![]()

The GBP/USD is coming off a very interesting week to kick off April. Helped along by decent Manufacturing Production data and a stationary BOE, the pair surged up to test its 4.5-year high at 1.6820 on Thursday before losing steam and turning back lower on Friday. Though the longer-term trend remains to the topside, there are some technical signs that Friday’s selling pressure may carry over into this week’s trade.

Looking to the daily chart first, last week’s reversal has created an Evening Star* formation off the highs. This relatively rare 3-candle reversal pattern shows a gradual shift from buying to selling pressure and is often seen at major tops in the market. In fact, the pair has already formed two significant tops after similar patterns already this year! Meanwhile, the Slow Stochastics indicator is forming a possible bearish divergence with price after ticking into overbought territory ahead of the top.

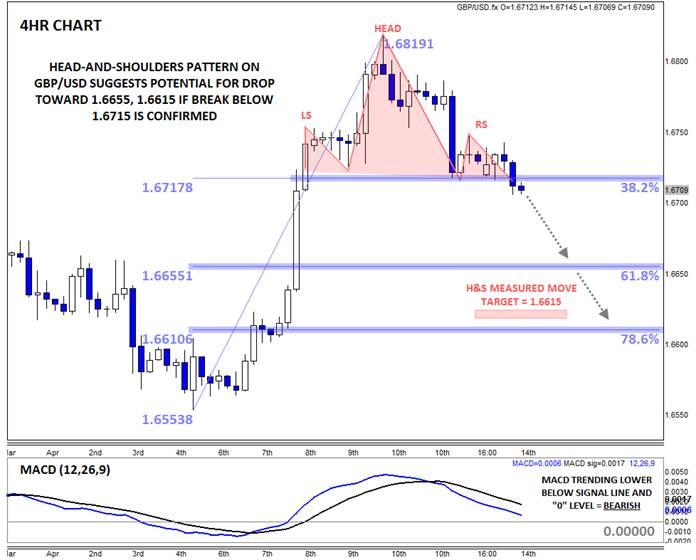

Zooming into the 4hr chart (below) reveals a potentially actionable pattern for readers to monitor. Within the daily Evening Star formation, the GBP/USD has actually carved out clear Head-and-Shoulders pattern. With a confirmed break of the neckline near 1.6715 (more aggressive traders may even consider the current dip toward 1.6710 as significant enough), the bearish pattern would be confirmed, pointing to a deeper pullback in the early part of this week. In addition to the price pattern, the downward trending MACD suggests that the momentum has shifted to the bears as well.

The measured move target of the Head-and-Shoulders pattern projects a move down to around 1.6615, but the unit may also find support at the near-term 61.8% Fibonacci retracement at 1.6655. On the other hand, a break back above the right shoulder near 1.6750 may invalidate, or at least delay, the pattern and shift the bias back to neutral in the short term.

- An Evening Star candle formation is relatively rare candlestick formation created by a long green candle, followed a small-bodied candle near the top of the first candle, and completed by a long-bodied red candle. It represents a transition from bullish to bearish momentum and foreshadows more weakness to come.

Key Economic Data/Events that May Impact GBP/USD This Week (all times GMT):

Ø Monday: US Business Inventories (14:00), UK BRC Retail Sales Monitor (23:01)

Ø Tuesday: UK CPI, PPI, & HPI (8:30), US CPI & Empire State Manufacturing Survey (12:30), Speech by Fed Chair Yellen (12:45), US TIC Purchases (13:00), NAHB Housing Market Index (14:00), Speech by Fed Member Plosser (19:00)

Ø Wednesday: Speech by Fed Member Kocherlakota (00:00), UK Claimant Count & Unemployment Rate (8:30), Fed Member Stein Speaks (12:00), US Building Permits & Housing Starts (12:30), US Industrial Production and Capacity Utilization (13:15), Speech by Fed Chair Yellen (16:15), Speech by Fed Member Fisher (17:25), Fed Beige Book (18:00)

Ø Thursday: US Unemployment Claims (12:30), US Philly Fed Manufacturing Index (14:00)

Ø Friday: Good Friday – US and UK stock markets closed (All Day)

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.