- Yen found committed buyers at the weekly kijun intersection, allowing for a recovery back above the 101.50 after an intraday double bottom. The run higher has the characteristics of corrective in nature though.

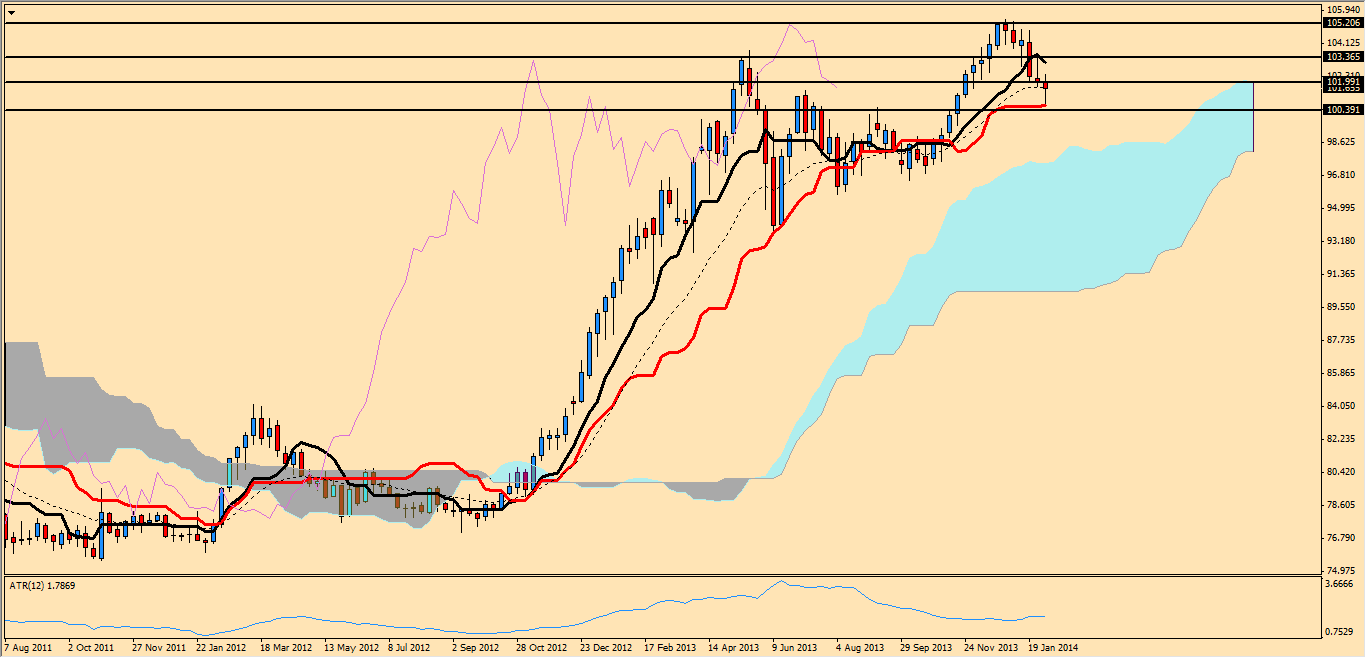

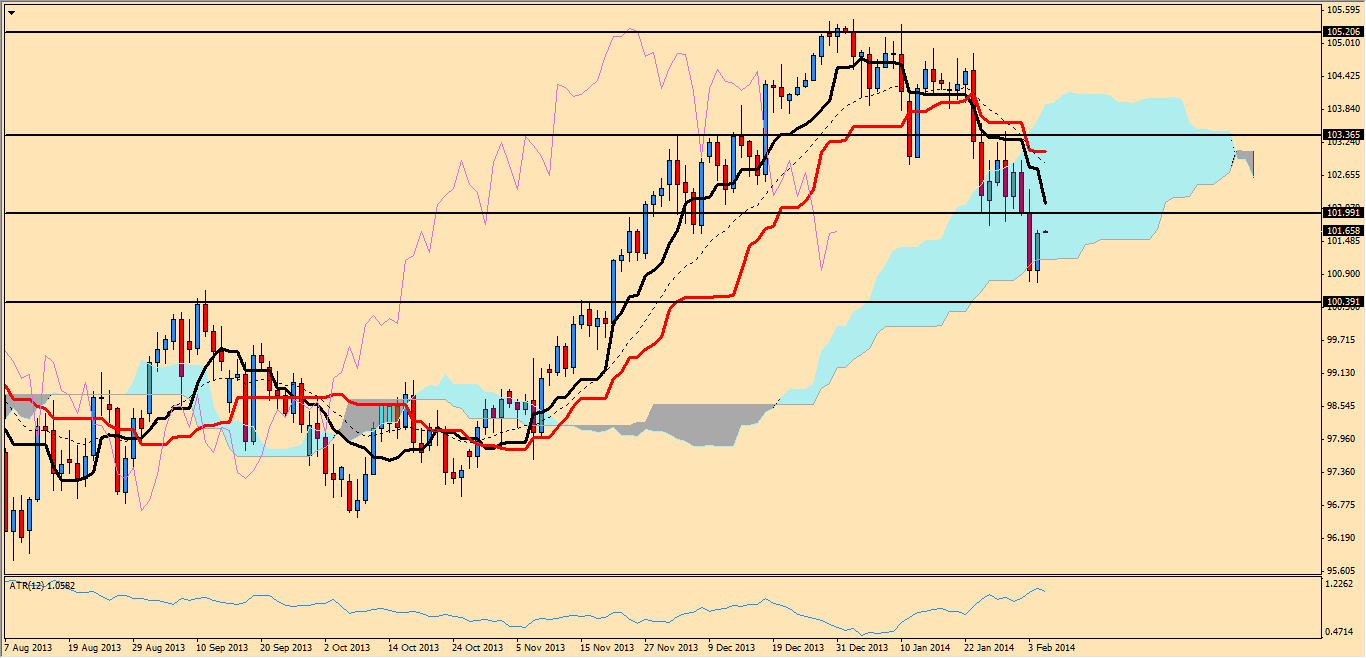

USD/JPY Daily Chart

- Following a breakout of the kumo cloud, first time since early Nov 2013, a corrective move is slowly taking the exchange rate towards 'value area' 101.80/102.00 to potentially re-sell the US Dollar. The impulsive selling in the last few weeks continues to be challenged by 'too timid' up moves. The leading/future kumo cloud continues in bearish territory, first time it occurs since Dec 19, a negative sign for sentiment, which should result in greater confidence to still be a seller on strength. Meanwhile, the chikou span (magenta line) continues to faces no troubling areas ahead until faced with the top of the kumo cloud.

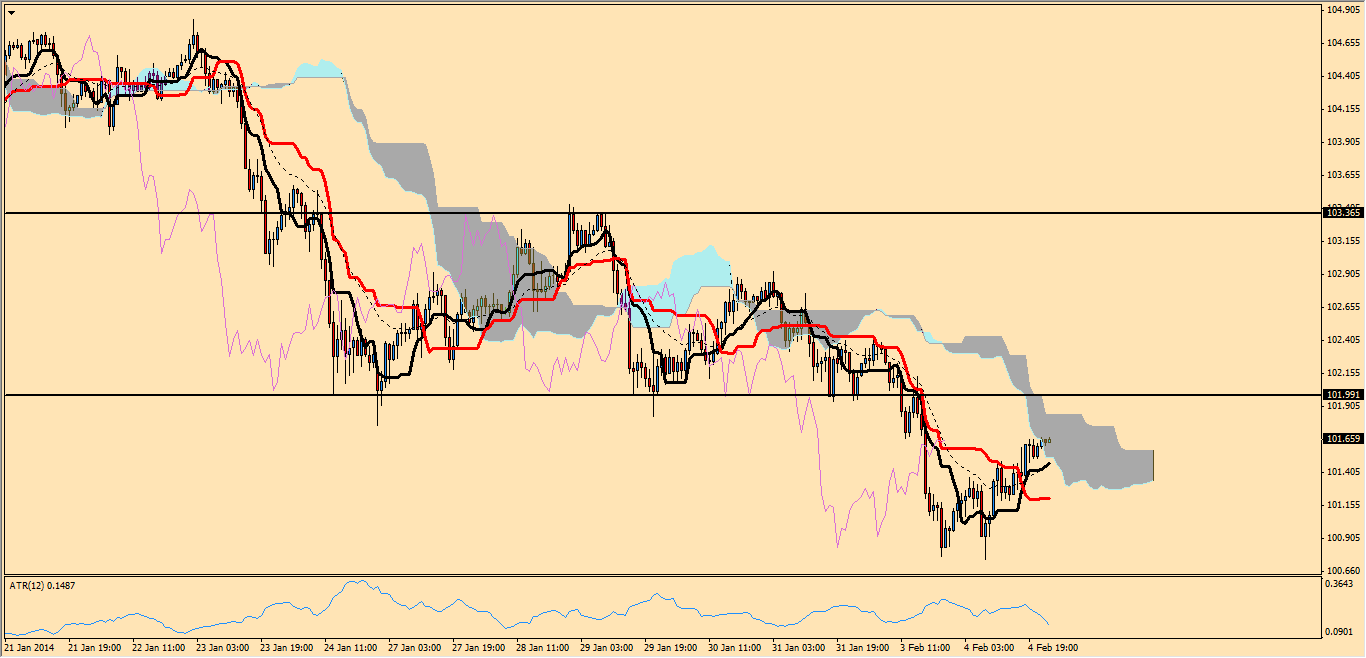

USD/JPY H1 Chart

- We had a weak cross on the H1 chart, a communication that short-term corrective moves may extend until 102.00, level where the real battle will take place. Before a potential retest, buyers should overcome a thick kumo cloud, with the first signs (price consolidating inside the cloud) suggesting that an attack towards the top of the cloud at 101.80/85 is a real possibility now. Also note, the chikou span has broken through the kijun line, further reinforcing a extension of the correction in Asia.

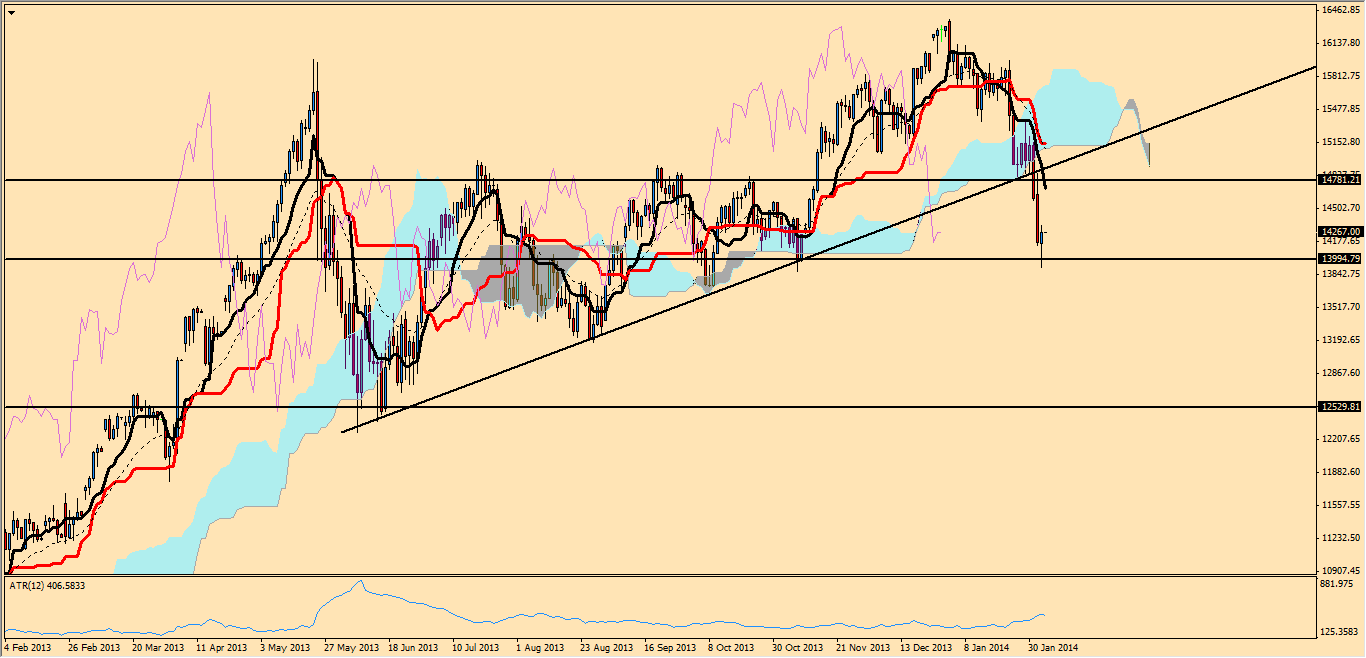

Nikkei 225 Futures Daily Chart

- Failure to break through 14,000 in the Nikkei 225 supported a recovery in the Yen crosses on Tuesday. The rebound allows further room for correction as no congestion areas are detected near by, which if combined with the positive sentiment in the SP500 (up 0.75%) creates some upside risks for the session ahead. That being said, the dynamics in the Nikkei 225 market have changed, and until price action does not negate the bias, selling on strength at higher levels (14,600-14,800) is still favoured. The combination of a bearish leading kumo cloud and the chikou span facing no congestion (cloud broken) supports the notion of selling rallies.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.