![]()

Precious metals have surged higher, even though the Indian government may have disappointed a few by refusing to reduce the import duty on the metal as it unveiled the 2014/5 budget today. It looks like the price of gold has been driven, above all, by safe haven buying as other risk assets such as stocks and crude oil have dropped sharply and extending their recent weakness. While crude oil has fallen on receding supply worries, stocks have sold off mainly on concerns about the health of Banco Espirito Santo which has caused bank shares to lose ground across the board today. With BES being the largest Portuguese bank, the market is refusing to ignore its potential impact on Portugal and other eurozone peripheries. Also boosting the appetite for safe-haven assets has probably been the escalation of the conflicts between Israel and Palestine.

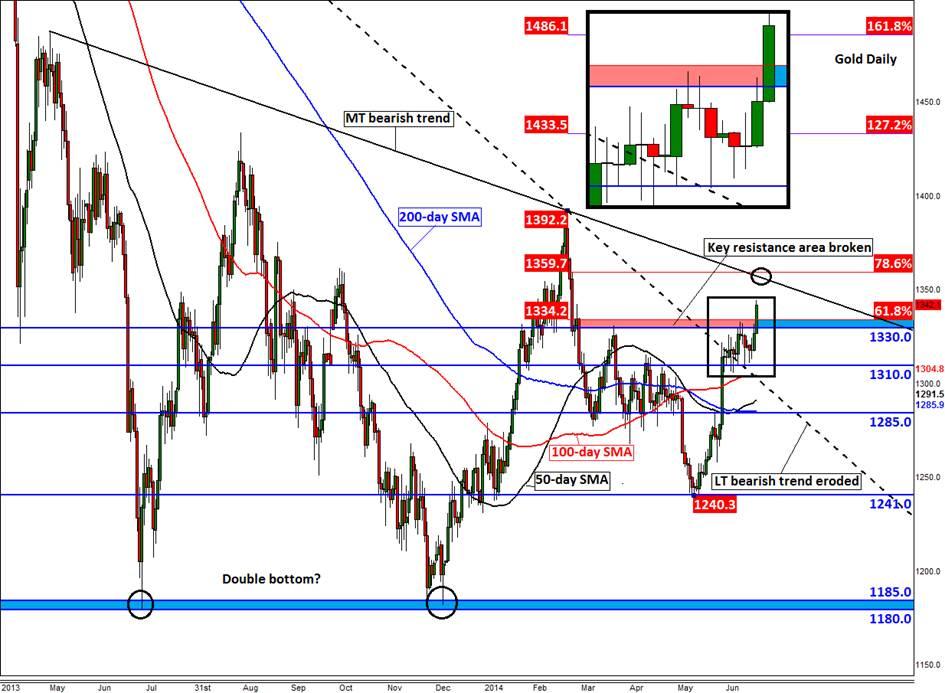

From a technical point of view, the spike in the price of gold was probably fuelled by the fact that a large number of stop loss orders, sitting above the recent two-week consolidative range, were tripped which forced many bearish speculators to abandon their positions. As can be seen on the chart, the yellow precious metal had struggled to break through the $1325/30 area in recent days. But the fact that the pullback from there was only 10-15 bucks each time, it correctly suggested that the control was with the bulls. Now that another major hurdle has been broken, the bears’ control has correspondingly diminished. As more and more resistance levels fall, we will likely see further position squaring by the existing sellers. Meanwhile speculators who have been on the side lines are likely to come back into play as the metal climbs higher. But with one resistance area cleared, another is fast approaching around $1355/60. This is where a medium-term bearish trend line meets the 78.6% Fibonacci retracement level of the down move from the Mark high of $1392. If and when this area is taken out then I would not only expect gold prices to reach that March peak, but break above it too and head higher.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.