![]()

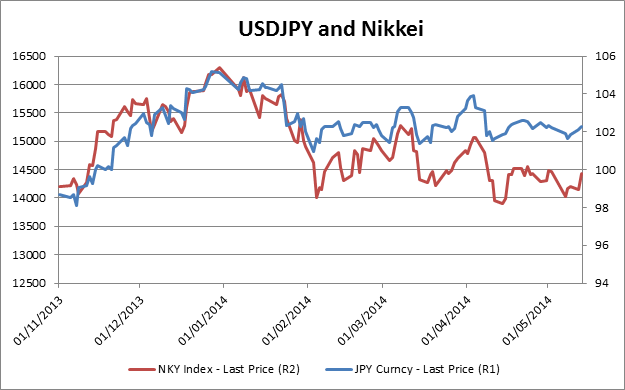

For much of the second half of last year the Nikkei and USDJPY moved in the same direction. However, this relationship has deteriorated since the start of this year, as both the Nikkei and USDJPY have traded in a range. The Nikkei has lagged other major global indices, but now may be the time for it to play catch up, which could have big implications for USDJPY.

The Nikkei has followed US indices higher this week, as US indices including the Dow and the S&P 500 made fresh record highs. If this continues, and the relationship with USDJPY makes a comeback, then this important G10 FX pair could follow suit.

The technical view:

USDJPY is testing a critical resistance level at 102.39, the 50-day sma. The latest strength in this pair has seen momentum cross higher, which is a bullish sign, and if we can clear the 50-day sma then there is scope to test resistance at 103.06 – the 61.8% retracement of the April sell off. Above here opens the way to 104.13 – the high from April 4 th and then 104.92 – the January 16 th high.

Strong support lies at 101.20 – the low from March 3 rd , which has prompted a rebound twice since then, and looks like a medium-term low for this pair.

Takeaway:

Global stocks are starting to rally, which could boost the Nikkei.

Strength in the Nikkei could boost USDJPY.

USDJPY looks strong in its own right; if it can get above 103.06 resistance then we could re-test the highs of the year so far.

On the downside, 101.20 looks like a medium-term low for this pair.

Figure 1:

Figure 2:

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.