![]()

Highlights

- NFP Prep: Beware the Ides of March

- Another View: Scope for Payroll Disappointment, but Big Reaction Unlikely

- View How Our NFP Forecasts Compare

1, NFP Prep: Beware the Ides of March

By: Neal Gilbert, Senior Market StrategistThis month my Non-Farm Payroll model is predicting a mere 150k increase in jobs in March 2014, which overall, may be a brutal disappointment to the many investors and analysts who were expecting a weather-related bump with this release. For months, the talking heads around financial media, and even some members of the Federal Reserve, have been saying that the cold and snowy conditions over the last three months or so have been a drag on not only employment, but a whole host of economic figures. However, if my model ends up being correct, there may be a whole lot of explaining to do by those who procure their opinions, present company included.

So let me see if I can get ahead of this; while March would typically be viewed as a good weather month, devoid of crippling snow storms and bone chilling temperatures, was that really the case? Not according to the Weather Channel, who let us know that this March was one of the coldest on record for many parts of the country. In fact, the weather experienced in March wasn’t that much different than that experienced in the previous three months, meaning we may have to wait until next month to see the weather-related bounce so many have foreseen.

Using my prediction model had previously required me to take last month’s result and either add to or subtract from it based on ten employment reports released before NFP; however, the volatile weather during Q1 created a challenge to that doctrine in that previous results were anticipated to be revised substantially higher. While that anticipation turned out to be inherently incorrect, my prediction was fairly accurate utilizing my new method of calculation. Therefore, for this month, I will continue to repeat the method of using a three-month average which takes into consideration the possibility of a revision. So instead of using 175k as my base (last month’s result), it will now be 126k (an average of 75k December, 129k January, and 175k February).

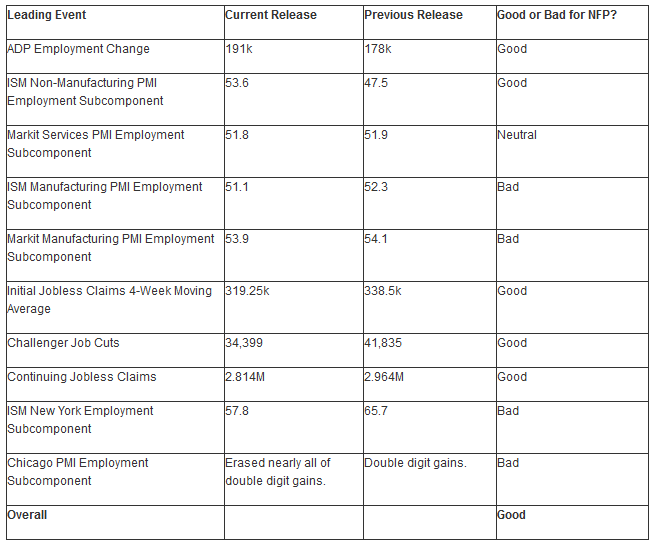

Here is the breakdown of the leading employment reports:

2, Another View: Scope for Payroll Disappointment, but Big Reaction Unlikely

By: Matt Weller, Senior Technical Analyst

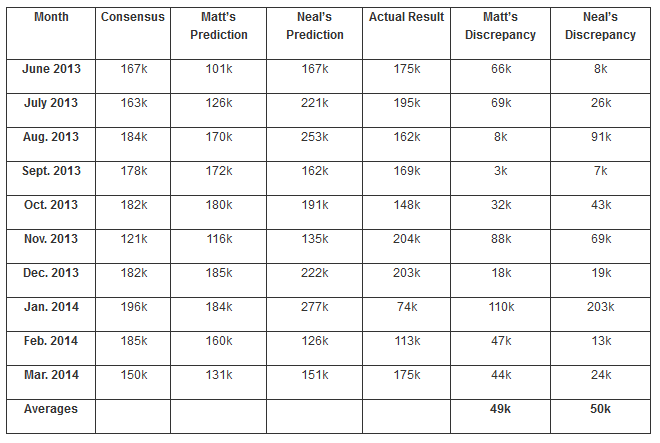

The March Non-Farm Payroll report will be released tomorrow at 8:30 ET (13:30 GMT), with expectations centered on a headline print of 199k new jobs. My proprietary 4-Factor NFP prediction model suggests that the NFP report will come in below expectations, with leading indicators suggesting a March headline NFP reading of just 164k.

The model has been historically reliable, with a correlation coefficient of .90 with the unrevised NFP headline figure dating back to 2001 (1.0 would show a perfect 100% correlation). As always, readers should note that past results are not necessarily indicative of future results.

Figure 1:

Source: Bureau of Labor Statistics & www.forex.com

Source: Bureau of Labor Statistics & www.forex.com

Employment indicators this month were generally positive: ADP, ISM Services PMI employment, and Initial claims all improved relative to last month’s readings, though ISM Manufacturing PMI employment bucked the bullish trend by falling one point to 51.1.

Trading Implications

After three months of weather-inhibited US data, traders are looking for a release of pent-up demand as we head into spring (though the weather impact on Non-Farm Payrolls was likely overstated anyway).The broad improvement in leading employment indicators suggests that the US economy may finally start to accelerate out of its winter malaise, and investors have accordingly ratcheted up their expectations for this month’s NFP report.

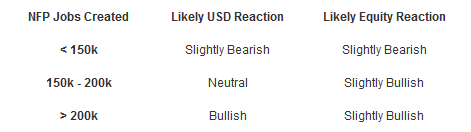

In some ways, tomorrow’s NFP report may be less impactful than usual. It appears that the Fed is generally set on its current taper timeline barring any major surprises, and it’s still too premature to start drawing any meaningful conclusions about the first interest rate hike, which is likely at least a year away. Nonetheless, the market is hoping for a print above the psychologically significant 200k level, which would raise hopes of an accelerating labor market heading into Q2. The table below highlights three possible scenarios, along with the likely market reaction:

Typically, USD/JPY has one of the most reliable reactions to payrolls data, so traders with a strong bias on the outcome of the report may want to focus on trading that pair.

Though this type of model can provide an objective, data-driven forecast for the NFP report, readers should note that the U.S. labor market is notoriously difficult to predict and that all forecasts should be taken with a grain of salt. As always, tomorrow’s report may come in far above or below my model’s projection, so it’s absolutely essential to use stop losses and proper risk management in case we see an unexpected move. Also, please be aware that placing contingent orders will not necessarily limit your losses.

3, View How Our NFP Forecasts Compare

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.