![]()

Yesterday saw the global stock markets make a reversal as better-than-expected US retail sales and Citigroup’s first quarter earnings results offset concerns over Ukraine where the crisis continues to escalate. The prospects of further stimulus from the ECB have also soothed the nerves after Mario Draghi stepped up his verbal intervention over the weekend by suggesting some sort of non-standard policy measures such as quantitative easing could be unleashed if the euro continued to appreciate further. However the rally faded somewhat overnight and European markets started today’s session on the back foot. Miners were leading the way down on the FTSE although the losses were limited by some good corporate updates from the likes of GKN and Aggreko.

On the data front, we had some mixed-bag ZEW numbers out of the eurozone while the UK’s Consumer Price Index (CPI) fell back to 1.6% in March from 1.7 percent the month before. This was the CPI’s lowest reading since October 2009, helped in part by weaker fuel prices. The ONS’s jobs data on Wednesday will likely show wage growth rose 1.8% in the three months to February compared to the same period a year ago. As such, wages may have at long last outpaced inflation for the first time since early 2012. For details, see my colleague Kathleen Brooks’ article here. Meanwhile UK’s jobless claims are expected to have fall by around 30.2 thousand applications in March compared to the 34.6 thousand the month prior while the unemployment rate is expected to have remained unchanged at 7.2%. With the inflation remaining comfortably below the Bank of England’s 2% target, the MPC can easily justify maintaining their ultra-loose policy for some time yet even if the unemployment rate falls below the Bank’s previous threshold of 7% that would have triggered the first rate hike. The improving domestic data and the Bank of England’s on-going support could fuel another rally for the FTSE.

Meanwhile Wednesday’s release of Chinese economic data, which includes the first quarter GDP estimate and the latest industrial production number, are particularly significant for the London-listed mining stocks. The world’s second largest economy is expected to have grown by around 7.3% year-on-year during the quarter, slightly below the government full-year target of 7.5%. Therefore we cannot rule out the possibility for an intervention by the PBOC in order to stimulate demand. But with the US earnings season about to kick into a higher gear this week, most of the focus will be on the individual companies. JP Morgan’s disappointing results is a chilling reminder of what to expect following that the severe cold winter in the US. Analysts have already trimmed their earnings forecasts, with Bank of America, for example, expecting flat earnings, rather than 5% growth as they had previously estimated, for the S&P 500 companies compared to last year. Today we will hear from the likes of Coca-Cola, Yahoo and Intel.

Technical outlook

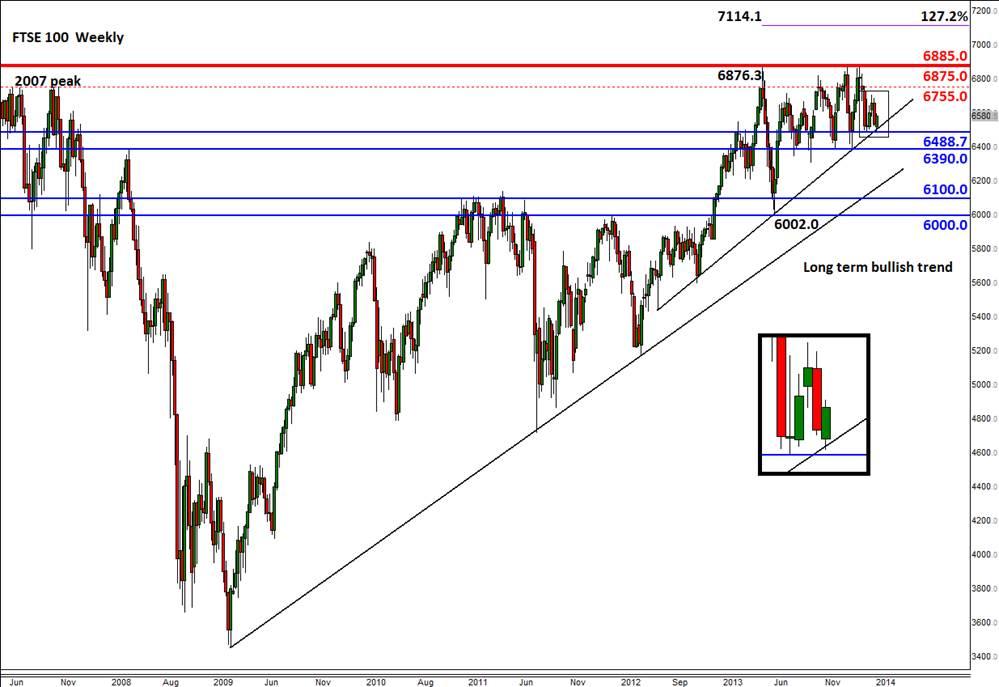

From a technical point of view, the FTSE continues to trade sideways but it does feel a bit heavy with recent sell-offs being more intense than the rallying periods. The key level is 6500 and if this gives way then I would expect to see some more downside action towards the 2014 lows of 6390 at the very least. There’s a clear bearish trend established and this comes in somewhere between the next two resistance levels of 6620 and 6680. The FTSE could be in the process of forming a descending triangle pattern which is bearish.

Having said that, the index has now rallied off the 6500 level on three separate occasions now. This suggests that a potential triple bottom pattern could develop here which is obviously a bullish outcome. A potential break above the trend line could confirm this. Meanwhile as the weekly chart shows, the FTSE has also managed to once again defend a medium term bullish trend line and it may be in the process of making an ascending triangle pattern on the higher time frame.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold price shines amid fears of fresh escalation in Middle East tensions

Gold price rebounds to $2,380 in Thursday’s European session after posting losses on Wednesday. The precious metal holds gains amid fears that Middle East tensions could worsen and spread beyond Gaza if Israel responds brutally to Iran.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.