On Wednesday, March 19th, the FOMC concludes their 2-day meeting and willrelease their March statement in conjunction with the summary of economic projections at 14:00ET/19:00GMT, followed by Janet Yellen’s press conference at 14:30ET/19:30GMT. We anticipateafurther reduction of their monthly pace of asset purchases by another $10B ($5B in Treasuries and $5B in Mortgage Backed Securities) bringingApril’s QE amount to $55B overall– $30B of Treasuries & $25B of MBS, and to keep interest rates at 0-0.25%.

In the FOMC statement we may see just a few minor tweaks to their description of the economy, aside from possible weather related distortions the recent economic data has not changed materially from the previous meeting, however thesummary of economic projections and following press conference by Janet Yellen will be closely monitored. We anticipate the following changes to the Fed’s 2014 central tendency forecasts from the December projections:

- Change in real GDP: Revise lower to 2.6-3.0%, from 2.8-3.2%

- Unemployment Rate: Revise lower to 6.1-6.4%, 6.3-6.6%

- PCE inflation: Remain at 1.4-1.6%

- Core PCE inflation: Remain at 1.4-1.6%

Forward Guidance bullets from Jan. meeting minutes suggest a change may be imminent:

- Participants agreed “it would soon be appropriate” to change forward guidance on rates…given unemployment rate approaching 6.5%

- Some participants favored quantitative guidance (numerical thresholds), while others preferred a qualitative approach

- Several participants suggested FG “should give greater emphasis” on keeping rates low if inflation remains persistently below the FOMC’s 2% objective

A primary difficulty facing the Fed appears to be thebroad range of opinion within the FOMC regarding how to altertheir present quantitative thresholds – keep rates exceptionally lowas long as the unemployment rate remains above 6.5% and 1-2 year projected inflation remains below 2.5%; to that of a more qualitative approach. New York Fed President William Dudley accentuated this qualitative shift in an interview with the Wall Street Journal a few weeks ago “My personal opinion is 6.5% is not providing a lot of value right now in terms of our communications…this is probably a reasonable time to revamp the statement to take out that 6.5% threshold because it’s not really providing any great value and I’d rather do it before I reached that threshold [than after].” That being said, one caveat to modifying their guidance at tomorrow’s meeting is the fact that theUS Senate has yet to confirm President Obama’s nominees to the FOMCBoard of Governors – Stanley Fischer (Vice Chairman), Lael Brainard and Jerome Powell (re-nominated) and Fed President Pianalto, whom had plans to retire in early 2014, will be replaced by Loretta Mester effective June 1st. As a result, this may impair their ability to formulate a decisive view on forward guidance with several key members still missing from the Federal Open Market Committee.

Interestingly, certain aspects of the Fed statement already contain qualitative references and if the FOMC were to simply omit their ‘quantitative’ guidance it may provide just enough information to the market until a more concrete view can be reached. Under such a scenario, the section with respect to forward guidance could look something like this:

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

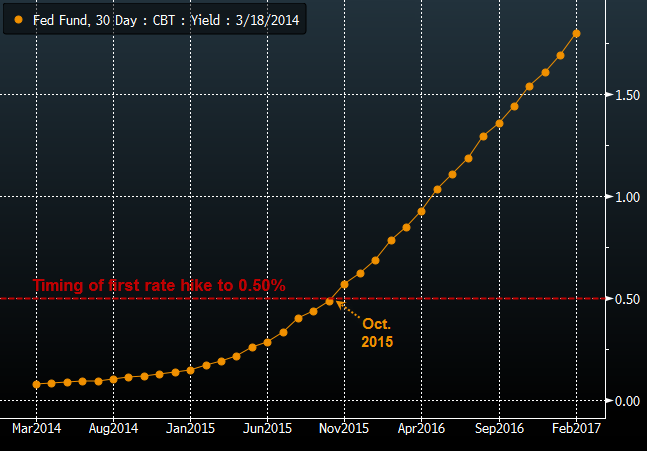

More importantly this would also give the newFed Chairman, Janet Yellen, the ability to explain the committee’s rationale behind switching to a more qualitative approach as well as the proper platform to deliver their ‘additional measures of labor market conditions’ similar to the nature in which the Bank of England delivered their qualitative measures just a few weeks ago. Furthermore,another nugget of insight may come from the FOMC’s projected pace of interest rate hikes over the coming years, which can be found in their Figure 2: Overview of FOMC participants' assessments of appropriate monetary policy, whereby we believe their 2015/16 interest rate forecasts could be revised lower and further out into the future. In order to see if this ultimately proves successful, we will keep an eye on the30-day Fed Fund futures curve – As of March 18th, the market believes the timing of the first Fed rate hike is October 2015.

Chart Source: Bloomberg, FOREX.com

Recommended Content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.