![]()

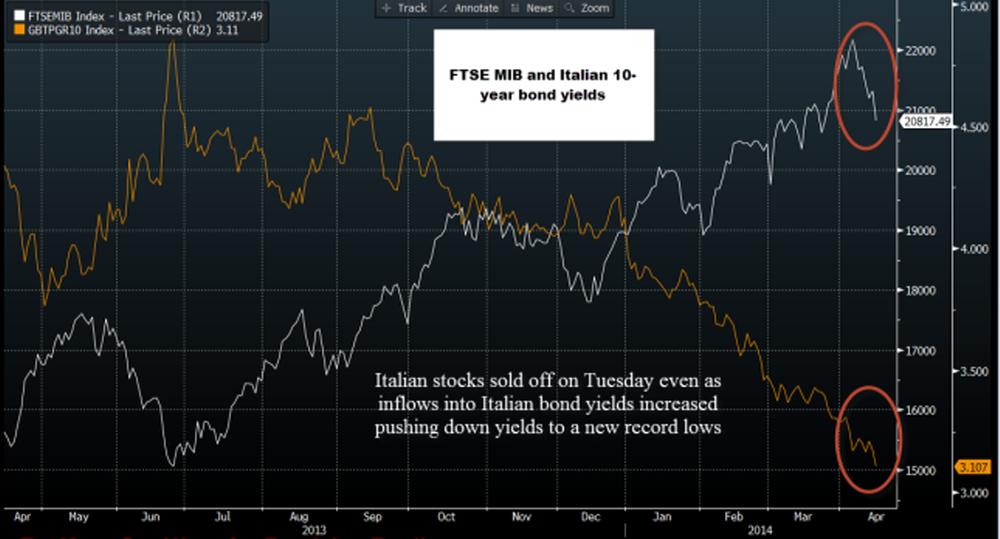

Tuesday saw some interesting price action; European stocks fell sharply on the back of a few factors and were led lower by Italy’s FTSE MIB, which fell more than 2%. However, at the same time as Italian stocks were being sold sharply, investors were buying Italian bonds and 10-year GBT yields actually fell.

As you can see in the chart below, the FTSE MIB (white line) usually moves in the opposite direction to bond yields (orange line), however today the two have moved together. This could be down to a few factors:

- Italian stocks were hit by a double whammy of pressures, firstly, overall risk aversion triggered by events in Ukraine and secondly, confirmation that the government is planning to overhaul the management structures at some state-owned companies, including changing their CEOs.

- The decline in bond yields (rise in bond prices) could also be down to Ukraine fears as we saw inflows into peripheral bonds today even though European stocks sold off. The Ukraine crisis could be triggering “safe haven” flows into European bond markets.

Who would have thought that Italian and Spanish bonds could be considered a safe haven, especially on a day that the dollar faltered? The markets work in mysterious ways and today’s moves may have been exacerbated by weak volumes in a holiday-shortened week for Europe. We will be watching this closely to see if it continues and if Russian/ Ukraine fears grab the market’s consciousness once more then we may have to get used to some strange moves in the markets.

Figure 1:

Source: FOREX.com and Bloomberg

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.