![]()

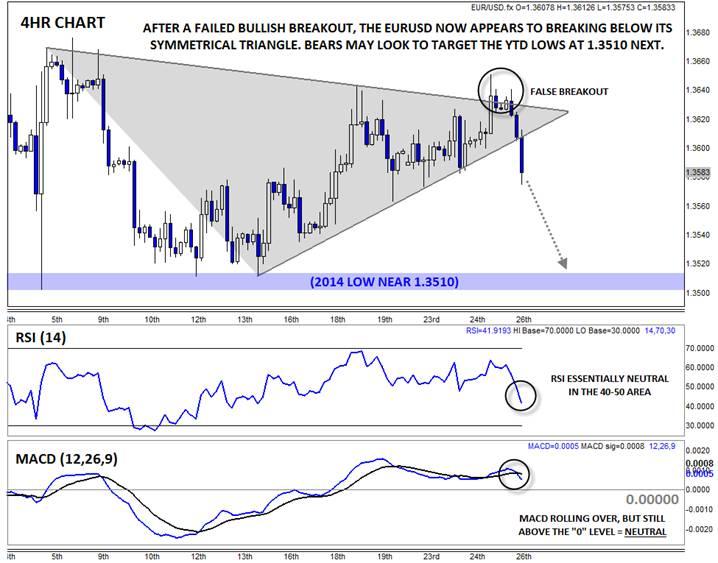

The US and Germany kick off a “massive” World Cup match in just a few hours, but the currencies of the two countries have also been locked in a tight competition this week. Yesterday, it appeared the Germans (and the rest of the Eurozone) were pulling ahead with an attempted breakout from the EURUSD’s 3-week symmetrical triangle pattern (see 4hr chart below). However, the US stepped up its game at the last second and drove the pair back down to the bottom of its triangle near 1.3600. As we go to press, the pair is inching below the lower trend line, but given the failed upside breakout yesterday, it would be prudent to wait for a daily close below this level before confirming the breakdown.

For the uninitiated, a breakout from a symmetrical triangle pattern suggests a strong move in the same direction. Using the measured move method of projecting a target based on the “height” of the triangle points to a possible 150-pip move once the breakout is confirmed, which could drive the EURUSD either back up toward 1.3800 or down to new 2014 lows in the mid 1.3400s, so there could be plenty at stake here for traders.

Unfortunately, the secondary indicators are not giving any advance warning of which way the pair may trend next. The RSI is essentially neutral near the 50 level, while the MACD is rolling over, but still holding above the 0 level, showing receding bullish momentum.

Coincidentally, the resolution of the German-US battle in the FX market may take place at the same time as the countries’ World Cup clash. Oddsmakers favor the Germans on the futbol pitch, but the Americans currently have the upper hand on traders’ screens. No matter how these situations resolve, fans and traders are in for some serious excitement over the course of the day!

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.