![]()

The biggest news on the macro front this morning was the European PMI surveys for June. These timely indicators saw the index inch down further than expected, with the Eurozone composite PMI falling to 52.8 from 53.5. This is the second consecutive monthly decline, so is it time to panic and sell the EUR?

Digging deeper

Although the headline PMI number was weak, the detail told a slightly different picture. The new orders sub- component, a key lead indicator that has a close relationship with Eurozone GDP, rose to a new recovery high at 53.0. Also, the employment sub-index remains above 50.00, which is constructive for unemployment in the region.

The periphery fights back

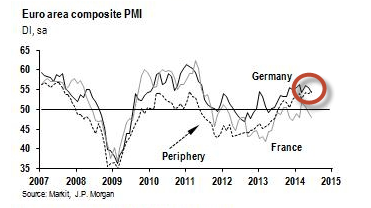

Perhaps the most promising piece of news from this PMI survey was the strength of the peripheral PMI readings. The average reading of the June PMIs in the periphery was a solid 54.5, which was above Germany’s composite PMI reading for this month, which fell to 54.2, (see figure 1). German PMIs may be retreating, but they remain at strong levels. Thus, with Germany and the periphery doing well, the weakest link is France. The second largest economy in the currency bloc is, by far, the weakest link in the Euro-area. It is weighing heavily on the overall Eurozone index, the French composite index fell to 48.00 – the lowest level since February, which reversed the recent mini-recovery in the French economy. But, if France can bounce back in the coming weeks and months then we could see the overall index move higher.

So, the economic picture in the Eurozone may be stronger than it first looks. If the market can look through the headline PMI figure then we could see some short-term strength in EURUSD, however, before rushing into a EUR position it is worth checking out the technical picture, which remains bearish.

The technical outlook:

In the short-term 1.3620 is a key resistance level. It corresponds with an hourly trend line. If EURUSD can get above here then we could see an extension of the rally and 1.3670 – the all-important 200-day sma – comes into view.

Although the fundamental picture for EURUSD may be encouraging, the technical picture remains bleak. Both the hourly and the daily MACDs remain below the zero line, which suggests that momentum is to the downside and the risk is that the market rejects resistance at 1.3620. If this happens, then 1.3477 – the February low – comes back into view.

Figure 1: The periphery starts to outperform Germany

Figure 2:

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.