![]()

The data highlight on Thursday was the big drop in initial jobless claims. They fell to 300k from an upwardly revised 332k. This is the lowest level since 2007, and adds to evidence that the US labour market is getting over the weather-effect that knocked it sideways earlier this year.

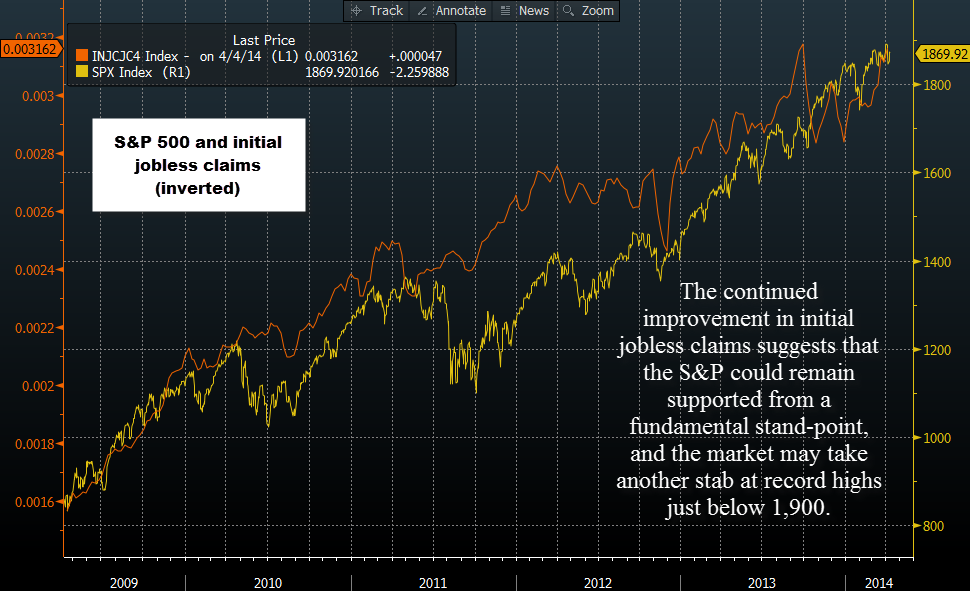

This weekly data point is worth watching, not only because it is the timeliest indicator of the US labour market, but also because it correlates nicely with the S&P 500. The chart below shows the 4-week moving average of initial jobless claims (orange line) and the S&P 500 (yellow line). The orange line is inverted, so the decline in initial jobless claims is represented by a rising line.

What is this chart showing us?

The two lines track each other closely, if not perfectly, which makes sense, as an improving US labour market should benefit corporate America.

The other thing to note is that in the last week or so initial jobless claims have continued to improve, while the S&P 500 has fallen back from last week’s record highs. Although this correlation is not perfect, since the two tend to move in the same direction, if jobless claims are improving then the S&P 500 may continue to push higher to re-test the recent record highs.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD regains 1.2350 ahead of UK PMIs

GBP/USD is recovering ground above 1.2350 in the European session, as the US Dollar comes under fresh selling pressure on improving risk sentiment. The further upside in the pair could be capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.