Up by the stairs, down by the elevator. Yesterday’s equity sell-off in Japan highlights the somewhat shaky foundations that this year’s equity rally has been built upon. Optimism is contagious, but pessimism is arguably more infectious.

Shortly after hitting a resistance zone around 16,000 the Nikkei 225 lost the most ground in one day since the tragic earthquake of 2011, plummeting over 7.0% in yesterday’s session. But there wasn’t one overriding cause of the sell-off. Instead, a toxic cocktail of negative sentiment, yen strength and multi-year highs poisoned the Nikkei. Yet, is the sell-off the surprise or the fact that it took so long?

While China’s May private sector manufacturing PMI was disappointing, it was by no means disastrous. And, the market’s reaction to Bernanke’s comments about possibly ending QE3 sooner than previously anticipated if economic data provides the base for an early exit were overdone in our opinion. It’s not new news that the Fed monitors US economic data in order to determine the severity/duration of quantitative easing. In fact, the bank made this clear when it announced QE3. Likewise, we didn’t consider the push higher in the yen to be extreme. USDJPY remains comfortably above 100.00 and has since regained most of its lost ground.

Hence, it appears that the Nikkei’s record run higher may have been built on rocky foundations. Therefore, a further correction to the downside cannot be ruled out in the short-term, especially if global sentiment starts to turn.

However, potential dips in the near-term may be opportunities to get long. As we have previously stated, Abeonomics appears to be working. While we aren’t overly optimistic about the monetary policy side of the equation – we don’t think the BoJ can reach its 2% inflation target (current market inflation expectations, as judged by futures pricing, aren’t very optimistic either) – we are however optimistic about Abe’s economic policy as a whole. Our biggest concern is Japan’s aging population, but there are ways around this (immigration, incentives, etc.).

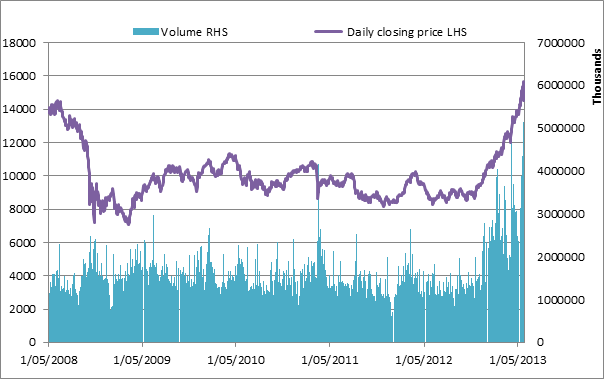

From a technical standpoint, the recent price correction to the downside isn’t entirely surprising. Since mid-November the Nikkei 225 has posted gains of around 85%, so a 7.5% drop isn’t enough to suggest the index’s upward trend is over, especially given the record amounts of volume that lifted the market to its recent highs.

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase of sale of any currency. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.