![]()

At the start of this week, we asked if USDCAD could be the “Mecca†of G10 volatility this week. While that prediction has not come to fruition (the pair has been contained to just a 70-pip range thus far this week), the fundamental and technical picture is starting to look more constructive ahead of tomorrow’s Canadian employment report.

Tackling the fundamental side of the ledger first, data out of the Great White North has been mixed over the past few days. The biggest headline was Monday’s terrible Ivey PMI report, which came out at just 46.9 vs. 51.3 expected. This report marked the second straight month of outright contraction according to the indicator, suggesting that the Canadian economy took a stumble in Q2 after a strong start to the year. That said, Canadian housing data has taken a bit of the sting out of the poor PMI report, with Building Permits rising at 13.8% rate m/m and Housing Starts also beating expectations.

In the US, yesterday’s Fed minutes were generally hawkish, with the FOMC stating that it would likely end QE with a $15B taper in October, but the greenback is broadly unchanged since the release. Bullish traders are hoping today’s better-than-expected initial jobless claims report (304k vs. 316k anticipated) will provide a positive catalyst for the buck. Without a clear economic trend in favor of either of the North American nations, the USDCAD has simply consolidated below 1.07. Looking forward, traders are hoping that tomorrow’s Canadian employment report (26k jobs, 7.0% unemployment expected) can wake the pair from its stupor.

Technical View: USDCAD

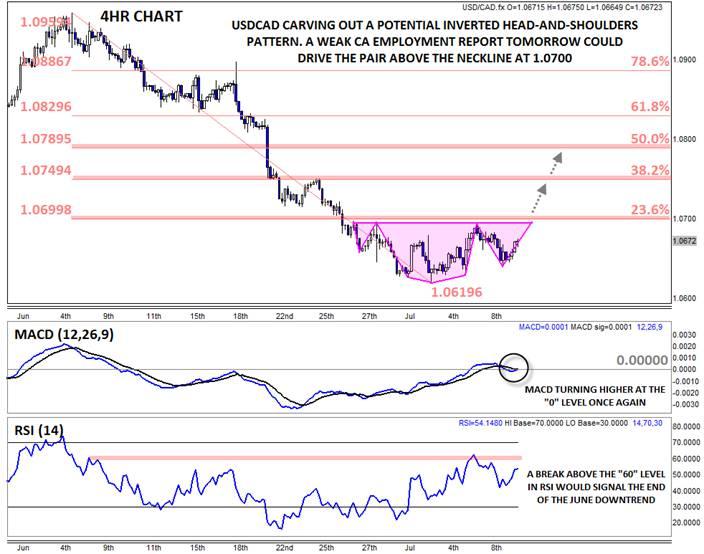

Monday’s article covered the longer-term perspective for the USDCAD, but over the past two weeks, rates have carved out a potential inverted Head-and-Shoulders formation. This classic price action pattern shows a gradual shift from a downtrend (lower lows and lower highs) to an uptrend (higher highs and higher lows) and typically marks a significant bottom on a chart. Readers should take note though, this pattern will not be confirmed unless we see a break above the neckline at 1.0700; until then, the USDCAD is just in a consolidation range.

Looking to the secondary indicators reinforces the potential for bullish shift in the coming days. The MACD has been trending up for over two weeks now and is turning higher above the “0†level as of writing. The RSI indicator, meanwhile, is essentially neutral around 50, but a break above the 60 area in the coming days would signal an end to the June downtrend and open the door for a more substantial recovery in the USDCAD exchange rate.

At this point, the USDCAD’s outlook hinges on tomorrow’s employment report. If the report disappoints expectations, the pair could break above the 1.07 neckline, clearing the way for a move up to 1.0750 (the 38.2% Fib retracement) or 1.0790 (the 50% Fib retracement) next. On the other hand, a decent employment report could keep the USDCAD locked in its recent 1.0600-1.0700 consolidation zone in the near-term.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'