![]()

This Friday the US Bureau of Labor Statistics will release their March Employment report. This is of particular significance because it should be the first data point in 2014 which will not see any ‘weather-related’ effects. If another strong report is released, the Fed could rest soundly knowing that their decision to shift to a qualitative stance was the correct one and that their current pace of QE tapering will remain on course.

While much has been made about the role that weather has played over the past few months, we believe its impact on the two headline numbers the BLS produces (NFP and the Unemployment rate) has been dramatically overstated – As a result, now that the bad weather has subsided we do not envision a major ‘payback’ to the headline March employment figures. That being said, when we look at how the BLS states “bad weather” influences the numbers, we have identified a key area where a rebound due to improving weather may be seen.

“In the establishment survey, the reference period is the pay period that includes the 12th of the month. Unusually severe weather is more likely to have an impact on average weekly hours than on employment. Average weekly hours are estimated for paid time during the pay period, including pay for holidays, sick leave, or other time off. The impact of severe weather on hours estimates typically, but not always, results in a reduction in average weekly hours…In order for severe weather conditions to reduce the estimate of payroll employment, employees have to be off work without pay for the entire pay period. Employees who receive pay for any part of the pay period, even 1 hour, are counted in the payroll employment figures.”

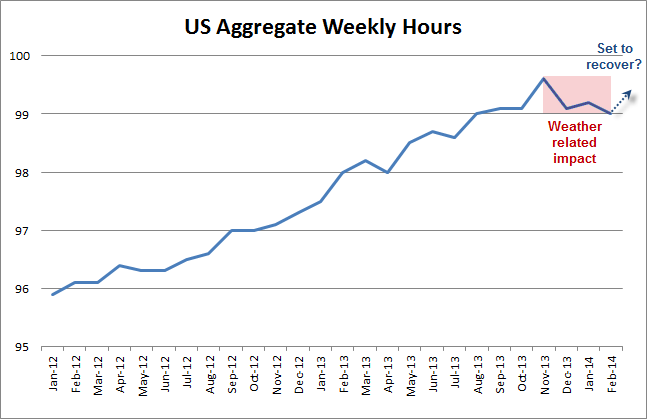

Accordingly, while most of the media and journalists on Friday will be looking at the headline NFP number or the unemployment rate, it may be more prudent to keep an eye on the US Index of aggregate weekly hours. Some argue this is one of the key metrics the Fed should be using to determine the health of the labor market, rather than the unemployment rate or headline NFP number, because it measures the total labor required to produce real GDP. The rationale behind this is that an employer is more likely to scale back or increase an employee’s number of hours worked before deciding to add or reduce the number of people employed; hence some believe it is a leading employment indicator, however for these same reasons it is also more susceptible to a ‘severe weather’ impact. If weather played a role in impacting US employment over the past few months, then it is plausible to expect this metric to rebound back towards levels witnessed in the latter part of 2013, and thus investors could have more confidence that the US economy is heading in the right direction.

Source: Bureau of Labor Statistics, FOREX.com

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.