Outlook:

Don't look now, but G20 is meeting in China this weekend and will talk about Brexit, exchange rate policy and perhaps the fall in the Chinese currency, according to Reuters. It's not clear we will get anything interesting from G20. Bloomberg reports that China may be just about ready to draw a line in the sand at ¥6.7/USD. The yuan is down 3.3% from the March high, sending cash out of the country by about $49 billion in June, according to Goldman. Outflow was about $25 billion in May. For some reason, nobody is paying much attention to the stealth depreciation.

And in a world where the only driver are the central banks, Draghi declined to drive yesterday. It's too early to judge the Brexit fallout and markets are demonstrating "encouraging resilience." Besides, the ECB's policies so far have been "highly effective." That makes you wonder what he had up his sleeve if markets had freaked out. Draghi said the ECB will reassess the situation in September.

Draghi's reticence doesn't stop the commentators, who say the next ECB meeting on Sept 8 will probably extend QE past March next year by at least six months. Draghi ducked the problem of a scarcity of qualified paper. Draghi calls it a technicality. But Reuters wants to press the issue. "Analysts polled by Reuters expect changes including purchases of bonds yielding less than the deposit rate and an increase of the 33 percent purchase limit on individual bonds. There has been talk the ECB could make bigger changes such as a shift to buying bonds in proportion to a country's debt rather than the size of its economy, though bank estimates suggest this would only add five to eight weeks to a scheme some predict will hit the buffers within months.

"Unless the ECB takes action to address bond scarcity, analysts say the pressure on long-dated bonds could see 30-year German yields head towards zero percent. Those yields have tumbled 21 bps since the Brexit vote, notching up more falls than in any other maturity." One analyst says "The sheer weight of the ECB's presence could push 30-year bond yields to zero."

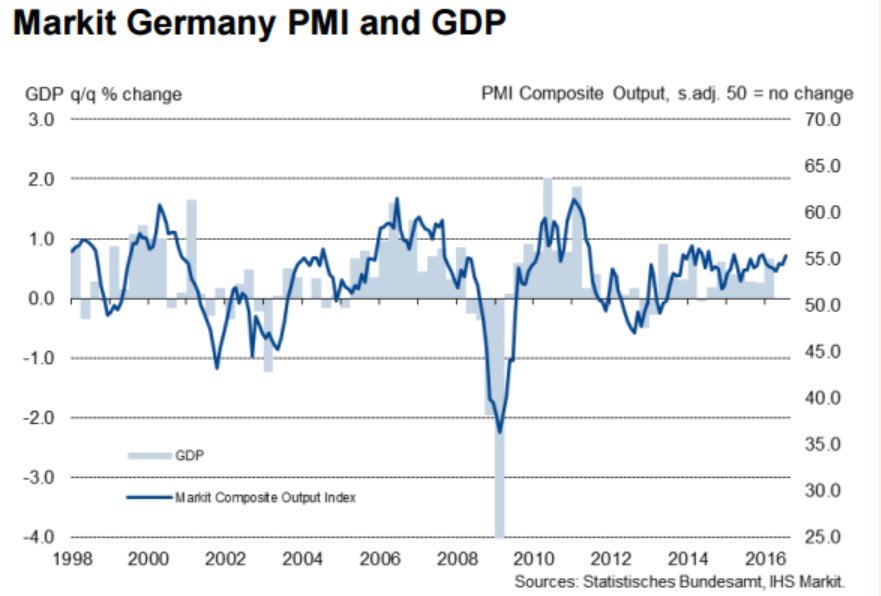

And then there is growth, visible in today's PMI data. Growth in Germany does not offset a shortage of eligible paper. Presumably growth is confidence-inspiring and lifts demand from private parties. More demand means higher prices—and lower yields. See the chart. (next page). Growth is not always unmitigated joy.

And another question is whether decent growth in Germany suffices to lead the eurozone. The euro "should" fall as long-term yields go to zero and below while the US has positive numbers. But the yield differential seems to have lost is determinative power these days. In fact, nobody seems to know what is driving or should be driving FX except the occasional knee-jerk response to data releases (like the PMI's today). It's assuming that when you go to the FT's "currency" section, the top two stories are about oil and equities, even though conditions are not crisis-mode and the correlation among asset classes is stronger when a crisis mentality prevails. The dollar "should" be firm and getting firmer, but don't count on it.

Political Tidbit: Trump invoked fear of social anarchy and economic decline with his usual bluster. He even managed not to congratulate himself every other sentence. But Trump promises to "fix" what's wrong with the US but then gets every single basic fact wrong.

He will cut taxes, saying the US is one of the most highly taxed country in the world, but the tax plan is muddled, to say the least. The WSJ rebuts: "Compared with other large industrialized nations, the U.S. is, in fact, a low-tax country. In 2014, according to the most recent data, the U.S. federal state and local governments collected a total of 26% of gross domestic product in taxes, below the average of 34.4% for about 30 nations, which also typically provide more generous social benefits, according to the Organization for Economic Cooperation and Development."

If Trump meant the corporate tax rate, he would be right. But he didn't say corporate tax rate and there are no corporate tax rate specifics in his tax plan. Careless.

Trump says the national debt has doubled and blames Obama. But the right party to blame is Bush II, who started the wars. Guns vs. butter. Besides, the budget deficit is less than 3%, near the long-run average and what it was before the recession. The WSJ again: "Debt-service as a share of GDP is near its lowest level since the 1960s—even with all this new debt. A number of economists have suggested that surprising decline in interest rates suggests that the U.S. should consider tolerating higher debt levels in order to spend money on things that might boost long-run economic growth, such as infrastructure or research and development."

Trump seems not to know the difference between the cumulative debt and the annual budget deficit.

Careless. Not surprising for someone who went bankrupt four times.

As for crime, Trump accuses Obama of a "rollback in enforcement." But police departments are the responsibility of state and local governments, not the Feds. Here the WSJ rebuttal falls short, saying 1974 had more police officer shooting deaths than we have had so far in any of the Obama years. As for the crime of illegal immigration, the Obama administration has thus far deported 2.5 million people, 23% more than Bush II.

The most interesting thing about the Trump speech is the press response to it. Every single major press outlet now offers fact-checking on Trump's assertions. To be fair, he is making it up less than before ("the majority of white murders in the US are by blacks"). But he is still distorting facts and it's not trivial or petty. In fact, it's careless.

The NYT fact-checking gives Trump a passing grade while the WSJ is far more critical (and exact).

Bloomberg details the crime segment, too. "... why would Trump so transparently distort crime statistics on national television? One word: fear. Fear is what fuels the engine of reactionary politics; and the only universe in which Donald Trump makes it to the White House is a universe in which every American feels they must constantly be looking over their shoulder. Donald Trump needs Americans to think the country is more dangerous than it really is. Because to accept that things are imperfect, but generally improving, is to admit Americans don't actually need him."

The Guardian also adds that the US is not "giving" Iran $150 million for the nuclear deal, as Trump presents it. It's actually unlocking some of Iran's own funds. And it's not $150. TreasSec Lew estimates $56 billion. Iran has numbers ranging from $32 to $100 billion. "Complicating the math are Iran's debts: it will have to pay off tens of billions to countries such as China, which have helped it survive through decades of sanctions." The Guardian doesn't say that China would presumably have to sue in US courts to get its hands on Iran's money.

Overshadowed by the convention speech is the Trump interview earlier in the NYT in which Trump says NATO is outdated and he would decide whether to defend the Baltic states from a Russian military excursion by consulting whether they had paid their fair share for the costs of NATO. This is carelessness on an epic scale, starting with the command structure of NATO and running through the treaties themselves, which are unconditional.

Clinton was pilloried by the FBI for carelessness about secure communication. Trump's carelessness extends to every issue he mentions. Be frightened.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 106.10 | LONG USD | STRONG | 07/13/16 | 104.63 | 1.40% |

| GBP/USD | 1.3129 | SHORT GBP | WEAK | 07/20/16 | 1.3187 | 0.44% |

| EUR/USD | 1.1024 | SHORT EURO | STRONG | 06/27/16 | 1.1026 | 0.02% |

| EUR/JPY | 116.97 | SHORT EURO | WEAK | 05/02/16 | 122.33 | 4.38% |

| EUR/GBP | 0.8397 | LONG EURO | STRONG | 06/24/16 | 0.8006 | 4.88% |

| USD/CHF | 0.9856 | LONG USD | STRONG | 06/28/16 | 0.9784 | 0.74% |

| USD/CAD | 1.3122 | LONG USD | WEAK | 06/27/16 | 1.3010 | 0.86% |

| NZD/USD | 0.6988 | SHORT NZD | WEAK | 07/18/16 | 0.7103 | 1.62% |

| AUD/USD | 0.7475 | LONG AUD | WEAK | 06/06/16 | 0.7245 | 3.17% |

| AUD/JPY | 79.30 | LONG AUD | WEAK | 07/18/16 | 80.20 | -1.12% |

| USD/MXN | 18.5901 | LONG USD | WEAK | 05/06/16 | 17.9418 | 3.61% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.