![]()

As US traders groggily filter into their desks after a long holiday weekend of sun and barbeque, the market is still digesting last week’s action-packed economic calendar. Though the ECB’s monetary policy statement and press conference brought few surprises, the US jobs report blew the doors off expectations with a stellar 288k reading and 0.2% drop in the unemployment rate (to 6.1%). Looking ahead to this week, markets may be a bit more subdued, though the economic calendar and recent price action may present some trading opportunities in the Canadian dollar.

With no meaningful US data scheduled, the Canadian Building Permits (12:30 GMT) and Ivey PMI (14:00 GMT) reports will take center stage in today’s US session. Both reports came in below expectations last month, so it may take a clear improvement for Canadian bulls to drive the loonie to new heights. Later this week, USDCAD traders will get new insight into US JOLTS Job Openings (Tuesday), Canadian Housing Starts and the FOMC Minutes (Wednesday), Canadian New Home Prices and Unemployment Claims (Thursday), and finally the Canadian Employment report, which will try to match the strength seen in its southern neighbor last week.

Technical View: USDCAD

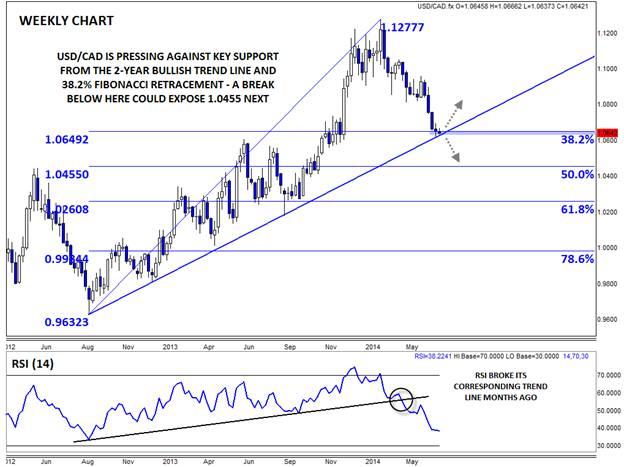

Beyond being aware of the upcoming fundamental data this week, traders should be careful not to lose sight of the longer-term technical picture for the USDCAD. Looking first to the weekly chart, the pair is testing a 2-year bullish trend line off its September 2012 low at .9632, as well as the 38.2% retracement of this trend. This converging support area could lead to a bounce this week, especially if Canadian data generally misses expectations. That said, the weekly RSI broke below its corresponding trend line long ago, and if price follows the indicator lower, a quick move down to the 50% Fibonacci retracement at 1.0455 may be seen next.

Zooming in to the daily chart reveals a more nuanced picture. Rates are clearly testing key support in the mid-1.0600s, but some of the other technical indicators suggest any bounces may be short-lived. For one, the 50-day MA is about to cross below the 200-day MA, pointing to an imminent “death cross” in the pair. This classic technical indication suggests that the longer-term trend has turned lower and points to more weakness in the coming months. Meanwhile, the MACD continues to trend lower below its signal line and the “0” level, showing growing bearish momentum. On a short-term basis, the oversold RSI could lead to a bounce, but traders may lean toward fading any bounce toward 1.07 or 1.08 given the bearish longer-term indications.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.