![]()

Annual inflation in the UK fell to its lowest level since October 2009 last month, due to a large fall in transport costs, particularly air fares. The 0.1% drop in prices last month was a shock, since the market had been expecting a 0.2% rise. Prices in the UK have now been below the 2% Bank of England target rate since the start of 2014, thus, was Bank Governor Mark Carney premature in touting the prospect of a rate increase during his Mansion House speech last week?

Rate hikes vs. weak inflation

So, has Carney taken his eye off the ball? How can the bank prep the market for a rate rise if inflation is falling well below the target rate? Luckily for Carney the Office for National Statistics (ONS) has his back. It noted that the timing of Easter in April is “likely” to have had an impact on the index, most notable air and sea fares. Thus, we could see prices play catch up in the coming months, especially as we get closer to the summer holiday season, and we May’s decline in prices could reverse in the next month or two.

Producer prices for May were also weak, with input prices down 5% compared to a year ago, output prices also stayed on the weak side. The lack of price pressure in the UK economy may not worry the BOE; after all the Bank ignored rates staying above target from 2009 until late 2013, so why wouldn’t they raise rates when prices are below target? The average inflation rate for the last 5 years is 3.1%, which could justify a hike, especially since the economy is back firing on all cylinders.

Market reaction:

In the aftermath of the inflation data market expectations for the first rate hike from the BOE have not shifted from January 2015, this may limit the decline in the pound. Initially GBPUSD fell sharply on the news, however the decline was limited to 1.6939 and the there appears to be willing buyers below 1.6950. The reason why the decline in cable may not be sustainable could be due to a few reasons: 1, 1.6950 is a major level of support, it is the top of the monthly Ichimoku cloud, and 2, the FOMC meeting on Wednesday could keep the dollar crosses fairly subdued in the next 24 hours, and 3, the market may think that this weakness in inflation is only temporary due to the timing of Easter.

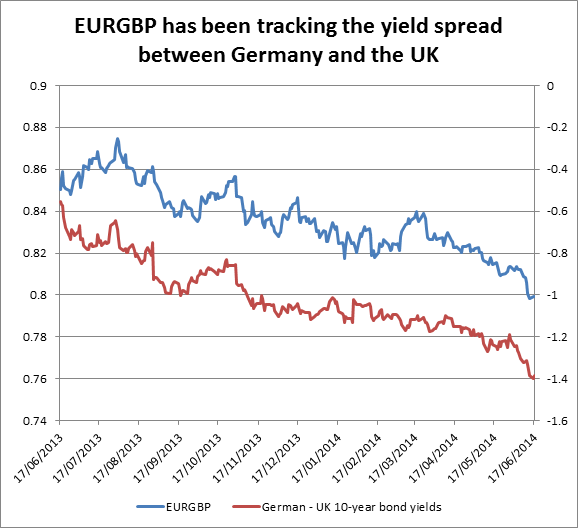

The reaction was fairly similar in EURGBP. It managed to get above 0.8000 after rallying on the back of the news; however it has not been able to sustain gains, which suggests some selling pressure lies above the 0.80 level. As you can see in the chart below, sterling is still benefitting from the yield effect and the relative stance of the BOE vs. the ECB. As we believe that the UK will hike rates years ahead of the ECB, the pound may continue to have the yield advantage over the EUR for some time.

Takeaway:

The decline in prices to 1.5% was a shock for the markets .

However, it could have been down to the timing of Easter and could reverse in the coming months.

The decline in prices may not stop the BOE from raising rates early next year, since the Bank has ignored the inflation target in the past.

This could limit GBP’s decline, especially versus the USD and the EUR.

Figure 1:

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.