![]()

The two major crude oil contracts are little-changed this Friday afternoon. Brent fell back yesterday on news China’s oil imports had dropped 8% in March and as reports suggested that the Libyan crude oil terminal Al-Hariga, which has a normal output capacity of 110,000 barrels per day, was expected to be reopened next week after it was recovered from the rebel hands. On top of this, the International Energy Agency said that Iran once again broke the 1-million-barrel-per-day oil export limit that was imposed by the West under the interim nuclear deal agreed last year. After exporting 1.65 million barrels per day in February, the IEA has estimated that a further 1.05 million b/d were shipped out in March and this figure is likely to be revised higher on receipt of more complete data. However worries over potential disruptions of Russian energy supplies to Europe via Ukraine amid the on-going standoff between Moscow and the West have prevented Brent crude to fall more sharply. In fact, the London-based oil contract has just turned higher at the time of this writing.

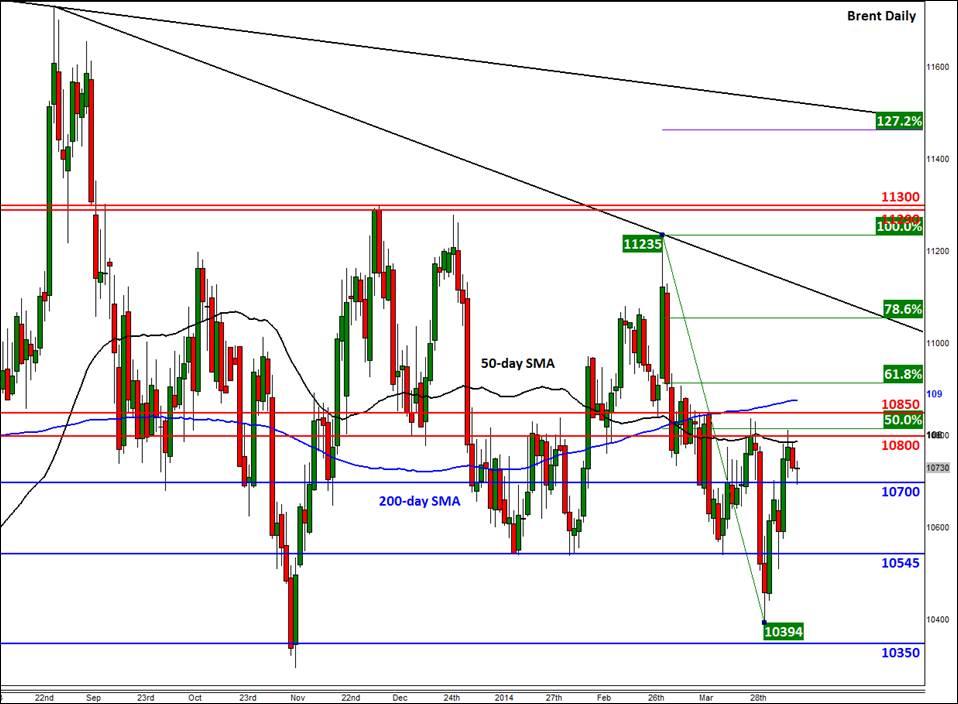

Figure 1:

In the US, WTI has remained elevated despite the recent rises in crude stockpiles and the first build at Cushing in ten weeks. It looks like investors are paying greater attention to gasoline inventories which fell once again last week by 5.2 million. At 210.4 million barrels, they remain “well below the lower limit” of the average for this time of the year, according to the US Department of Energy. This suggests that demand is very strong for gasoline, which is significant as the US driving season has not even started yet. Ethnically however WTI has struggled to rise and hold above the $103.50 level over the past couple of days. As mentioned previously, this is where a bearish trend line that goes back to the summer of last year converges with the 78.6% Fibonacci retracement level of the downswing from the March peak. So, there is a chance for a pullback towards $102.20 in the near-term. However if WTI breaks and closes above $103.50 then we could easily see it revisit the March high of $105.20 and potentially beyond.

Figure 2:

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.