake. If this is the case then everyone will point the finger at Russia and they will come under extreme pressure to help de-escalate the situation in Ukraine. In other words, this unfortunate incident might actually turn out to be a good thing for risk assets over the coming weeks. In the short-term however it may cause further uncertainty as it would undoubtedly increase calls for further sanctions on Russia. As a result, it will not just be energy prices that may rise but other commodities too such as copper, palladium and gold.

But worryingly for the stock markets bulls, there are other signs to suggest a bigger correction may be on the way. For example, as our colleague Matt Weller reported last week, there’s been some evidence of possible sector rotation taking place whereby safe haven stocks such as utilities, energy and health care have all gained ground while riskier cyclical, financial, and industrial stocks had weekend. This week,Matt pointed out the recent underperformance of small-cap stocks, which are more vulnerable to domestic economic activity than their large cap peers. Both of these factors, combined with some valuation methods such as the elevated price to earnings (PE) ratio suggest the market may be over-priced and that a correction could be on the way soon.

Nevertheless, the S&P 500 and the other major US indices continue to defy gravity and remain near record levels. Although the VIX spiked as result of the Malaysian plane crash, it remains near historical lows which either suggests that the market bulls are extremely complacent or that they are not worried about the geopolitical and other risks. We continue to think that it is the low interest rate environment which is providing the biggest support to equities, above all. On top of this, sentiment has been supported by improving signs about China’s economy as well as the solid US corporate earnings results that we have seen so far, especially from the banking sector. Although compared to a year-ago period, some financial sector earnings may have fallen, most of them have managed to top expectations and that is ultimately the deciding factor for some short-sighted speculators. Meanwhile technology companies have also begun reporting their results with the likes of eBay, Google and IBM all reporting mostly positive numbers. Next week, the earnings season will kick into a higher gear and once again there are plenty of tech companies scheduled to report their quarterly results. On Monday, for example, we will hear form Netflix, followed by Apple and Microsoft on Tuesday and Facebook a day later on Wednesday. These are all S&P 500 companies.

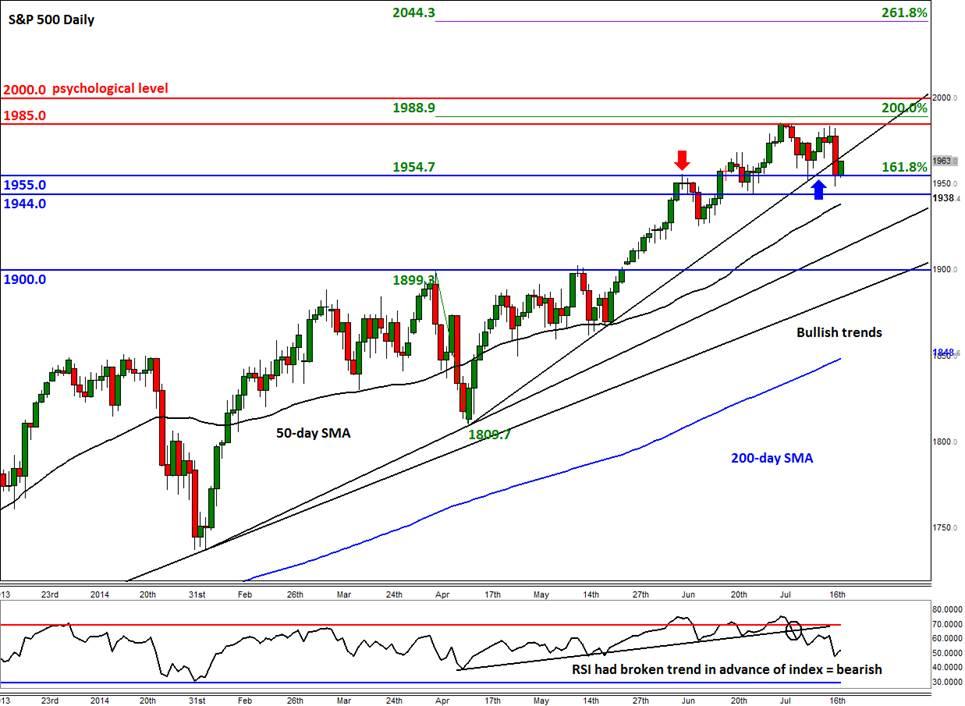

Ahead of those and other earnings results, and despite Thursday’s selling pressure, the technicals are still looking solid for the S&P 500 from a bullish point of view. As can be seen from the daily chart, the index is comfortably above both its 50 and 200 day moving averages, which suggests the trend is still very strong. Although a short-term bullish trend line has been broken as a result of Thursday’s sell-off, the longer term trends are still intact. We expect the S&P to at least take a short-term bounce around those trend lines, should it get there at all. Ahead of those is the 50-day moving average at 1938 and a support level at 1944. On the upside, the prior all-time high of 1985.5 remains the main reference point. If and when this gets broken then the only notable technical level standing on the way to 2,000 is 1989 which corresponds with the 200% extension level of the corrective move from 1899 to 1809.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.