The Euro has been in the eye of the Greek storm for a prolonged period on the one hand, and will most likely remain vulnerable for the rest of this year, while the US Dollar on the other hand remains trapped in a neutral territory waiting for a clearer interest rate hike signal by the US Federal Reserve, with a 50 / 50 change of such an event happening in September 2015.

US Dollar rally stalling due to the negative impact of a strong US Dollar weighing on US company earnings and economic growth

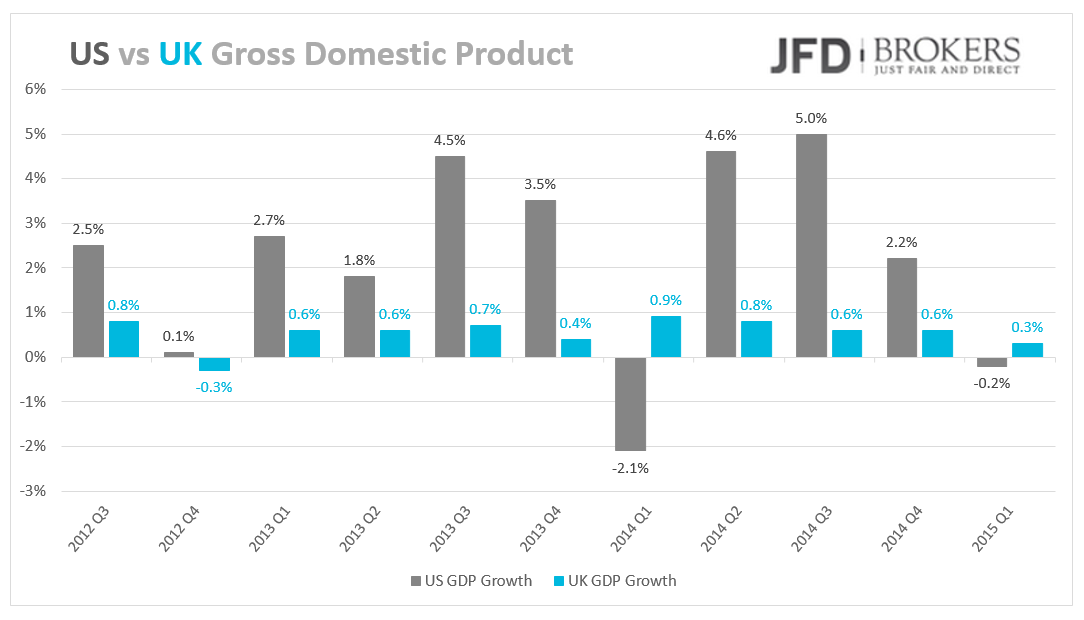

Even though the US Economy has grown as result of the Federal Reserve’s quantitative easing program which ended eight months ago, coupled with a low interest rate environment, the increasing strength of the dollar from mid-2014 to the end of the first quarter of 2015 has taken a toll on the growth of the economy over the past six months. Meanwhile, the UK economy has been growing at a lower but steadier pace.

A strong dollar harms the profitability of US based multinationals and the growth of US economy

A high number of US companies have been reporting an erosion of their profits, as it makes their products unaffordable abroad, while the products of foreign competitors have become cheaper and more attractive to US consumers.The impact of dollar’s strength on the fundamentals of US multinational corporations depends on various parameters of their operations. Lowered earnings attributed to currency effects does not draw the complete picture. One must closely examine macro-economic impact of a strong move on either side. The effects of such a move may have several dimensions, such as (a) transaction effects that occur when the company reports a high number of foreign-currency-denominated receivables and payables on its balance sheet, (b) effects on working capital, such as accounts payable, (c) currency translation effects from reporting the performance of its foreign units in US Dollars.

Inflation risks and strong dollar pressures make the decision for hiking US interest rates a real challenge

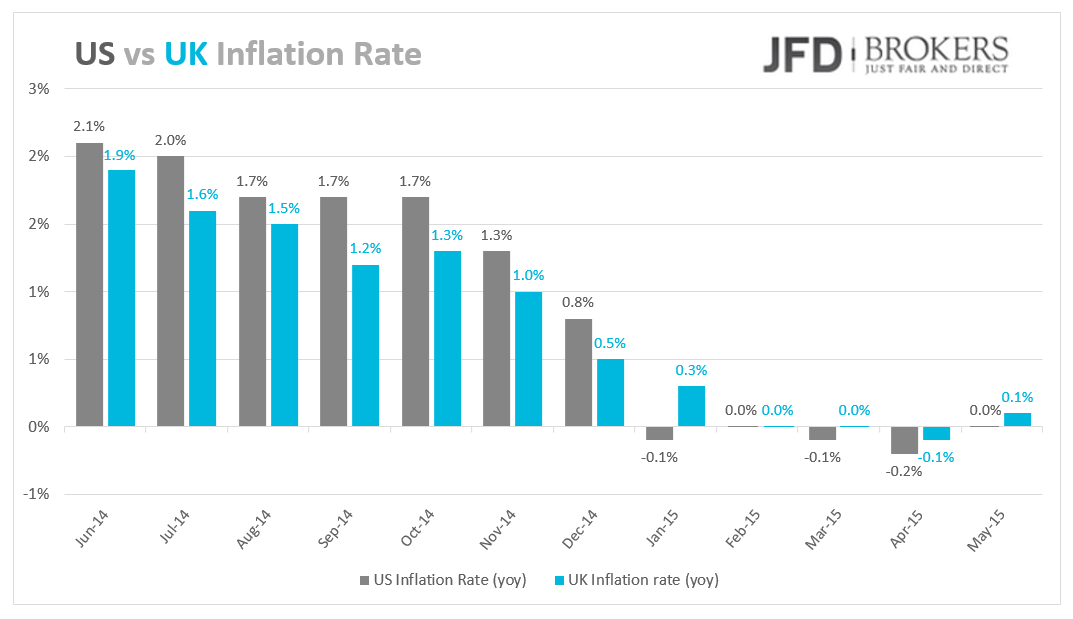

Although the US Fed has good reasons to raise interest rates, such as attracting foreign investment, it would however bid up the US Dollar against other currencies and will further exacerbate the aforementioned pressures felt by US multinationals. These adverse effects would discourage a quicker pace of wage increases and hiring and generally keep the recovery in low gear.US inflation on the other hand, has gradually decreased to zero or even slightly negative during the past six months, lifting off an immediate need for hiking interest rates. The most recent US GDP fixed investment figure has recorded an improvement, however, which could gradually lead to hiring and stronger consumer spending, housing and domestic lead growth, and as a consequence all of these factors could lead to an increase in inflation in the coming months.

If inflation starts to pick up again as we move into the second half of 2015 and the beginning of 2016, the Fed will seriously consider raising interest rates. Federal Reserve policymakers are facing an extremely tough dilemma when it comes to considering the timing of the rate hike, since the strong dollar on the one hand and inflation risks on the other, put them between a rock and a hard place.

Further uncertainty around the Euro, drawing a vague outlook with Greek crisis still looming

Even though the markets were expecting Greece to end up negotiating yet another last minute temporary solution with its official creditors over the weekend and manage to receive the necessary funds in order to meet its loan repayments for the next couple of months, there has been a very abrupt turn of events as no agreement was reached and the Greek government has decided to let the Greek people decide for the country’s fate through a referendum that will take place on the 5th of July.Furthermore, the ECB capped its emergency liquidity line to the country’s banking system yesterday and the Greek government has decided to impose capital controls as well as keep the banks and the stock exchange closed until the day of the referendum, in order to prevent a bank run and economic collapse.

The uncertainty around Greek crisis developments is causing strong currency jitters as the Euro is falling this morning against other major currencies and especially the Japanese Yen as well as gold, on safe haven investor demand. Uncertainty around the fate of the common currency will persist as dramatic developments unfold in the next few days and throughout the rest of the year, which could of course present short term trading opportunities.

US Dollar and Euro uncertainty could push gold recovery from recent low levels

Gold has long been considered to be a safe-haven asset, as throughout its history market participants tend to pile into the precious metal, especially during times of turmoil such as the current “Greek accident” situation.Even though the price of gold has performed poorly in recent years, for many investors it is still considered to be safe because it is an asset that cannot be manipulated by an interest rate decision of any country.

The rise and fall of gold in recent years

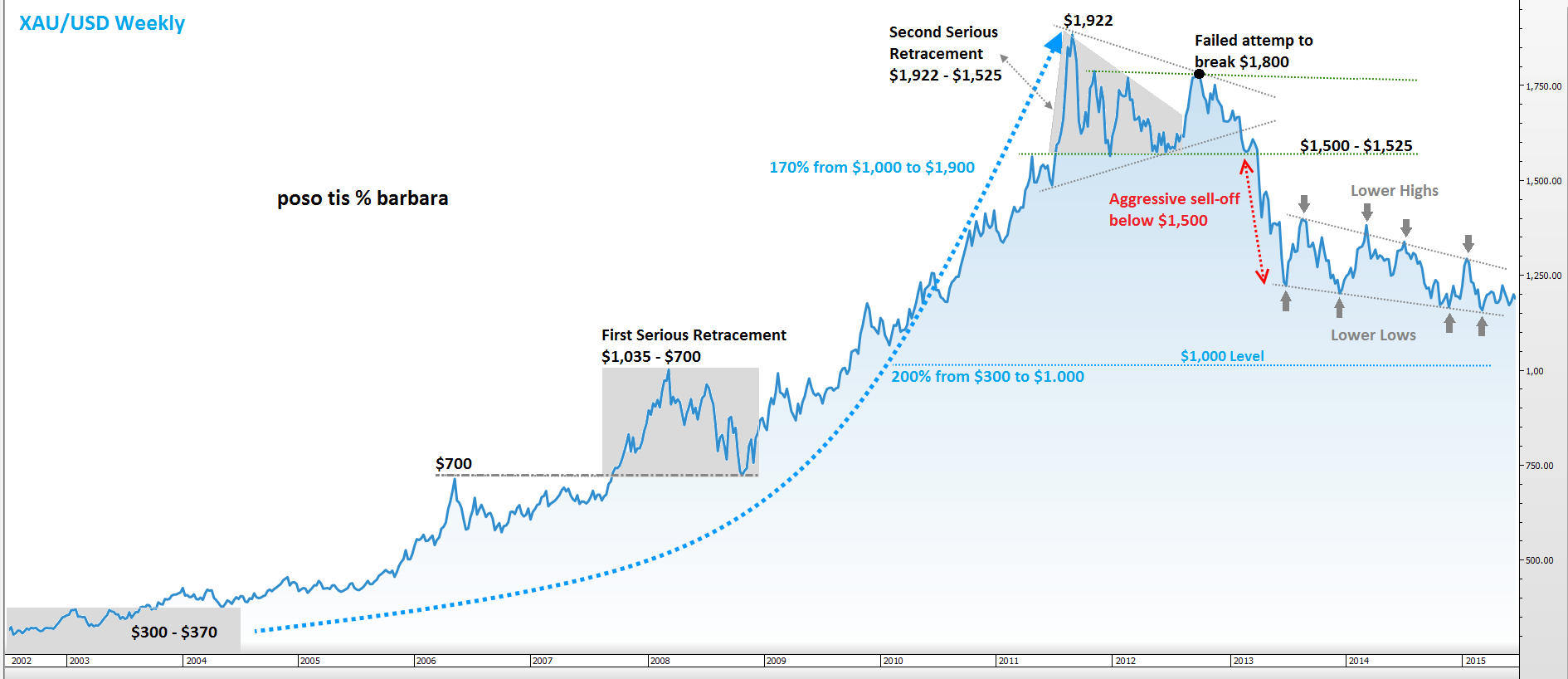

The precious metal buying was boosted by aggressive demand back in 2000 when it was around USD 300 per ounce. Since then, it rose by more than 200% to reach the key psychological level of USD 1,000 for the first time in its history. By late March 2008, the price of gold had established itself in a range of USD 1,035 – 700 per ounce, which it was the first serious retracement. Following the strong rebound from the USD 700 level, the metal rose more than 170% to an all-time high of USD 1,922, slightly above the key psychological level of USD 1,900, taking all the way the key level of USD 1,500.

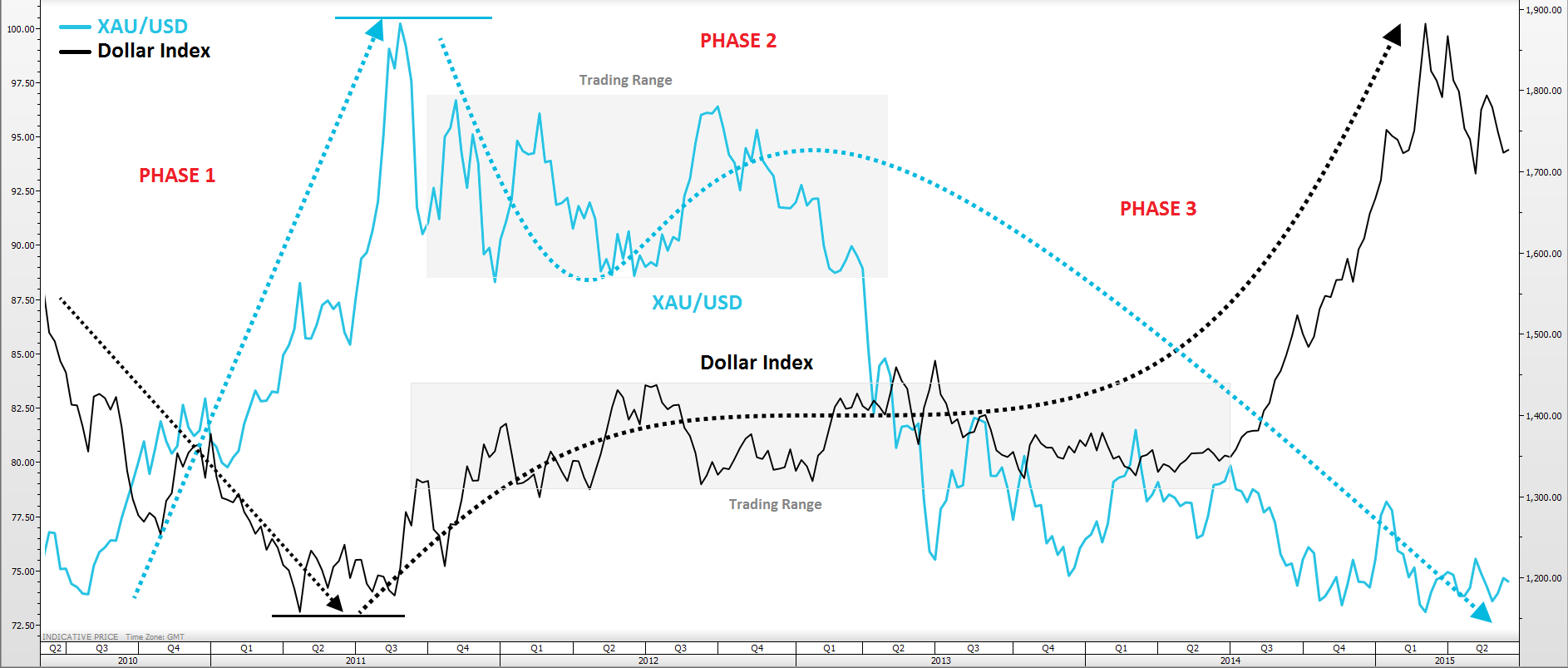

By October 2011, the role of gold as a ‘safe-haven’ appeared to have diminished substantially on the back of a gold crisis as market participants rushed to cash in, after the precious metal had been recording consecutive fresh highs and was considered to be an overbought asset following its peak above USD 1,900. Gold selling / US Dollar buying action by investors can be clearly confirmed in the XAU/USD – Dollar Index chart.

The dramatic fall in gold price and the second serious retracement came after the metal collapsed below the USD 1,800 level, following the retest of the USD 1,900 level. Gold plunged by more than 11% in September 2011 and experienced a further drop in excess of 10% in December 2011, pushing its price below USD 1,600. The gold bulls made several unsuccessful attempts to break above the psychological level of USD 1,800. The yellow metal suffered a rapid decrease in value in 2013 as it plunged by more than 30%, followed by a 7% recovery in 2014.

The precious metal appears to have reached a bottom

Despite the fact that XAU/USD is forming lower highs since mid-2013, it survived several attacks without a weekly close below the key psychological level of USD 1,200 during the period of June 2013 to December 2013, thus forming a strong floor. Furthermore, at the same time it failed to form a higher high three times (USD 1,390, USD 1,345 and USD 1,308), causing the bulls to resign from the battle a year later, as the precious metal plunged below USD 1,200 for first time in late 2014, recording a 5-year low at USD 1,131. Since then, gold prices have been fluctuating around the critical level of USD 1,200.

The precious metal, which has been facing an unprecedented slide since October 2012, has now started to rebound as we approach the second half of 2015. We believe that the dip below the psychological level of USD 1,200 offers buyers a great opportunity to hold the metal since this is the first time in a decade that gold prices have dipped by more than 33%. Furthermore, at this point, it’s worth noting that gold has recorded for the first time since 2013 a higher low at USD 1,142 and more recently once more around USD 1,162 (lower timeframes), lifting again the XAU/USD near the USD 1,200 level.

The second-half of 2015 could be one of the last gold buying opportunities

It is our view that as long as the precious metal remains below or around the USD 1,200 level, it represents an excellent buying opportunity! If it continues in the same pattern, with bulls maintaining gold prices above the USD 1,130, USD 1,140 and USD 1,160 levels (short-term ascending trend line), and especially until the US Federal Reserve begins to raise interest rates which is another issue to keep an eye on, the start of the second-half of 2015 could be one of the last gold buying opportunities at such bargain prices. Furthermore, one should keep in mind that central banks around the world will need the yellow metal to stabilize their currencies, especially the European Central Bank (ECB) and the Central Bank of Russia (CBR), while investment funds will use it as a hedging instrument to protect their portfolios. In addition, it is important to note that gold is up by 0.70% so far this year following a positive 2014 performance of +7%, therefore if it manages to maintain its positive outlook above the USD 1,180 level, it will record for the first time since 2009 two consecutive years of gains.

A surprise move by the UK in raising its interest rates ahead of the US would lift-off the Pound

The British Pound has been supported by a strong economy and the Bank of England (BoE) may surprise the market with an earlier than expected interest rate hike. Furthermore, the BoE has held interest rates at a record low of 0.5% since 2009 and lately there have been warnings by officials about a rate hike before the end of this year, depending on the strength of economic growth, earnings, productivity and inflation moves over the coming months.Inflation rate near zero, though starting to slightly pick up

The UK got out of deflation in May after battling with deflation for three months. UK consumer prices increased by 0.1% year-over-year in May after a 0.1% drop the month before. The country’s Consumer Price Index (CPI) had been gradually decreasing since the high of mid-2011 when the index had reached 5.2%. However, the decline below the BoE inflation target level of 2.0% lead the country to slight deflation in April, after experiencing two months of a flat inflation rate. The BoE sees inflation returning to its 2% target level in 2016.

Consumer Spending and Retail Sales picking up

Consumer spending has been increasing gradually since the start of 2011, reaching an all-time high of GBP 278 billion in the first quarter of 2015. Meanwhile, retail sales have been growing impressively during the last five years, speeding up during 2013. The indicator is not even above zero since April 2013, however it is currently accelerating by 4.60% monthly, indicating a strong sector performance.

GDP and the Labour Market

The UK economy has been advancing at a slow pace, without a pullback nevertheless, since 2013. In the first quarter of 2015 the economy has exhibited a meagre expansion of 0.3% from 0.6% the previous quarter. Furthermore, the unemployment rate remained unchanged at 5.50% the last two months recording historic lows since 2008, while average weekly earnings growth reached a four-year high in April.

Hunting for Investment Opportunities in the British Pound

The US Dollar had an impressive rally against the British pound as the rate has fallen by more than 5% from 1.7180 in June 2014 to below the key level of 1.6000 at the current time. The GBP/USD pair has fallen to a 5-year low of 1.4560, following the aggressive sell-off which took place near the psychological level of 1.5500. However, the pound managed to recover versus the dollar, with a spectacular rally of more than 1000 pips, following the strong rebound near the 1.4600 level, in two months’ time. The main catalyst for the move has been the weaker dollar which came on the back the US Federal Reserve signalling a rate hike later than sooner. Moreover, there have also been some positive signs around the strength of the UK economy as outlined above.

On the other hand, the pound rose against some of the other major currencies. In particular, the pound has risen by more than 30% against the euro since 2009, following a weak year in 2008, when the euro experienced an outstanding rally of 16.50%, or 2000 pips, to reach an all-time high at 0.9780. Moreover, the pound staged an impressive rally against the yen, as since its trough below the key psychological level of 120.00, it surged by more than 40% surpassing some significant levels, including the historical level of 150.00. Currently, the GBP/JPY is trading around the 195.00 level.

Having the above in mind, it is clear that the pound had an outstanding performance versus some of the majors, except the dollar, however, the recent GBP/USD pattern suggests that the recovery above the key support level of 1.4600 could change the bearish picture to bullish and could possibly turn this aggressive move above the psychological level of 1.5000 to a new-born uptrend.

British Pound outlook versus the US Dollar and the Euro

We therefore expect the pound to maintain its positive attitude against its majors, particularly the US Dollar and the Euro. For the GBP/USD is very important to maintain its move above the key support levels of 1.54 and 1.51, however the pair could test these levels soon in case of a more aggressive pullback, recovering thereafter and testing the key psychological level of 1.6000 by the start of the last quarter of 2015, leading to a higher level of 1.6500 in early 2016.

Moreover, we expect selling pressure to continue in the near-term for the EUR/GBP pair, with the euro reaching a fresh 9-year-low against the pound, below the key support level of 0.7000, prompting a more aggressive move towards the 0.6800 in a few months and ending the year near the psychological zone of 0.6500 – 0.6600.

Conclusion

The timing of the commencement of interest rate rises by the US Fed and the BoE is extremely difficult to predict, due to a number of factors affecting such a decision. Whether the Fed or the BoE makes the first move, the start of hiking interest rates will definitely be an alarm for participants across all markets and sectors, signalling that the era of low rates and inexpensive credit in these developed economies is coming to an end.Although the Euro and the US Dollar may present short term trading opportunities, the continuing uncertainty and day-by-day developments affecting the currencies’ behaviour - especially with the new dramatic Greek developments - are sending conflicting signals, therefore making trading a challenging experience. In our opinion, investing in gold and the British pound for the next three to six months offers far safer as well as extremely attractive alternatives.

We believe that as long as gold remains below or around the USD 1,200 level, the start of the second-half of 2015 could be one of the last gold buying opportunities at such bargain prices. Furthermore, we expect the British pound to maintain its positive attitude against its majors, particularly the US Dollar and the Euro, and could experience a huge lift-off in the event of a surprise interest rate rise action by the BoE.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.