Earlier this month it looked like stocks were about to hit the skids on the backs of fears about a bubble, particularly in the technology sector. However, in the last 24 hours the view has changed markedly. Both Facebook and Apple announced monster profits. Facebook saw revenues increase by a whopping 72% and daily users of Facebook rose to 802 million, with a 40% jump in mobile users. Apple also surprised the naysayers and reported revenue to the tune of $45.6bn for the first three months of the year after a rebound in iPhone sales.

This has changed the short term picture for tech stocks and may put fears of a bubble to bed, at least for now. Tech stocks started to sell off earlier this month on fears that some companies’ valuations were too high and after a series of expensive acquisitions started to arouse investors’ fears. However, with a bedrock of strong, cash-rich, and revenue-generating companies like Facebook and Apple, the tech sector seems to be on sturdy ground.

Earnings Q1:

The fundamentals are looking good for the Nasdaq. While only a third of companies on the tech-heavy Nasdaq 100 have reported Q1 earnings so far, the results have been good. Both sales and earnings figures have surprised on the upside, largely due to Facebook and Apple. On the growth front, so far, sales growth is at its highest level for 12 months. While we need to see what the other 69 companies have to offer, this is a good start, and if it reflects the signs of things to come then the Q1 2014 earnings season could be one to remember.

Interestingly, if the Nasdaq can stage a recovery on the back of the Apple/ Facebook earnings news this could be important for S&P traders also. The S&P 500 and the Nasdaq have a correlation of 92%, although if you trade European stocks, don’t look at the Nasdaq for direction, the Dax has only moved with the Nasdaq 43% of the time since the start of this year.

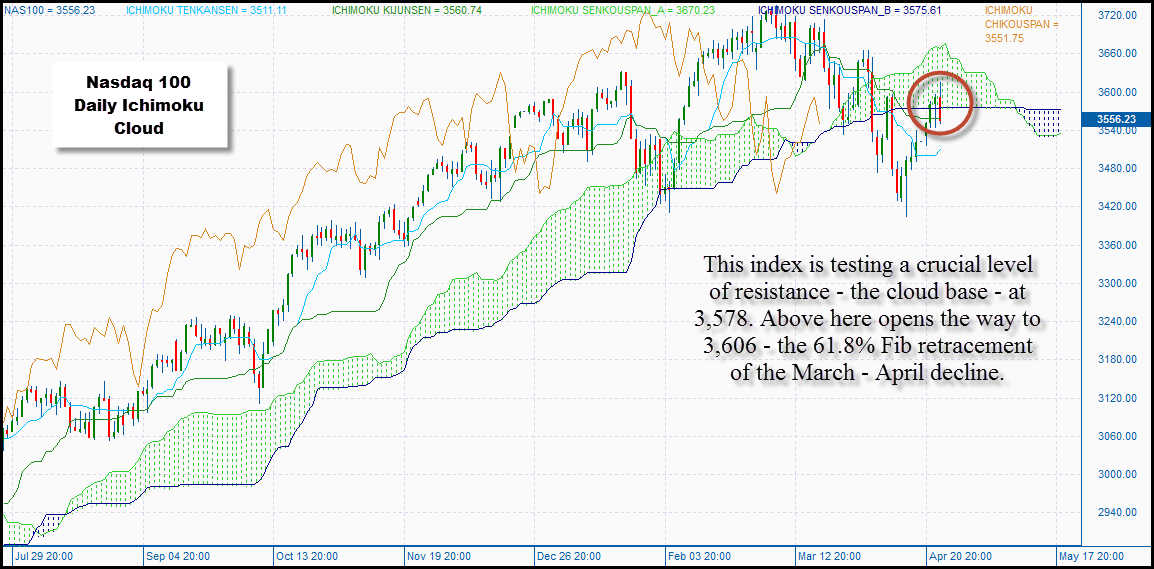

Technical outlook:

The Nasdaq is testing a crucial short term resistance zone at 3,578 – the base of the daily Ichimoku cloud. If we can stay above this level then it would be a bullish development and suggest that the recent downtrend may be over. Above here opens the way to 3,606 – the 61.8 % Fib retracement of the March – April decline.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.